Question: Question Completion Status: 3 25 10 15 Note: The averages of the historical returns are not needed, and they are generally not equal to the

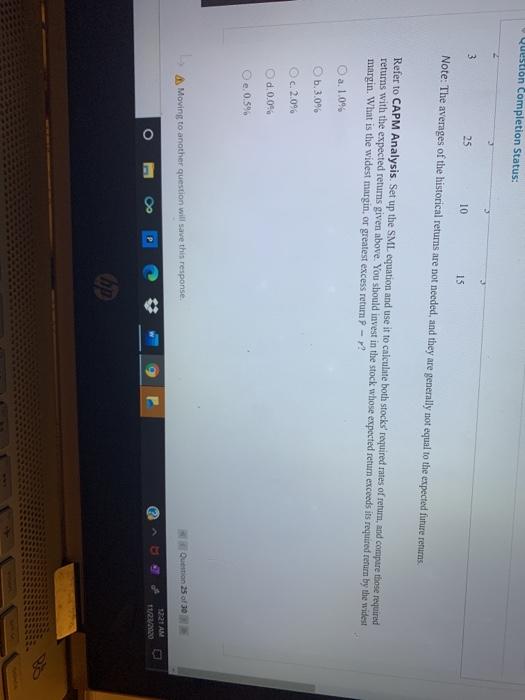

Question Completion Status: 3 25 10 15 Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns Refer to CAPM Analysis. Set up the SML equation and use it to calculate both stocks required rates of retum, and compare those required returns with the expected returns given above. You should invest in the stock whose expected return exceeds is required return by the widest margin. What is the widest margin, or greatest excess return? - 2 a. 1.0% b.3.0% c2.0% d. 0.04 De 0.5% Moving to another question will save this response Question 25 of 30 12:21 AM 11/20 O P Question Completion Status: 3 25 10 15 Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns Refer to CAPM Analysis. Set up the SML equation and use it to calculate both stocks required rates of retum, and compare those required returns with the expected returns given above. You should invest in the stock whose expected return exceeds is required return by the widest margin. What is the widest margin, or greatest excess return? - 2 a. 1.0% b.3.0% c2.0% d. 0.04 De 0.5% Moving to another question will save this response Question 25 of 30 12:21 AM 11/20 O P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts