Question: Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

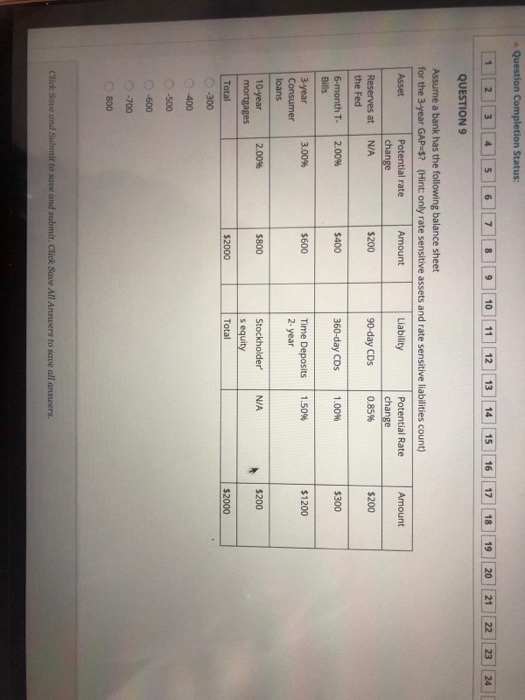

Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 QUESTION 9 Assume a bank has the following balance sheet for the 3-year GAP=$? (Hint: only rate sensitive assets and rate sensitive liabilities count) Asset Potential rate Amount Liability Potential Rate change change Reserves at N/A $200 90-day CDs 0.85% the Fed Amount $200 6-month T- 2.00% $400 360-day CDs 1.00% $300 Bills 3.00% $600 1.50% $1200 3-year Consumer loans Time Deposits 2-year 2.00% $800 N/A $200 10-year mortgages Stockholder s equity Total Total $2000 $2000 -300 400 -500 -600 -700 800 Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts