Question: Question B2 Quantum Ltd is considering three separate new product development projects, due to capital rationing they can only invest in one of the three

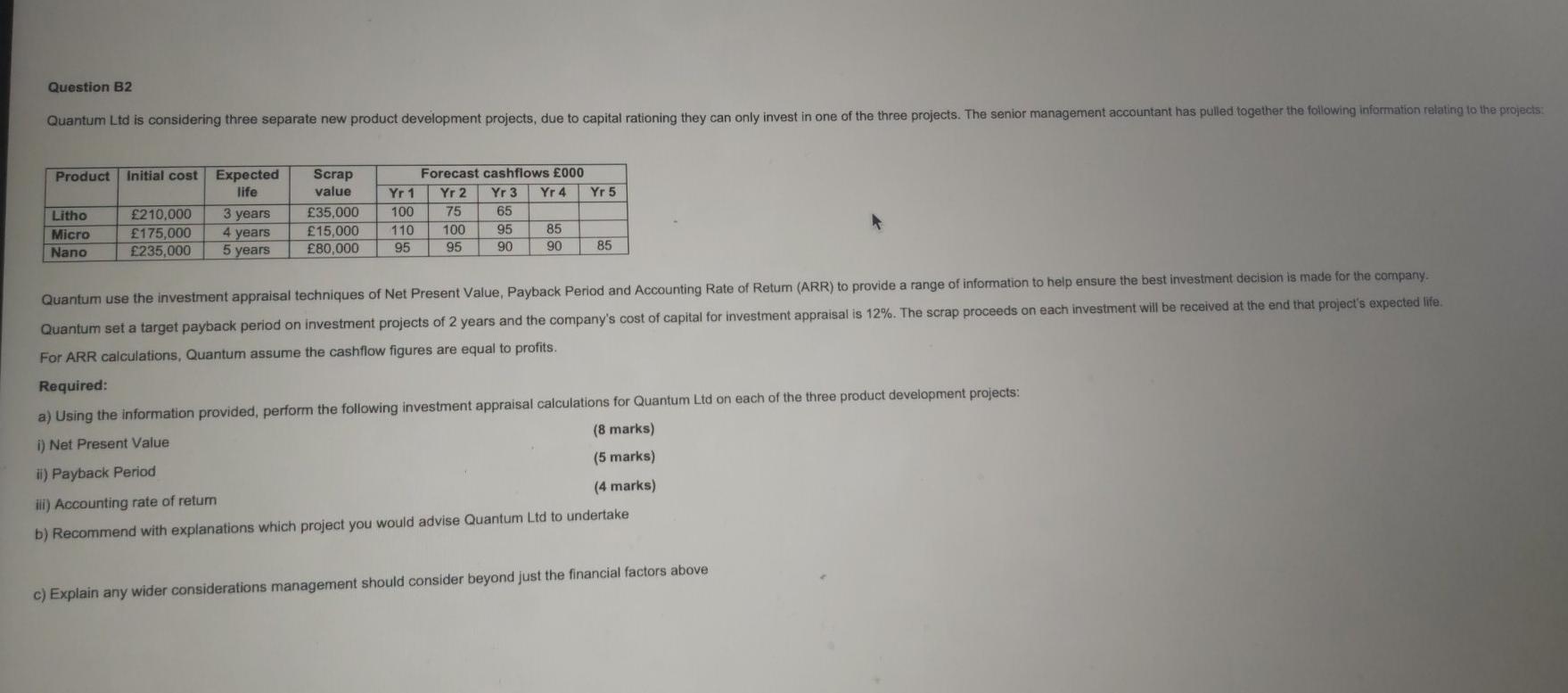

Question B2 Quantum Ltd is considering three separate new product development projects, due to capital rationing they can only invest in one of the three projects. The senior management accountant has pulled together the following information relating to the projects: Product Initial cost Expected life Litho Micro Nano 210,000 175,000 235,000 3 years 4 years 5 years Scrap value 35,000 15,000 80,000 Forecast cashflows 000 Yr 1 Yr 2 Yr 3 Yra Yr 5 100 75 65 110 100 95 85 95 95 90 90 85 Quantum use the investment appraisal techniques of Net Present Value, Payback Period and Accounting Rate of Retum (ARR) to provide a range of information to help ensure the best investment decision is made for the company. Quantum set a target payback period on investment projects of 2 years and the company's cost of capital for investment appraisal is 12%. The scrap proceeds on each investment will be received at the end that project's expected life. For ARR calculations, Quantum assume the cashflow figures are equal to profits. Required: a) Using the information provided, perform the following investment appraisal calculations for Quantum Ltd on each of the three product development projects: i) Net Present Value (8 marks) ii) Payback Period (5 marks) ili) Accounting rate of return (4 marks) b) Recommend with explanations which project you would advise Quantum Ltd to undertake c) Explain any wider considerations management should consider beyond just the financial factors above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts