Question: Question Com Status: What journal entry does Taft, Inc. need to make in their accounting records if they accept a $1,500 note receivable in substitution

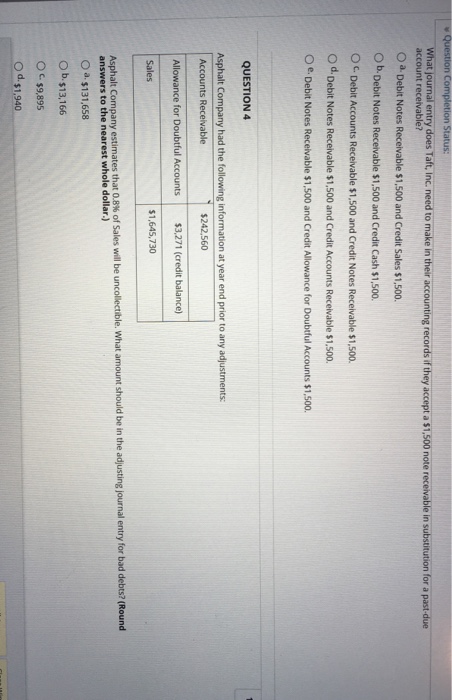

Question Com Status: What journal entry does Taft, Inc. need to make in their accounting records if they accept a $1,500 note receivable in substitution for a past-due 0 a. Debit Notes Receivable $1,500 and Credit Sales $1,500. Ob. Debit Notes Receivable $1,500 and Credit Cash $1,500. OC Debit Accounts Receivable $1,500 and Credit Notes Receivable $1,500 d) d. Debit Notes Receivable $1,500 and Credit Accounts Receivable $1,500. O e. Debit Notes Receivable $1,500 and Credit Allowance for Doubtful Accounts $1,500 QUESTION4 Asphalt Company had the following information at year end prior to any adjustments: $242,560 Accounts Receivable Allowance for Doubtful Accounts Sales $3,271 (credit balance) $1,645,730 Asphalt Company estimates that 0.8% of Sal answers to the nearest whole dollar.) es wil be uncollectible. What amount should be in the adjusting ournal entry for bad debts? (Round o a $131,658 O b.$13,166 O c. $9,895 o $1,940 d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts