Question: Question Background info : Listed below are some transactions for Oriole Products Ltd . , which uses a perpetual inventory system and reports under ASPE.

Question Background info : Listed below are some transactions for Oriole Products Ltd which uses a perpetual inventory system and reports under ASPE.

May : Sold inventory on account to Pharoah Inc., terms Selling price $; cost $

May : Received a portion of the inventory sold on the previous day because it was damaged and could never be sold in the

future. Selling price $; cost $

May : Received a portion of the inventory sold on May that was in good condition and could be sold to other customers in the

future. Selling price $ cost $

May : Received payment in full from Pharoah Inc. for the amount due from the sale made on May

MY QUESTION :

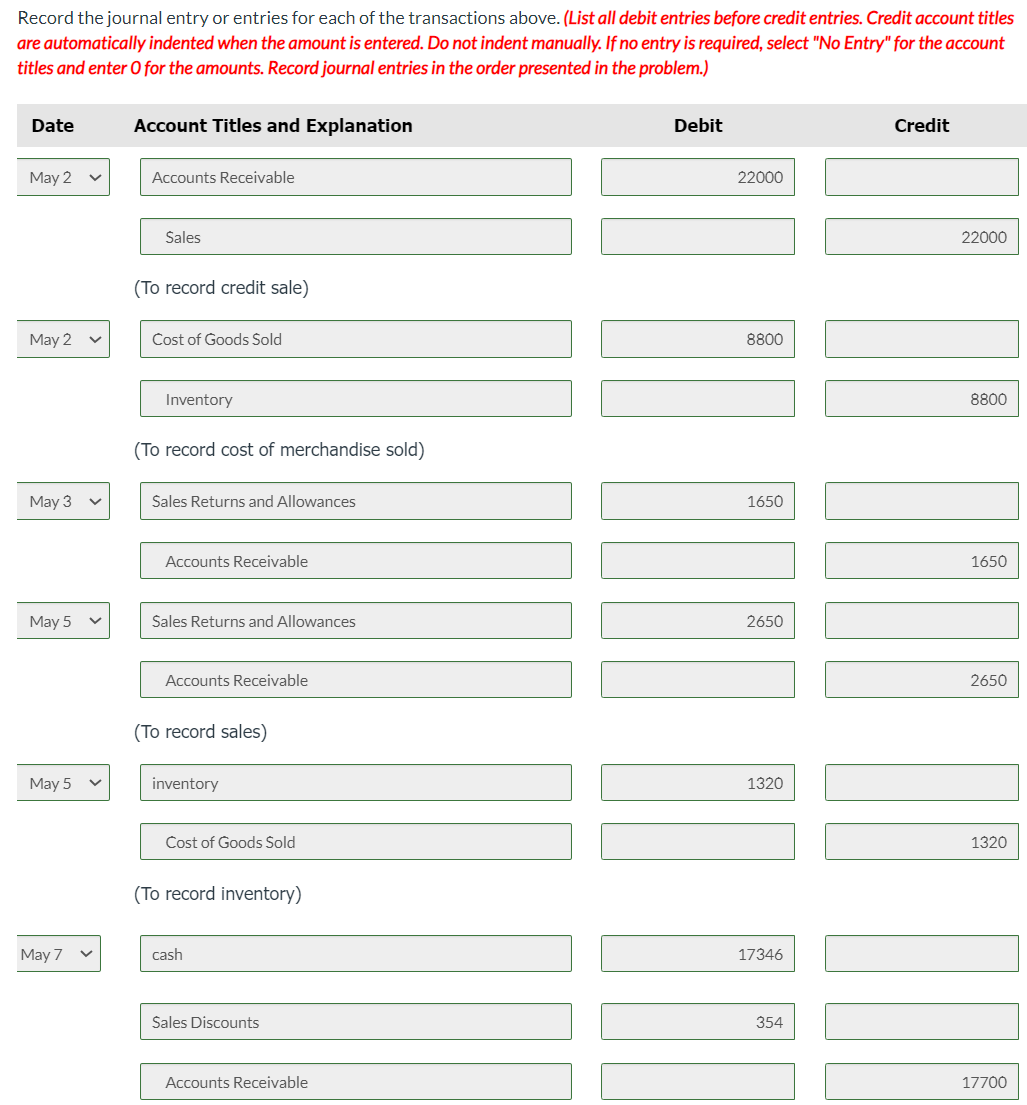

Determine the Oriole's gross profit based on the May TransactionsRecord the journal entry or entries for each of the transactions above. List all debit entries before credit entries. Credit account titles

are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account

titles and enter for the amounts. Record journal entries in the order presented in the problem.

To record credit sale

To record cost of merchandise sold

Sales Returns and Allowances

To record sales

To record inventory

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock