Question: question: Based on the given case, evaluate the alternate bases that Rolex might use to segments its market. Which base would you recommend and why?

question: Based on the given case, evaluate the alternate bases that Rolex might use to segments its market. Which base would you recommend and why?

question: Based on the given case, evaluate the alternate bases that Rolex might use to segments its market. Which base would you recommend and why?

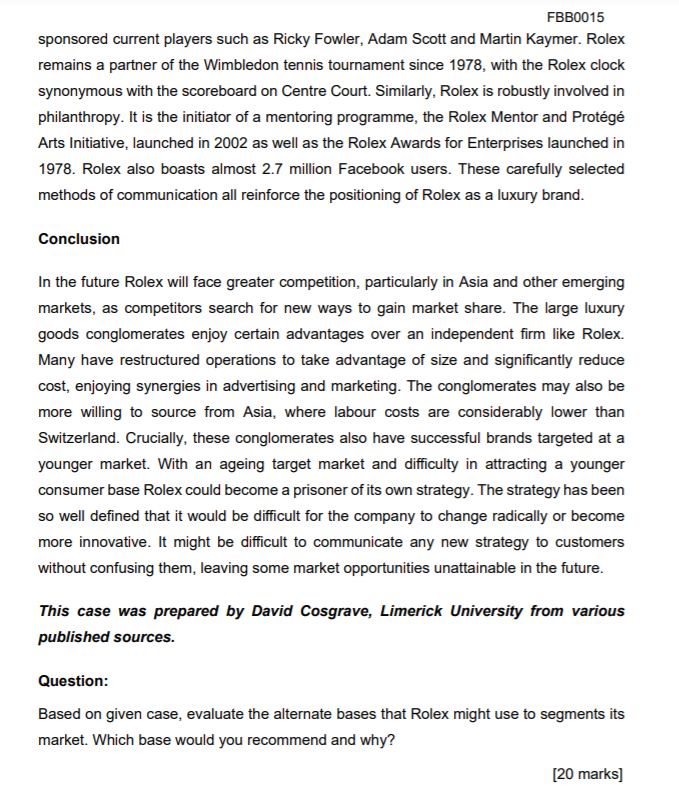

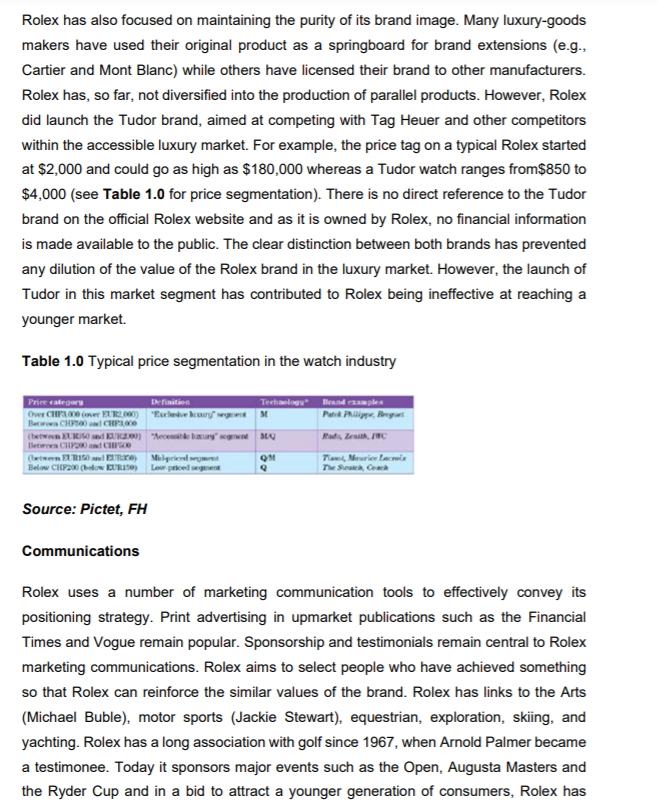

Case Study: Rolex: The symbol of personal achievement Luxury brands are often associated with the core competences of creativity, exclusivity, craftsmanship, precision, high quality, innovation, and premium pricing. Rolex, the leading name in luxury wristwatches, has been viewed as a symbol for prestige and performance for over a century. The crown logo of the Rolex brand symbolizes the superiority of the product and the sense of personal achievement associated with wearing a Rolex. Rolex was placed top on the list of Super brands in 2013 for a second consecutive year. This consumer survey rates leading products based on reputation, quality, reliability and distinction of offerings, based on the emotional and functional benefits they provide when compared with competitors. Rolex has maintained its position as a market leader in the luxury watch market by engaging in a very successful segmentation, target marketing and positioning strategy. However, this strategy presents a new challenge to Rolex, as it faces the difficult task of becoming the watch choice of a generation of younger consumers. Rolex was founded in 1905 by German, Hans Wilsdorf and Alfred Davis. Wilsdorf and Davis was the original name of what later became the Rolex Watch Company. Hans Wilsdorf registered the trademark name 'Rolex' in Switzerland in 1908. The name Rolex was conceived as it was easy to pronounce in every language and short enough to figure on the dial of the watch. At that time, Swiss workshops produced mostly pocket watches as it was still difficult to manufacture small enough movements that could be used in a wristwatch. In 1910, a Rolex watch was the first wristwatch in the world to receive the Swiss Certificate of Precision, granted by the Official Watch Rating Centre in Bienne. In 1914, Kew Observatory in Great Britain awarded a Rolex wristwatch a class 'A' precision certificate which until that point had been reserved exclusively for marine chronometers. This led to Rolex watches becoming synonymous with precision. Wilsdorf later relocated Rolex to Geneva in 1919. In 1926, Rolex took a major step towards developing the world's first waterproof wristwatch named the Oyster. The Oyster watch featured a sealed case providing optimal protection. The following year the Oyster was worn by Mercedes Gleitze, a young English swimmer who swam the English Channel. The watch remained in perfect working order after the 10-hour swim. This gave rise to the use of testimonials FBB0015 by Rolex to convey the superiority of the brand. In 1931, Rolex invented the world's first winding mechanism with a perpetual rotor. This system remains at the origin of every modern automatic watch. In the early 1950s, Rolex developed professional watches whose function went beyond that of simply telling time. The Submariner, launched in 1953, was the first watch guaranteed waterproof to a depth of 100 metres. In the same year, the expedition led by Sir Edmund Hillary equipped with the Oyster Perpetual, became the first to reach the summit of Mount Everest. History Before his death in 1960, Hans Wilsdorf created a private trust run by a board of directors to ensure the company could never be sold. Today, Rolex is the largest single luxury watch brand, with estimated revenues of around $4.5 billion in 2013 and annual production of between 650,000 and 800,000 watches. Rolex has remained independent even as many major competitors have sought the shelter of conglomerates. Rolex currently has 28 affiliates worldwide and maintains a network of 4,000 watchmakers in over 100 countries. According to Forbes (2013), Rolex has an estimated brand value of $7.4 billion. The watch industry The world of luxury is not just exclusive, it is highly secretive too. Several of the large luxury brands are privately held like Rolex and therefore, are not required to report annual or quarterly results. Many publicly listed companies (e.g. Louis Vuitton and Gucci) are part of much bigger companies which makes assessing the individual performance of these brands difficult to do with any accuracy. Many brands have responded to competition by merging into conglomerates focused on vertical integration. LVMH Mot Hennessy Louis Vuitton, the world's largest luxury goods company, includes watch brands such as Tag Heuer, Zenith, and Dior Watches. Compagnie Financire Richemont, the world's third largest luxury goods maker, owns watch brands such as Cartier, Baume and Mercier, Piaget, Jaeger-LeCoultre, and Officine Panerai. Well-known brands Movado, Patek Philippe, and Breitling remain essentially independent. In terms of watches, Switzerland possesses close to 100 per cent per cent of the luxury market value which represents 48 cent per cent of the watch market value. per Recent trends in the luxury market Exports of Swiss watches dropped 22 percent in 2009 which represented the biggest drop since the Great Depression. However, the 2009 crisis proved short-lived. As early as the following year, the watch industry returned to its growth trajectory at lightning speed. Double digit-growth rates were recorded in 2010, 2011, and 2012 (+22.2 per cent, +19.4 per cent, +11.0 per cent respectively) despite the strength of the Swiss franc and the Euro crisis. In 2012, watch exports reached a record value of 21.4 billion francs. Global interest for luxury watches grew +3.3 per cent, led by BRIC markets (+33.0 per cent). The three largest markets were China (25.6 per cent market share), the United States (19.5 per cent market share) and the United Kingdom (8.6 per cent market share). Global demand growth was fuelled by BRIC markets with the highest year-to-year increases in China (+36 per cent), Brazil (+29.4 per cent), Russia (+28.5 per cent) and India (+19.7 per cent). Early signs of demand decline were seen mostly in developed, mature, Western markets. The United States decreasing by 11.6 per cent and Europe by 8.3 per cent. Rolex continues to lead the global ranking thanks to number one spots in mostly developed, mature markets (the USA, India, Europe and the Middle East). Omega's continuing leadership in large, strongly developing markets (China, Brazil, Russia, Japan, Asia Pacific, Latin America) has helped it slowly but surely gain ground on industry leader, Rolex with the gap between the two expected to close further. Importance of emerging markets In particular, the Swiss watch industry owes its success to its foresight in actively targeting growth in the emerging markets. By far the biggest contribution to the growth of Swiss watch exports over the past decade has come from Asia. In overall terms, the Asian countries were responsible for around 70 per cent of the rise in exports from 200012. In 2000, Swiss exports of small watches to China amounted to just CHF 16.8 million. Since then, the value of annual exports has multiplied by a factor of 97 and totalled CHF 1.6 billion in 2012. After many years of spectacular growth, Swiss exports of small watches to China began to fall abruptly in the middle of 2012. Reasons include anti-corruption measures, restrictions on advertising, as well as slower economic growth in China. Because of further improvements in people's living standards and the dismantling of trade barriers (under the free trade agreement), China is likely to continue growing as an export destination. Similarly, due to rising incomes and growing prosperity, other emerging FBB0015 markets such as Vietnam, India, Russia, Ukraine, Malaysia, South Korea, and Mexico will offer substantial growth opportunities for the watch industry over the next few years. Brazil, South Africa, and Turkey also offer opportunities. Whether Rolex can indeed exploit the potential that exists in these emerging markets remains to be seen due to several potential challenges. Challenges for Rolex Rolex faces several significant challenges in the luxury market which will be outlined below. Over-dependence on current target market This represents the greatest challenge for Rolex. Rolex is faced with building relevance among a younger audience. A new generation of affluent consumers is needed to generate a vital source of business in both established and emerging markets. Unfortunately, many younger consumers see Rolex as an older status symbol and not a contemporary icon of achievement. A large majority view Rolex as the watch choice of their predecessors and parents. The average Rolex customer is 45+ and Rolex now needs to build interest, relevance and aspiration among consumers in their 30s and younger, in order to drive long-term growth. Rolex is in jeopardy of being seen as an older symbol of personal wealth, instead of a crowning symbol of timeless human achievement. Similarly, Rolex has been characterized as having a more 'male' identity and the brand still sells most of their watches to men. The opportunity of increasing their presence in the female segment has been identified as an area for development, but the company still appears to have difficulty in attracting new female customers. The positioning strategy that has been so successful for Rolex is in danger of isolating a new generation of consumers. Rolex faces a similar challenge of exploiting its target market in new emerging markets. Counterfeit Like many high-priced, brand-name accessories, Rolex watches are among the most counterfeited brands of watches, illegally sold on the street and on the Internet. According to the FH - Federation of the Swiss watch industry - counterfeit causes a damage of 800 billion to Swiss watchmakers. These fake watches are mainly produced in China due to the ease in copying the general design (EU figures show that 54 per cent of fakes seized in 2004 originated in China) and retail anywhere from $5 upwards to $1000 for high end replicas fabricated in gold. It is estimated that over 75 per cent of all replica watches produced annually are copies of Rolex Oyster Perpetual designs. It is widely accepted that the number of counterfeits on the market is larger than the number of original pieces. This figure serves as proof of the brand's aspirational quality. Rolex positioning Distribution. Rolex maintains its positioning strategy by limiting production, even as demand increases. For luxury goods, scarcity in the marketplace can influence value, spur demand and contribute to long-term appreciation. Rolex also ensures that its watches are sold only in designated stores. The crystal prism that indicates a store is an 'Official Rolex Dealer' is highly prized. Rolex seeks dealers with high-end images, relatively large stores, and attractive locations that can provide outstanding service. Maintaining this standard is not always easy. Rolex previously had a dispute with Tiffany because the retailer was imprinting its name on the Rolex watches it sold. When Tiffany refused to stop, Rolex dropped Tiffany as an official retailer. Similarly, in the 1990s, as part of an effort to control sales of their goods in the grey market, Rolex cancelled agreements with 100 dealers. More recently Rolex fought a lengthy court battle with online retailer eBay seeking an injunction to prevent the sale of Rolex-branded watches by the online auctioneer. The Supreme Court stated in its decision that eBay must take preventative measures to ensure that no counterfeit goods are sold under the pretence of being authentic Rolex watches. Rolex has also focused on maintaining the purity of its brand image. Many luxury-goods makers have used their original product as a springboard for brand extensions (e.g., Cartier and Mont Blanc) while others have licensed their brand to other manufacturers. Rolex has, so far, not diversified into the production of parallel products. However, Rolex did launch the Tudor brand, aimed at competing with Tag Heuer and other competitors within the accessible luxury market. For example, the price tag on a typical Rolex started at $2,000 and could go as high as $180,000 whereas a Tudor watch ranges from $850 to $4,000 (see Table 1.0 for price segmentation). There is no direct reference to the Tudor brand on the official Rolex website and as it is owned by Rolex, no financial information is made available to the public. The clear distinction between both brands has prevented any dilution of the value of the Rolex brand in the luxury market. However, the launch of Tudor in this market segment has contributed to Rolex being ineffective at reaching a younger market. Table 1.0 Typical price segmentation in the watch industry Price algory Definition Technology Brand Examples Our CHPX 00 ( TR2,000) Exclude oury M Pot Pippe Bugat Pew 98 CHF / CHE (between Und UK.02) "cel Bury MG Radi Zenit, INC Between CHP300 and CHICO (between ELR150 EURO) Mile QM Ti, Norielcro Below CHP20 (below EUR150) Low priced sement Q The State Coach Source: Pictet, FH Communications Rolex uses a number of marketing communication tools to effectively convey its positioning strategy. Print advertising in upmarket publications such as the Financial Times and Vogue remain popular. Sponsorship and testimonials remain central to Rolex marketing communications. Rolex aims to select people who have achieved something so that Rolex can reinforce the similar values of the brand. Rolex has links to the Arts (Michael Buble), motor sports (Jackie Stewart), equestrian, exploration, skiing, and yachting. Rolex has a long association with golf since 1967, when Arnold Palmer became a testimonee. Today it sponsors major events such as the Open, Augusta Masters and the Ryder Cup and in a bid to attract a younger generation of consumers, Rolex has FBB0015 sponsored current players such as Ricky Fowler, Adam Scott and Martin Kaymer. Rolex remains a partner of the Wimbledon tennis tournament since 1978, with the Rolex clock synonymous with the scoreboard on Centre Court. Similarly, Rolex is robustly involved in philanthropy. It is the initiator of a mentoring programme, the Rolex Mentor and Protg Arts Initiative, launched in 2002 as well as the Rolex Awards for Enterprises launched in 1978. Rolex also boasts almost 2.7 million Facebook users. These carefully selected methods of communication all reinforce the positioning of Rolex as a luxury brand. Conclusion In the future Rolex will face greater competition, particularly in Asia and other emerging markets, as competitors search for new ways to gain market share. The large luxury goods conglomerates enjoy certain advantages over an independent firm like Rolex. Many have restructured operations to take advantage of size and significantly reduce cost, enjoying synergies in advertising and marketing. The conglomerates may also be more willing to source from Asia, where labour costs are considerably lower than Switzerland. Crucially, these conglomerates also have successful brands targeted at a younger market. With an ageing target market and difficulty in attracting a younger consumer base Rolex could become a prisoner of its own strategy. The strategy has been so well defined that it would be difficult for the company to change radically or become more innovative. It might be difficult to communicate any new strategy to customers without confusing them, leaving some market opportunities unattainable in the future. This case was prepared by David Cosgrave, Limerick University from various published sources. Question: Based on given case, evaluate the alternate bases that Rolex might use to segments its market. Which base would you recommend and why? [20 marks]

question: Based on the given case, evaluate the alternate bases that Rolex might use to segments its market. Which base would you recommend and why?

question: Based on the given case, evaluate the alternate bases that Rolex might use to segments its market. Which base would you recommend and why?