Question: Question B2 (15 marks) Realforce is considering making a new mechanical keyboard. The company has spent $200,000 in research for a silent mechanical switch, which

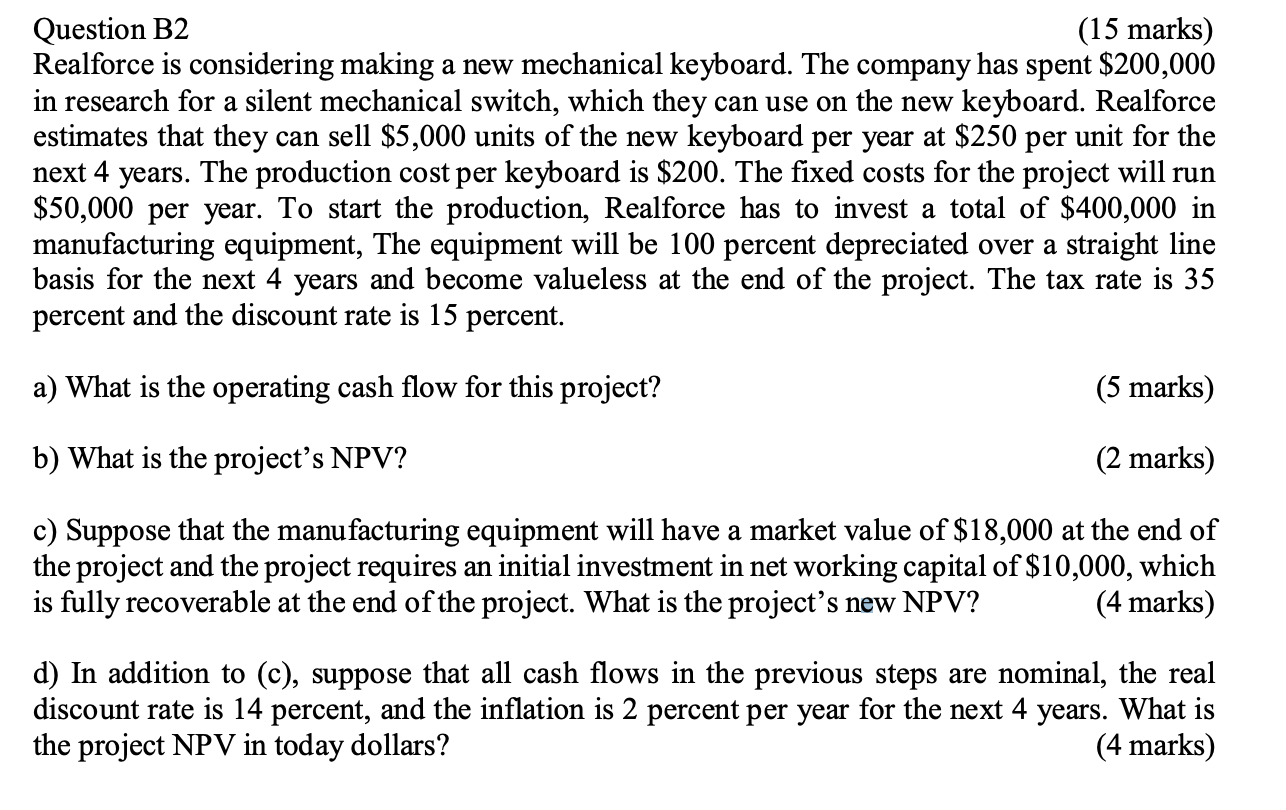

Question B2 (15 marks) Realforce is considering making a new mechanical keyboard. The company has spent $200,000 in research for a silent mechanical switch, which they can use on the new keyboard. Realforce estimates that they can sell $5,000 units of the new keyboard per year at $250 per unit for the next 4 years. The production cost per keyboard is $200. The fixed costs for the project will run $50,000 per year. To start the production, Realforce has to invest a total of $400,000 in manufacturing equipment, The equipment will be 100 percent depreciated over a straight line basis for the next 4 years and become valueless at the end of the project. The tax rate is 35 percent and the discount rate is 15 percent. a) What is the operating cash flow for this project? (5 marks) b) What is the project's NPV? (2 marks) c) Suppose that the manufacturing equipment will have a market value of $18,000 at the end of the project and the project requires an initial investment in net working capital of $10,000, which is fully recoverable at the end of the project. What is the projects new NPV? (4 marks) d) In addition to (c), suppose that all cash flows in the previous steps are nominal, the real discount rate is 14 percent, and the inflation is 2 percent per year for the next 4 years. What is the project NPV in today dollars? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts