Question: Question B needs solving, so like b1 and b2 1. 117 marks KIU On January 1, 2002, the Grind Company purchased a machine for use

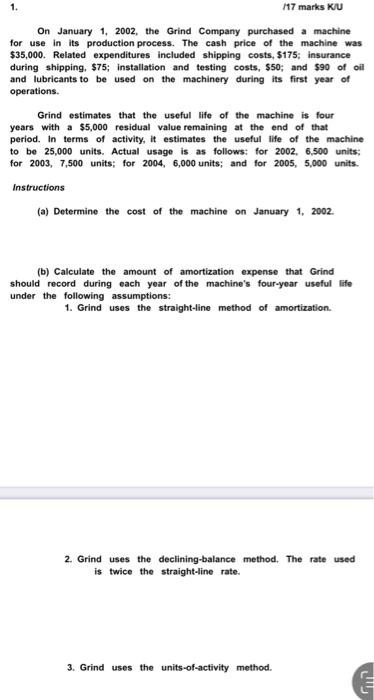

1. 117 marks KIU On January 1, 2002, the Grind Company purchased a machine for use in its production process. The cash price of the machine was $35,000. Related expenditures included shipping costs, $175: insurance during shipping, $75; installation and testing costs, $50; and $90 of oil and lubricants to be used on the machinery during its first year of operations. Grind estimates that the useful life of the machine is four years with a $5,000 residual value remaining at the end of that period. In terms of activity, it estimates the useful life of the machine to be 25,000 units. Actual usage is as follows: for 2002, 6,500 units for 2003, 7,500 units: for 2004, 6,000 units; and for 2005, 5,000 units. Instructions (a) Determine the cost of the machine on January 1, 2002. (b) Calculate the amount of amortization expense that Grind should record during each year of the machine's four-year useful life under the following assumptions: 1. Grind uses the straight-line method of amortization. 2. Grind uses the declining-balance method. The rate used is twice the straight-line rate. 3. Grind uses the units-of-activity method. CLI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts