Question: Question Completion Status: 16 25 2 26 7 30 27 40 28 80 50 29 101110 120 13 14 30 15 16 17 18 19

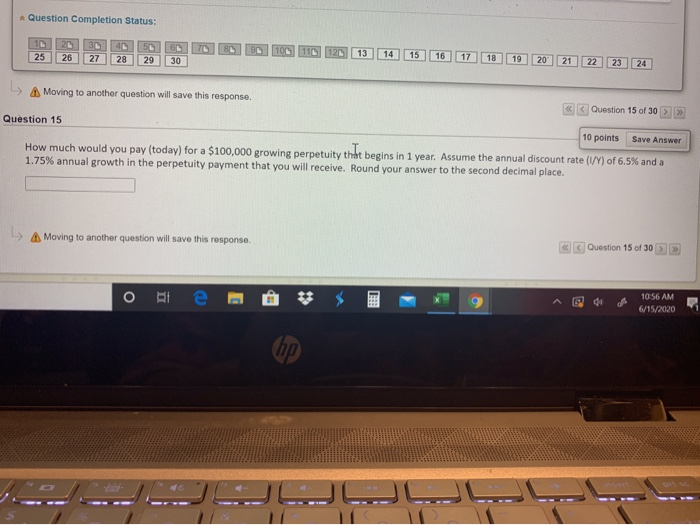

Question Completion Status: 16 25 2 26 7 30 27 40 28 80 50 29 101110 120 13 14 30 15 16 17 18 19 20 21 22 23 24 Moving to another question will save this response. Question 15 of 30 > Question 15 10 points Save Answer How much would you pay (today) for a $100,000 growing perpetuity that begins in 1 year. Assume the annual discount rate (1/) of 6.5% and a 1.75% annual growth in the perpetuity payment that you will receive. Round your answer to the second decimal place. Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock