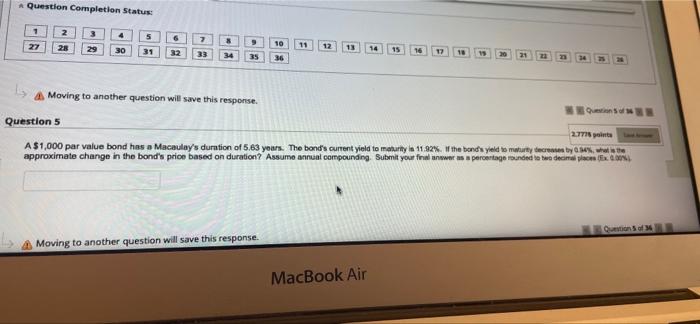

Question: Question Completion Status: 1 27 28 12 13 31 33 Moving to another question will save this response. Question 5 2777 A $1,000 par value

Question Completion Status: 1 27 28 12 13 31 33 Moving to another question will save this response. Question 5 2777 A $1,000 par value bond has a Macaulay's duration of 5.63 years. The bond's current yield to maturity in 11.92%. If the band's yieldsmatury tereby w is the approximate change in the bond's prion based on duration? Assume annual compounding Submit your flawwer as a percentage rounded to two decal Qui so Moving to another question will save this response. MacBook Air Question Completion Status: 1 27 28 12 13 31 33 Moving to another question will save this response. Question 5 2777 A $1,000 par value bond has a Macaulay's duration of 5.63 years. The bond's current yield to maturity in 11.92%. If the band's yieldsmatury tereby w is the approximate change in the bond's prion based on duration? Assume annual compounding Submit your flawwer as a percentage rounded to two decal Qui so Moving to another question will save this response. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts