Question: Question Completion Status: 12 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

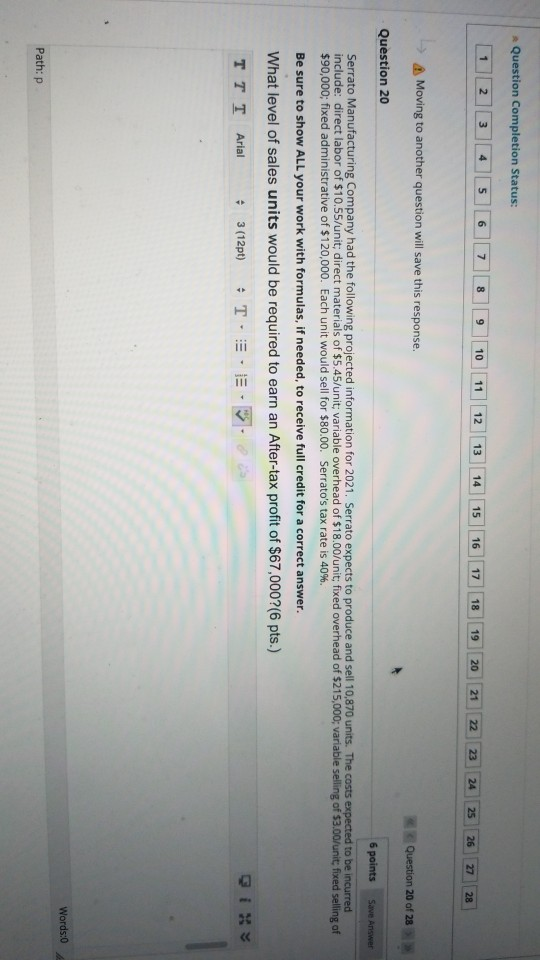

Question Completion Status: 12 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 > Moving to another question will save this response. Question 20 of 28 Question 20 6 points Save Answer Serrato Manufacturing Company had the following projected information for 2021. Serrato expects to produce and sell 10,870 units. The costs expected to be incurred include: direct labor of $10.55/unit; direct materials of $5,45/unit: variable overhead of $18.00/unit: fixed overhead of $215,000; variable selling of $3.00/unit: fixed selling of $90,000; fixed administrative of $120,000. Each unit would sell for $80.00. Serrato's tax rate is 40%. Be sure to show ALL your work with formulas, if needed, to receive full credit for a correct answer. What level of sales units would be required to earn an After-tax profit of $67,000?(6 pts.) TT T Arial 3(12pt) T. E Words:0 Path:p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts