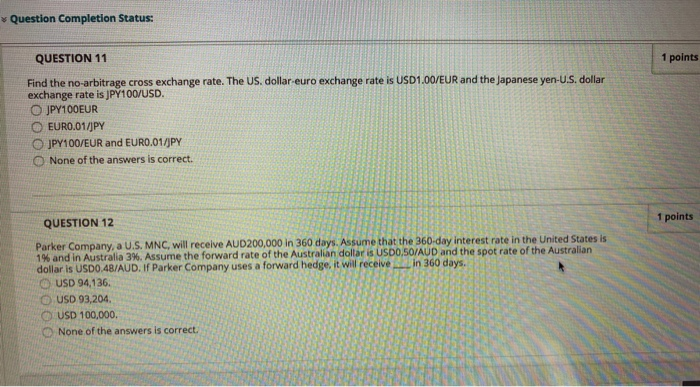

Question: Question Completion Status: 1 points QUESTION 11 Find the no-arbitrage cross exchange rate. The US dollar-euro exchange rate is USD1.00/EUR and the Japanese yen-U.S. dollar

Question Completion Status: 1 points QUESTION 11 Find the no-arbitrage cross exchange rate. The US dollar-euro exchange rate is USD1.00/EUR and the Japanese yen-U.S. dollar exchange rate is JPY100/USD. O JPY100EUR O EURO.01/JPY JPY100/EUR and EURO.01/JPY None of the answers is correct. 1 points QUESTION 12 Parker Company, a U.S. MNC will receive AUD200,000 in 360 days. Assume that the 360 day interest rate in the United States is 1% and in Australia 3%. Assume the forward rate of the Australian dollaris USDO,SO/AUD and the spot rate of the Australian dollars USD 4B/AUD. If Parker Company uses a forward hedge. It will receive in 360 days. USD 94,136. USD 93,204 USD 100,000 None of the answers is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts