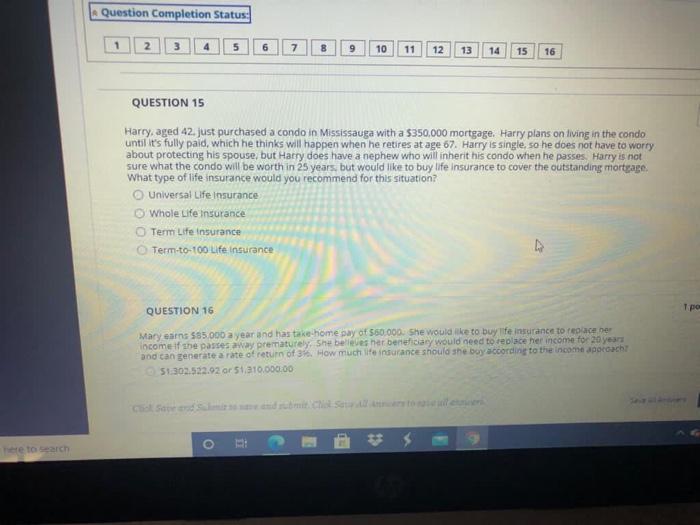

Question: Question Completion Status: 1 2 3 4 5 6 7 10 11 12 13 14 15 16 QUESTION 15 Harry, aged 42. just purchased a

Question Completion Status: 1 2 3 4 5 6 7 10 11 12 13 14 15 16 QUESTION 15 Harry, aged 42. just purchased a condo in Mississauga with a $350,000 mortgage. Harry plans on living in the condo until it's fully paid, which he thinks will happen when he retires at age 67. Harry is single, so he does not have to worry about protecting his spouse, but Harry does have a nephew who will inherit his condo when he passes Harry is not sure what the condo will be worth in 25 years, but would like to buy life insurance to cover the outstanding mortgage What type of life insurance would you recommend for this situation? Universal Life Insurance O Whole Life Insurance Term Life Insurance Term-to-100 Life Insurance QUESTION 16 Mary earns $85.000 a year and has take-home pay of 560.000. She would like to buy life insurance to receber income of the passes away prematurely, she believes her beneficiary would need to replace her income for 20 years and can generate a rate of return of 35. How much life insurance should she boy according to the income apocoach 51.302.522.92 or 51.210,000.00 Question Completion Status: 1 2 3 4 5 6 7 10 11 12 13 14 15 16 QUESTION 15 Harry, aged 42. just purchased a condo in Mississauga with a $350,000 mortgage. Harry plans on living in the condo until it's fully paid, which he thinks will happen when he retires at age 67. Harry is single, so he does not have to worry about protecting his spouse, but Harry does have a nephew who will inherit his condo when he passes Harry is not sure what the condo will be worth in 25 years, but would like to buy life insurance to cover the outstanding mortgage What type of life insurance would you recommend for this situation? Universal Life Insurance O Whole Life Insurance Term Life Insurance Term-to-100 Life Insurance QUESTION 16 Mary earns $85.000 a year and has take-home pay of 560.000. She would like to buy life insurance to receber income of the passes away prematurely, she believes her beneficiary would need to replace her income for 20 years and can generate a rate of return of 35. How much life insurance should she boy according to the income apocoach 51.302.522.92 or 51.210,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts