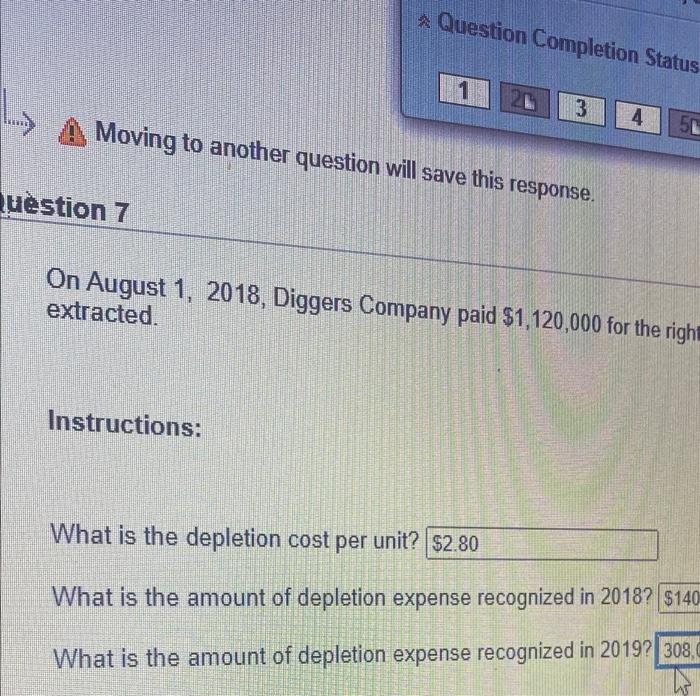

Question: Question Completion Status 1 3 4 50 Moving to another question will save this response. uestion 7 On August 1, 2018, Diggers Company paid $1,120,000

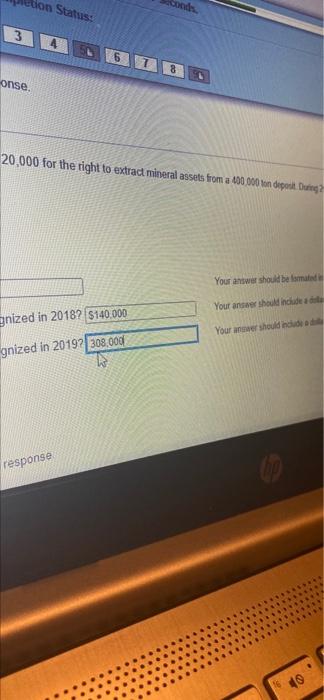

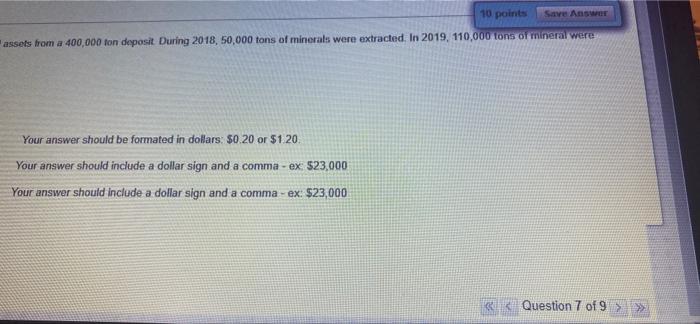

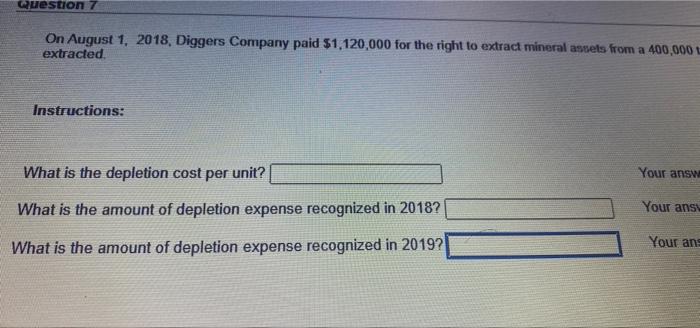

Question Completion Status 1 3 4 50 Moving to another question will save this response. uestion 7 On August 1, 2018, Diggers Company paid $1,120,000 for the right extracted Instructions: What is the depletion cost per unit? $2.80 What is the amount of depletion expense recognized in 2018? $140 What is the amount of depletion expense recognized in 20192 308, etion Status: es onse 20,000 for the right to extract mineral assets from a 400 000 ton depost. Dung? Your answer should be forma Your answer should included gnized in 2018? $140.000 Your answer should included gnized in 20192 308.000/ response 40 10 points Save Answer assets from a 400,000 fon deposit During 2018,50,000 tons of minerals were extracted. In 2019, 110,000 tons or mineral were Your answer should be formated in dollars: $0.20 or $120 Your answer should include a dollar sign and a comma - ex $23.000 Your answer should include a dollar sign and a comma - ex: $23,000 Question 7 of 9 > >> Question 7 On August 1, 2018, Diggers Company paid $1,120,000 for the right to extract mineral assets from a 400,000 extracted Instructions: What is the depletion cost per unit? Your answ What is the amount of depletion expense recognized in 2018? Your ans Your an What is the amount of depletion expense recognized in 2019? for the right to extract mineral assets from a 400.000 ton deposit During 2018. 50.000 tons of minerals were extracted. In 2019, 110 Your answer should be formated in dollars $0.20 or $1.20. 3? Your answer should include a dollar sign and a comma - ex $23,000 Your answer should include a dollar sign and a comma - ex $23,000 10 points Save Answer esitDuring 2018. 50,000 tons of minerals were extracted. In 2019, 110,000 tons of mineral were mated in dollars: $0.20 or $1.20. e a dollar sign and a comma - ex: $23,000 a dollar sign and a comma - ex: $23,000 Question Completion Status 1 3 4 50 Moving to another question will save this response. uestion 7 On August 1, 2018, Diggers Company paid $1,120,000 for the right extracted Instructions: What is the depletion cost per unit? $2.80 What is the amount of depletion expense recognized in 2018? $140 What is the amount of depletion expense recognized in 20192 308, etion Status: es onse 20,000 for the right to extract mineral assets from a 400 000 ton depost. Dung? Your answer should be forma Your answer should included gnized in 2018? $140.000 Your answer should included gnized in 20192 308.000/ response 40 10 points Save Answer assets from a 400,000 fon deposit During 2018,50,000 tons of minerals were extracted. In 2019, 110,000 tons or mineral were Your answer should be formated in dollars: $0.20 or $120 Your answer should include a dollar sign and a comma - ex $23.000 Your answer should include a dollar sign and a comma - ex: $23,000 Question 7 of 9 > >> Question 7 On August 1, 2018, Diggers Company paid $1,120,000 for the right to extract mineral assets from a 400,000 extracted Instructions: What is the depletion cost per unit? Your answ What is the amount of depletion expense recognized in 2018? Your ans Your an What is the amount of depletion expense recognized in 2019? for the right to extract mineral assets from a 400.000 ton deposit During 2018. 50.000 tons of minerals were extracted. In 2019, 110 Your answer should be formated in dollars $0.20 or $1.20. 3? Your answer should include a dollar sign and a comma - ex $23,000 Your answer should include a dollar sign and a comma - ex $23,000 10 points Save Answer esitDuring 2018. 50,000 tons of minerals were extracted. In 2019, 110,000 tons of mineral were mated in dollars: $0.20 or $1.20. e a dollar sign and a comma - ex: $23,000 a dollar sign and a comma - ex: $23,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts