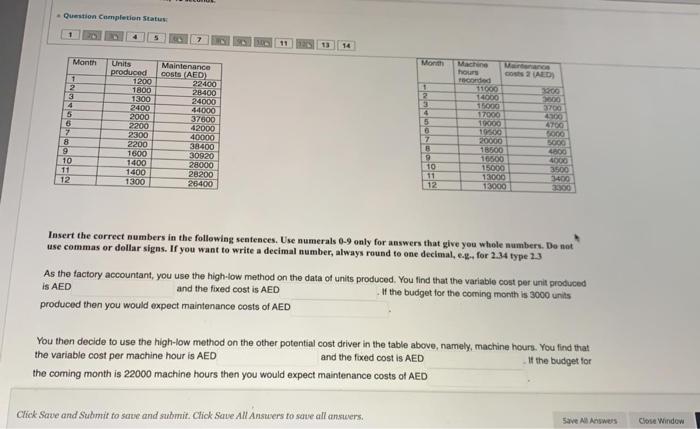

Question: Question Completion Status 1 14 Month Month AD 2 3000 Machine hours conded 11000 14000 15000 17000 TOO 3700 Units produced 1200 1800 1300 2400

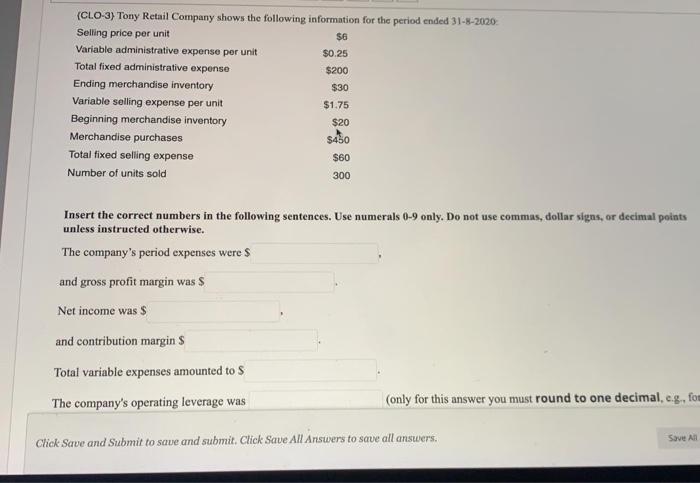

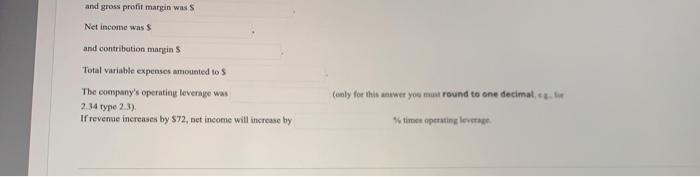

Question Completion Status 1 14 Month Month AD 2 3000 Machine hours conded 11000 14000 15000 17000 TOO 3700 Units produced 1200 1800 1300 2400 2000 2200 2300 2200 1600 1400 1400 1300 Maintenance costs (AED) 22400 28400 24000 44000 37000 42000 40000 38400 30920 28000 28200 26400 2 3 4 5 6 7 8 19 10 11 12 4 5 7 000 500 4800 9 10 20000 18500 16500 15000 13000 13000 3500 3400 12 Insert the correct numbers in the following sentences. Use numerals 0-9 only for answers that give you whole numbers. Do not use commas or dollar signs. If you want to write a decimal number, always round to one decimal, e...for 2.34 type 23 As the factory accountant, you use the high-low method on the data of units produced. You find that the variable cost per unit produced is AED and the fixed cost is AED If the budget for the coming month is 3000 units produced then you would expect maintenance costs of AED You then decide to use the high-low method on the other potential cost driver in the table above, namely, machine hours. You find that the variable cost per machine hour is AED and the fixed cost is AED It the budget for the coming month is 22000 machine hours then you would expect maintenance costs of AED Click Save and Submit to serve and submit. Click Save All Anstuers to save all ensurers. Save Al Answers Close Window (CLO-3) Tony Retail Company shows the following information for the period ended 31-8-2020 Selling price per unit $6 Variable administrative expense per unit $0.25 Total fixed administrative expense $200 Ending merchandise inventory $30 Variable selling expense per unit $1.75 Beginning merchandise inventory $20 Merchandise purchases $450 Total fixed selling expense $60 Number of units sold 300 Insert the correct numbers in the following sentences. Use numerals 0-9 only. Do not use commus, dollar signs, or decimal points unless instructed otherwise. The company's period expenses were $ and gross profit margin was $ Net income was $ and contribution margin $ Total variable expenses amounted to s The company's operating leverage was (only for this answer you must round to one decimal, e.g., fom Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save AR and gross profit margin wass Net income was and contribution margins Total variable expenses amounted to s The company's operating leverage was 2.34 type 2.3). If revenue increases by $72, net income will increase by enly for this answer you must round to one decimales. * times penting leve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts