Question: Question B2 (a) ABC plc, a group operating retail stores, is compiling its budget statements for 2022. In this exercise revenues and costs at each

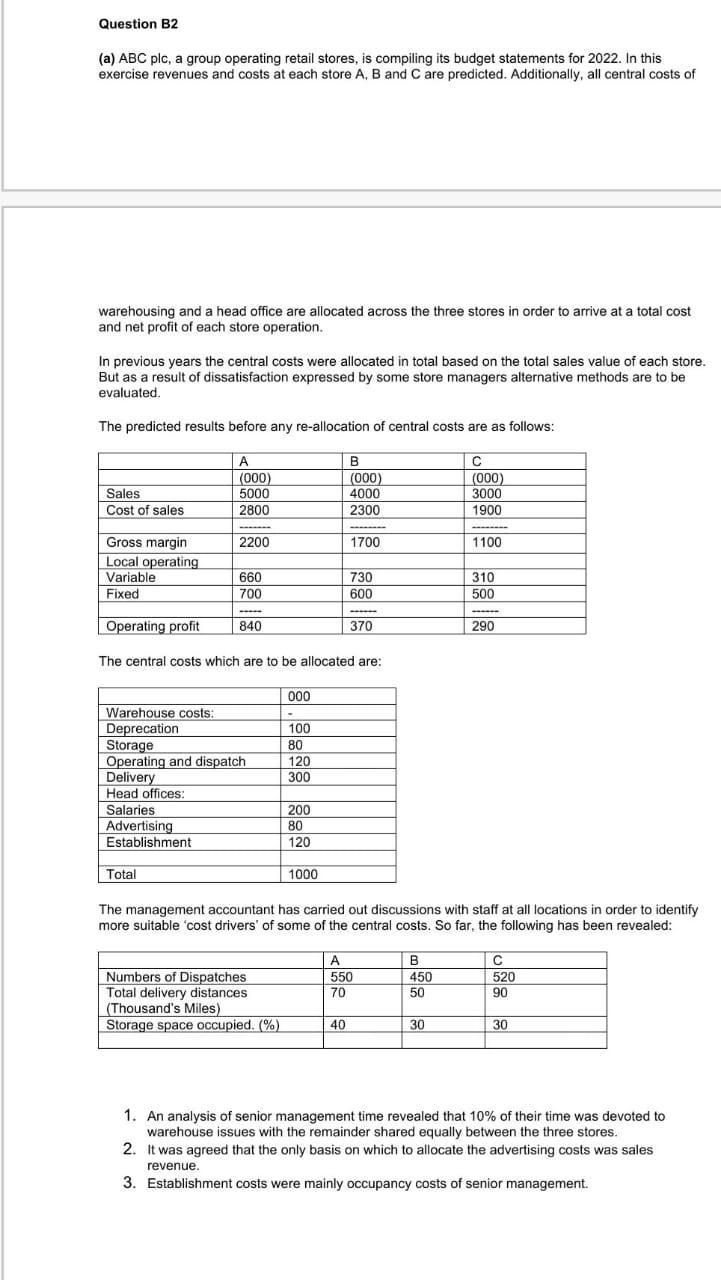

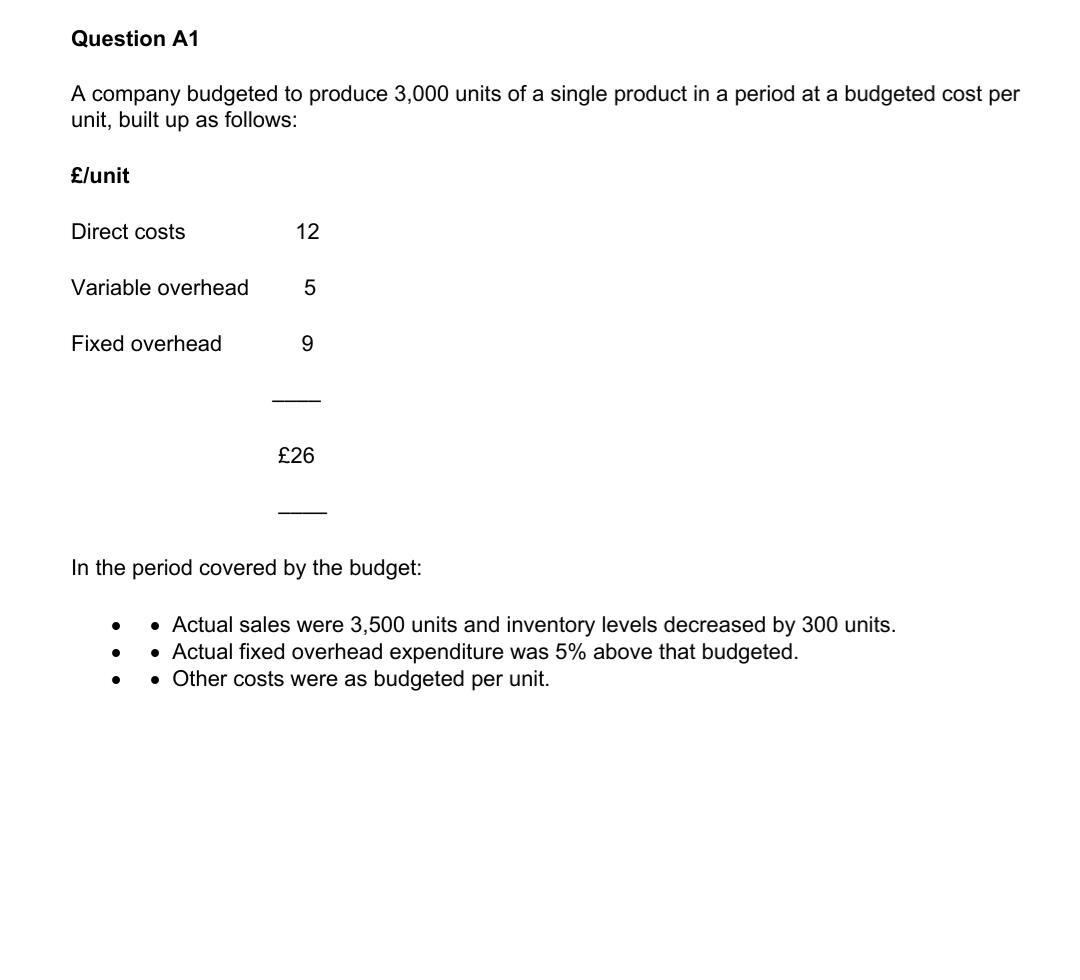

Question B2 (a) ABC plc, a group operating retail stores, is compiling its budget statements for 2022. In this exercise revenues and costs at each store A, B and C are predicted. Additionally, all central costs of warehousing and a head office are allocated across the three stores in order to arrive at a total cost and net profit of each store operation. In previous years the central costs were allocated in total based on the total sales value of each store. But as a result of dissatisfaction expressed by some store managers alternative methods are to be evaluated. The predicted results before any re-allocation of central costs are as follows: (000) (000) 5000 2800 B (000) 4000 2300 Sales 3000 Cost of sales 1900 2200 1700 1100 Gross margin Local operating Variable Fixed 660 700 730 600 310 500 Operating profit 840 370 290 The central costs which are to be allocated are: 000 Warehouse costs: Deprecation Storage Operating and dispatch Delivery Head offices: 100 80 120 300 Salaries Advertising Establishment 200 80 120 Total 1000 The management accountant has carried out discussions with staff at all locations in order to identify more suitable 'cost drivers' of some of the central costs. So far, the following has been revealed: A 550 70 B 450 50 || 520 90 Numbers of Dispatches Total delivery distances (Thousand's Miles) Storage space occupied. (%) 40 30 30 1. An analysis of senior management time revealed that 10% of their time was devoted to warehouse issues with the remainder shared equally between the three stores. 2. It was agreed that the only basis on which to allocate the advertising costs was sales revenue. 3. Establishment costs were mainly occupancy costs of senior management. Question A1 A company budgeted to produce 3,000 units of a single product in a period at a budgeted cost per unit, built up as follows: /unit Direct costs 12 Variable overhead 5 Fixed overhead 9 26 In the period covered by the budget: Actual sales were 3,500 units and inventory levels decreased by 300 units. Actual fixed overhead expenditure was 5% above that budgeted. Other costs were as budgeted per unit. . Question B2 (a) ABC plc, a group operating retail stores, is compiling its budget statements for 2022. In this exercise revenues and costs at each store A, B and C are predicted. Additionally, all central costs of warehousing and a head office are allocated across the three stores in order to arrive at a total cost and net profit of each store operation. In previous years the central costs were allocated in total based on the total sales value of each store. But as a result of dissatisfaction expressed by some store managers alternative methods are to be evaluated. The predicted results before any re-allocation of central costs are as follows: (000) (000) 5000 2800 B (000) 4000 2300 Sales 3000 Cost of sales 1900 2200 1700 1100 Gross margin Local operating Variable Fixed 660 700 730 600 310 500 Operating profit 840 370 290 The central costs which are to be allocated are: 000 Warehouse costs: Deprecation Storage Operating and dispatch Delivery Head offices: 100 80 120 300 Salaries Advertising Establishment 200 80 120 Total 1000 The management accountant has carried out discussions with staff at all locations in order to identify more suitable 'cost drivers' of some of the central costs. So far, the following has been revealed: A 550 70 B 450 50 || 520 90 Numbers of Dispatches Total delivery distances (Thousand's Miles) Storage space occupied. (%) 40 30 30 1. An analysis of senior management time revealed that 10% of their time was devoted to warehouse issues with the remainder shared equally between the three stores. 2. It was agreed that the only basis on which to allocate the advertising costs was sales revenue. 3. Establishment costs were mainly occupancy costs of senior management. Question A1 A company budgeted to produce 3,000 units of a single product in a period at a budgeted cost per unit, built up as follows: /unit Direct costs 12 Variable overhead 5 Fixed overhead 9 26 In the period covered by the budget: Actual sales were 3,500 units and inventory levels decreased by 300 units. Actual fixed overhead expenditure was 5% above that budgeted. Other costs were as budgeted per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts