Question: question (b) (c) Question 5 (a) A company is now considering to replace an old machine. The old machine was purchased at $600,000 four years

question (b) (c)

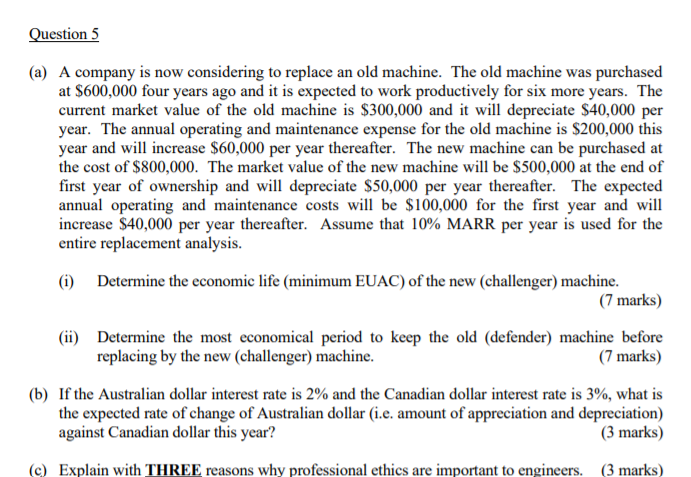

Question 5 (a) A company is now considering to replace an old machine. The old machine was purchased at $600,000 four years ago and it is expected to work productively for six more years. The current market value of the old machine is $300,000 and it will depreciate $40,000 per year. The annual operating and maintenance expense for the old machine is $200,000 this year and will increase $60,000 per year thereafter. The new machine can be purchased at the cost of $800,000. The market value of the new machine will be $500,000 at the end of first year of ownership and will depreciate $50,000 per year thereafter. The expected annual operating and maintenance costs will be $100,000 for the first year and will increase $40,000 per year thereafter. Assume that 10% MARR per year is used for the entire replacement analysis. (i) Determine the economic life (minimum EUAC) of the new challenger) machine. (7 marks) (ii) Determine the most economical period to keep the old (defender) machine before replacing by the new challenger) machine. (7 marks) (b) If the Australian dollar interest rate is 2% and the Canadian dollar interest rate is 3%, what is the expected rate of change of Australian dollar (i.e. amount of appreciation and depreciation) against Canadian dollar this year? (3 marks) (c) Explain with THREE reasons why professional ethics are important to engineers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts