Question: question c and d only QUESTIONS C AND D ONLY Reporting Finance Lease, Guaranteed Residual-Lessee On the first day of its accounting year, January 1,

question c and d only

QUESTIONS C AND D ONLY

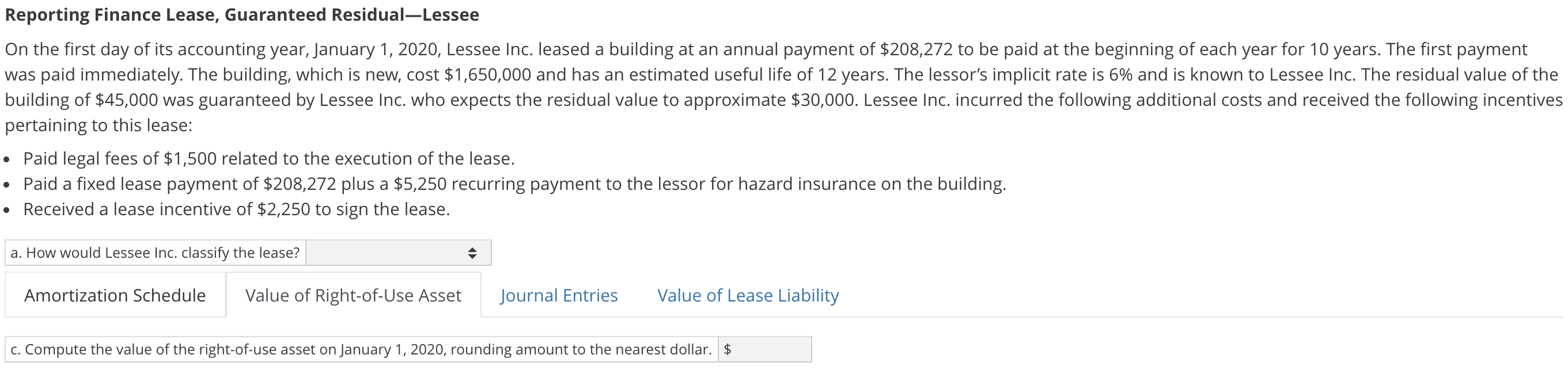

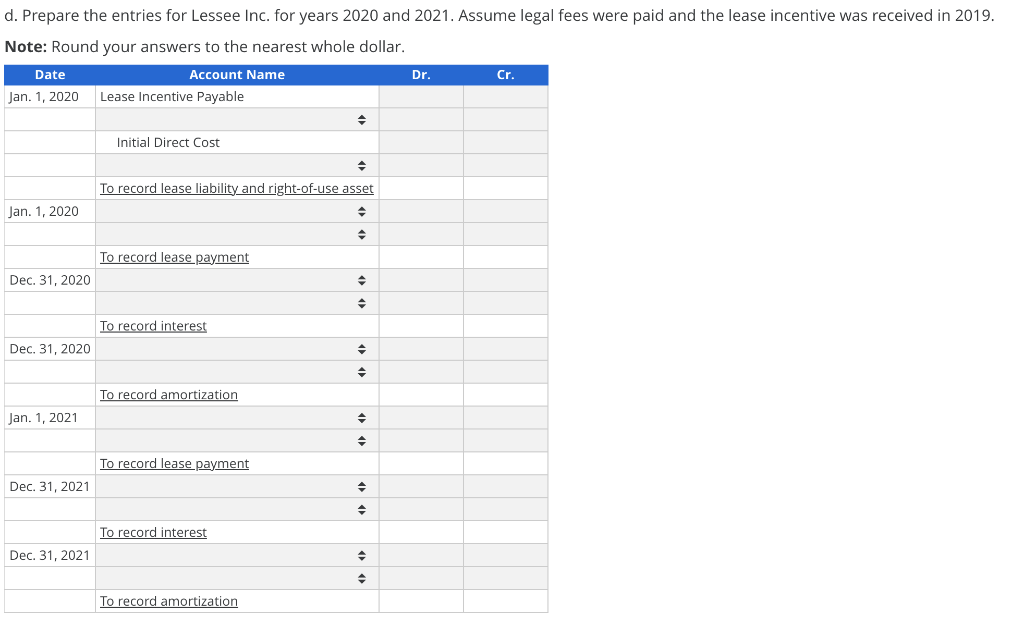

Reporting Finance Lease, Guaranteed Residual-Lessee On the first day of its accounting year, January 1, 2020, Lessee Inc. leased a building at an annual payment of $208,272 to be paid at the beginning of each year for 10 years. The first payment was paid immediately. The building, which is new, cost $1,650,000 and has an estimated useful life of 12 years. The lessor's implicit rate is 6% and is known to Lessee Inc. The residual value of the building of $45,000 was guaranteed by Lessee Inc. who expects the residual value to approximate $30,000. Lessee Inc. incurred the following additional costs and received the following incentives pertaining to this lease: Paid legal fees of $1,500 related to the execution of the lease. Paid a fixed lease payment of $208,272 plus a $5,250 recurring payment to the lessor for hazard insurance on the building. Received a lease incentive of $2,250 to sign the lease. . a. How would Lessee Inc. classify the lease? Amortization Schedule Value of Right-of-Use Asset Journal Entries Value of Lease Liability c. Compute the value of the right-of-use asset on January 1, 2020, rounding amount to the nearest dollar. $ d. Prepare the entries for Lessee Inc. for years 2020 and 2021. Assume legal fees were paid and the lease incentive was received in 2019. Note: Round your answers to the nearest whole dollar. Date Account Name Dr. Jan. 1, 2020 Lease Incentive Payable Cr. . Initial Direct Cost . To record lease liability and right-of-use asset Jan. 1, 2020 To record lease payment Dec. 31, 2020 To record interest Dec. 31, 2020 To record amortization Jan. 1, 2021 To record lease payment Dec. 31, 2021 To record interest Dec 31, 2021 To record amortization Reporting Finance Lease, Guaranteed Residual-Lessee On the first day of its accounting year, January 1, 2020, Lessee Inc. leased a building at an annual payment of $208,272 to be paid at the beginning of each year for 10 years. The first payment was paid immediately. The building, which is new, cost $1,650,000 and has an estimated useful life of 12 years. The lessor's implicit rate is 6% and is known to Lessee Inc. The residual value of the building of $45,000 was guaranteed by Lessee Inc. who expects the residual value to approximate $30,000. Lessee Inc. incurred the following additional costs and received the following incentives pertaining to this lease: Paid legal fees of $1,500 related to the execution of the lease. Paid a fixed lease payment of $208,272 plus a $5,250 recurring payment to the lessor for hazard insurance on the building. Received a lease incentive of $2,250 to sign the lease. . a. How would Lessee Inc. classify the lease? Amortization Schedule Value of Right-of-Use Asset Journal Entries Value of Lease Liability c. Compute the value of the right-of-use asset on January 1, 2020, rounding amount to the nearest dollar. $ d. Prepare the entries for Lessee Inc. for years 2020 and 2021. Assume legal fees were paid and the lease incentive was received in 2019. Note: Round your answers to the nearest whole dollar. Date Account Name Dr. Jan. 1, 2020 Lease Incentive Payable Cr. . Initial Direct Cost . To record lease liability and right-of-use asset Jan. 1, 2020 To record lease payment Dec. 31, 2020 To record interest Dec. 31, 2020 To record amortization Jan. 1, 2021 To record lease payment Dec. 31, 2021 To record interest Dec 31, 2021 To record amortization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts