Question: Question B1 (7 marks) Suppose Gordon is now aged 50 and plans to start saving for 15 years and will accumulate $1,500,000 at the age

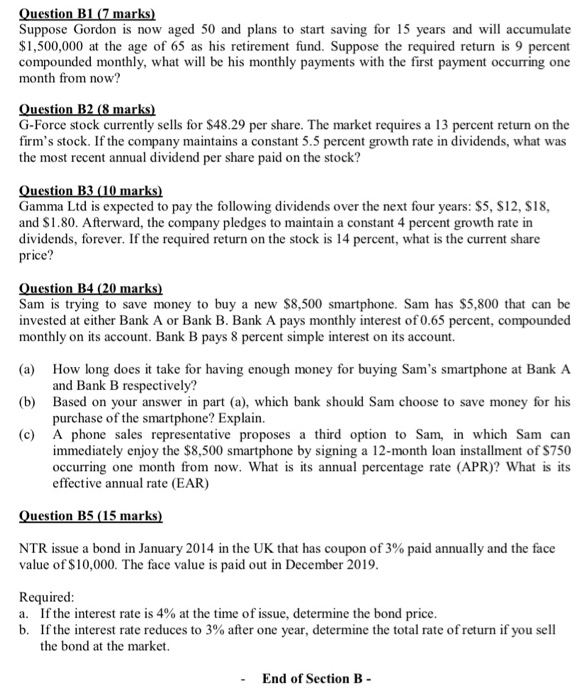

Question B1 (7 marks) Suppose Gordon is now aged 50 and plans to start saving for 15 years and will accumulate $1,500,000 at the age of 65 as his retirement fund. Suppose the required return is 9 percent compounded monthly, what will be his monthly payments with the first payment occurring one month from now? Question B2 (8 marks) G-Force stock currently sells for $48.29 per share. The market requires a 13 percent return on the firm's stock. If the company maintains a constant 5.5 percent growth rate in dividends, what was the most recent annual dividend per share paid on the stock? Question B3 (10 marks) Gamma Ltd is expected to pay the following dividends over the next four years: $5, $12, $18, and $1.80. Afterward, the company pledges to maintain a constant 4 percent growth rate in dividends, forever. If the required return on the stock is 14 percent, what is the current share price? Question B4 (20 marks) Sam is trying to save money to buy a new $8,500 smartphone. Sam has $5,800 that can be invested at either Bank A or Bank B. Bank A pays monthly interest of 0.65 percent, compounded monthly on its account. Bank B pays 8 percent simple interest on its account. (a) (b) (c) How long does it take for having enough money for buying Sam's smartphone at Bank A and Bank B respectively? Based on your answer in part (a), which bank should Sam choose to save money for his purchase of the smartphone? Explain. A phone sales representative proposes a third option to Sam, in which Sam can immediately enjoy the $8,500 smartphone by signing a 12-month loan installment of $750 occurring one month from now. What is its annual percentage rate (APR)? What is its effective annual rate (EAR) Question B5 (15 marks) NTR issue a bond in January 2014 in the UK that has coupon of 3% paid annually and the face value of $10,000. The face value is paid out in December 2019. Required: a. If the interest rate is 4% at the time of issue, determine the bond price. b. If the interest rate reduces to 3% after one year, determine the total rate of return if you sell the bond at the market. - End of Section B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts