Question: Question B please show your work/ how you got your answers! . QUESTION 3 For the following independent situations, produce the desired result Remember that

Question B please show your work/ how you got your answers!

Question B please show your work/ how you got your answers!

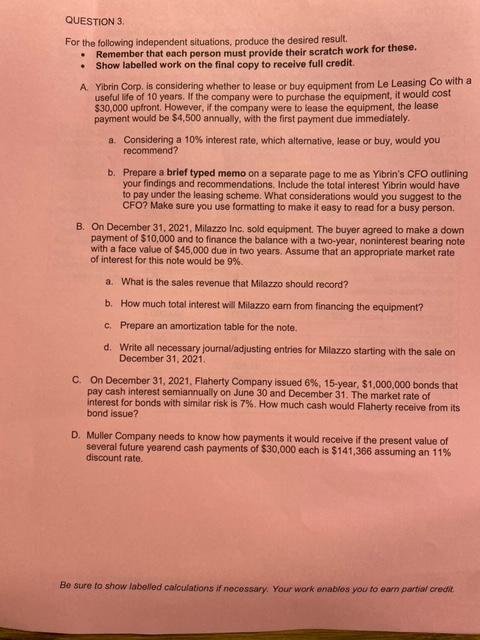

. QUESTION 3 For the following independent situations, produce the desired result Remember that each person must provide their scratch work for these. Show labelled work on the final copy to receive full credit A. Yibrin Corp. is considering whether to lease or buy equipment from Le Leasing Co with a useful life of 10 years. If the company were to purchase the equipment, it would cost $30,000 upfront. However, if the company were to lease the equipment, the lease payment would be $4,500 annually, with the first payment due immediately. a. Considering a 10% interest rate, which alternative, lease or buy, would you recommend? b. Prepare a brief typed memo on a separate page to me as Yibrin's CFO outlining your findings and recommendations. Include the total interest Yibrin would have to pay under the leasing scheme. What considerations would you suggest to the CFO? Make sure you use formatting to make it easy to read for a busy person B. On December 31, 2021, Milazzo Inc. sold equipment. The buyer agreed to make a down payment of $10,000 and to finance the balance with a two-year, noninterest bearing note with a face value of $45,000 due in two years. Assume that an appropriate market rate of interest for this note would be 9% a. What is the sales revenue that Milazzo should record? b. How much total interest will Milazzo earn from financing the equipment? c. Prepare an amortization table for the note d. Write all necessary journal/adjusting entries for Milazzo starting with the sale on December 31, 2021. c On December 31, 2021, Flaherty Company issued 6%, 15-year, $1,000,000 bonds that pay cash interest semiannually on June 30 and December 31. The market rate of interest for bonds with similar risk is 7%. How much cash would Flaherty receive from its bond issue? D. Muller Company needs to know how payments it would receive if the present value of several future yearend cash payments of $30,000 each is $141,366 assuming an 11% discount rate Be sure to show labelled calculations if necessary. Your work anables you to earn partial credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts