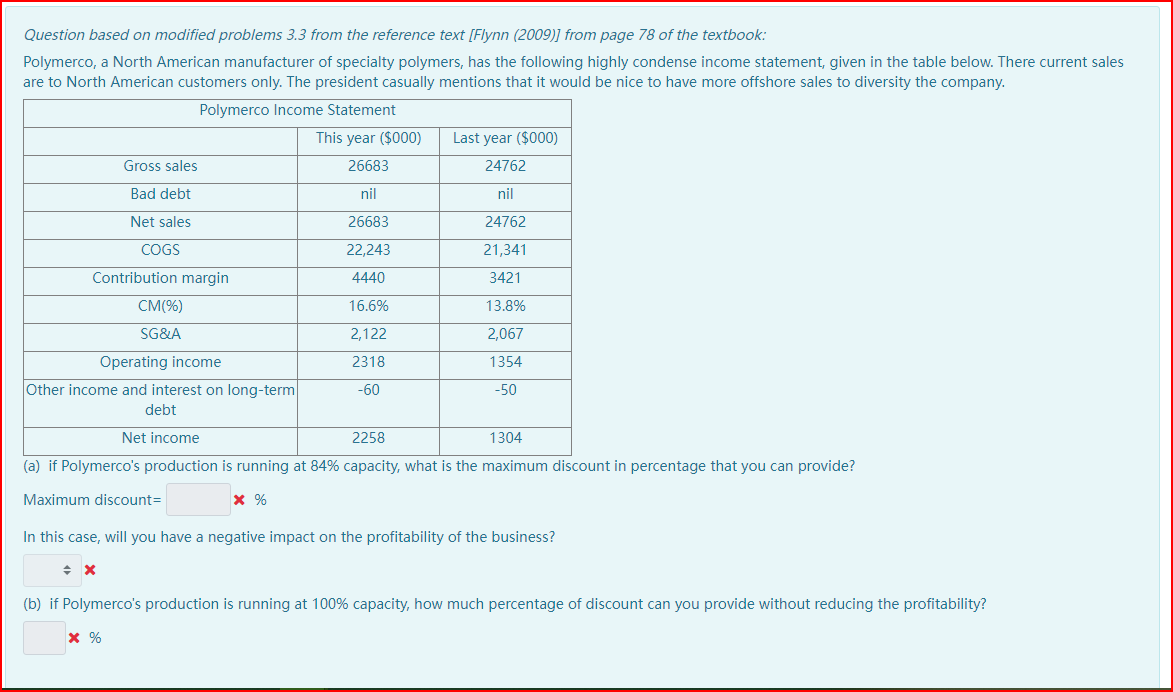

Question: Question based on modified problems 3.3 from the reference text [Flynn (2009)] from page 78 of the textbook: Polymerco, a North American manufacturer of specialty

Question based on modified problems 3.3 from the reference text [Flynn (2009)] from page 78 of the textbook: Polymerco, a North American manufacturer of specialty polymers, has the following highly condense income statement, given in the table below. There current sales are to North American customers only. The president casually mentions that it would be nice to have more offshore sales to diversity the company. Polymerco Income Statement This year ($000) Last year ($000) Gross sales 26683 nil 24762 nil Bad debt Net sales 26683 24762 COGS 22,243 21,341 Contribution margin 4440 3421 CM(%) 16.6% 13.8% SG&A 2,122 2,067 Operating income 2318 1354 Other income and interest on long-term -60 -50 debt Net income 2258 1304 (a) if Polymerco's production is running at 84% capacity, what is the maximum discount in percentage that you can provide? Maximum discount= * % In this case, will you have a negative impact on the profitability of the business? + X (b) if Polymerco's production is running at 100% capacity, how much percentage of discount can you provide without reducing the profitability? * % Question based on modified problems 3.3 from the reference text [Flynn (2009)] from page 78 of the textbook: Polymerco, a North American manufacturer of specialty polymers, has the following highly condense income statement, given in the table below. There current sales are to North American customers only. The president casually mentions that it would be nice to have more offshore sales to diversity the company. Polymerco Income Statement This year ($000) Last year ($000) Gross sales 26683 nil 24762 nil Bad debt Net sales 26683 24762 COGS 22,243 21,341 Contribution margin 4440 3421 CM(%) 16.6% 13.8% SG&A 2,122 2,067 Operating income 2318 1354 Other income and interest on long-term -60 -50 debt Net income 2258 1304 (a) if Polymerco's production is running at 84% capacity, what is the maximum discount in percentage that you can provide? Maximum discount= * % In this case, will you have a negative impact on the profitability of the business? + X (b) if Polymerco's production is running at 100% capacity, how much percentage of discount can you provide without reducing the profitability? * %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts