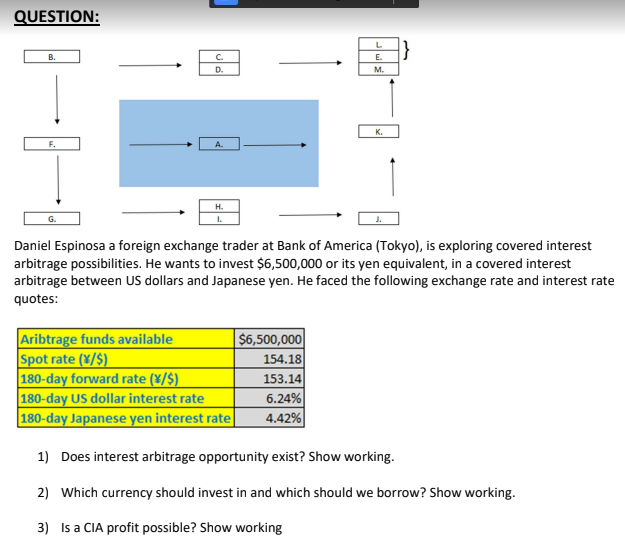

Question: QUESTION: } B. L E. M. C. D. K. a G. Daniel Espinosa a foreign exchange trader at Bank of America (Tokyo), is exploring covered

QUESTION: } B. L E. M. C. D. K. a G. Daniel Espinosa a foreign exchange trader at Bank of America (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $6,500,000 or its yen equivalent in a covered interest arbitrage between US dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: Aribtrage funds available $6,500,000 Spot rate (V/$) 154.18 180-day forward rate (/$) 153.14 180-day US dollar interest rate 6.24% 180-day Japanese yen interest rate 4.42% 1) Does interest arbitrage opportunity exist? Show working. 2) Which currency should invest in and which should we borrow? Show working. 3) Is a CIA profit possible? Show working

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts