Question: Question Completion Status: 1 2 3 5 6 7 10 11 12 13 14 15 16 17 18 19 20 Moving to another question will

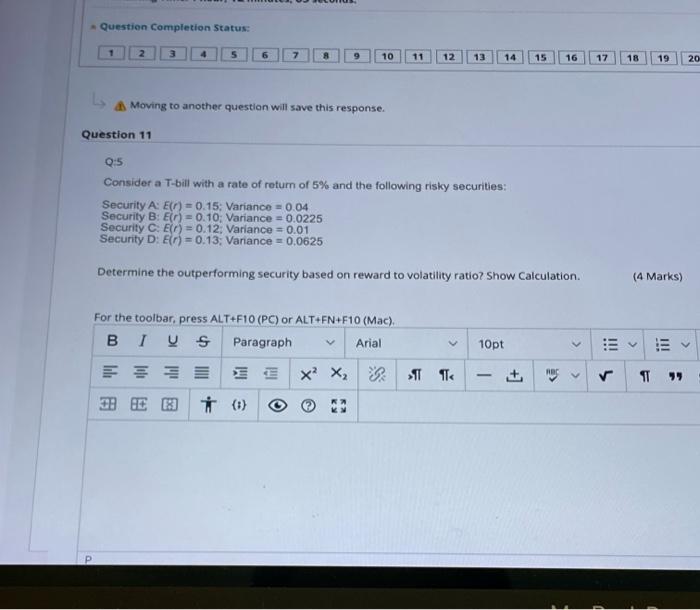

Question Completion Status: 1 2 3 5 6 7 10 11 12 13 14 15 16 17 18 19 20 Moving to another question will save this response. Question 11 0:5 Consider a T-bill with a rate of return of 5% and the following risky securities: Security A: E() = 0.15: Variance = 0.04 Security B: El ) = 0.10: Variance = 0.0225 Security C: E = 0.12. Variance = 0.01 Security D: En = 0.13 Variance = 0.0625 Determine the outperforming security based on reward to volatility ratio? Show Calculation (4 Marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac) I gs Paragraph Arial X X, BT Te 10pt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts