Question: Question Completion Status: 3 points Question 15 Save Answer Suppose that Dutchy Inc. (DI), a hypothetical technology company, and Great Investment Bank (GIB), a hypothetical

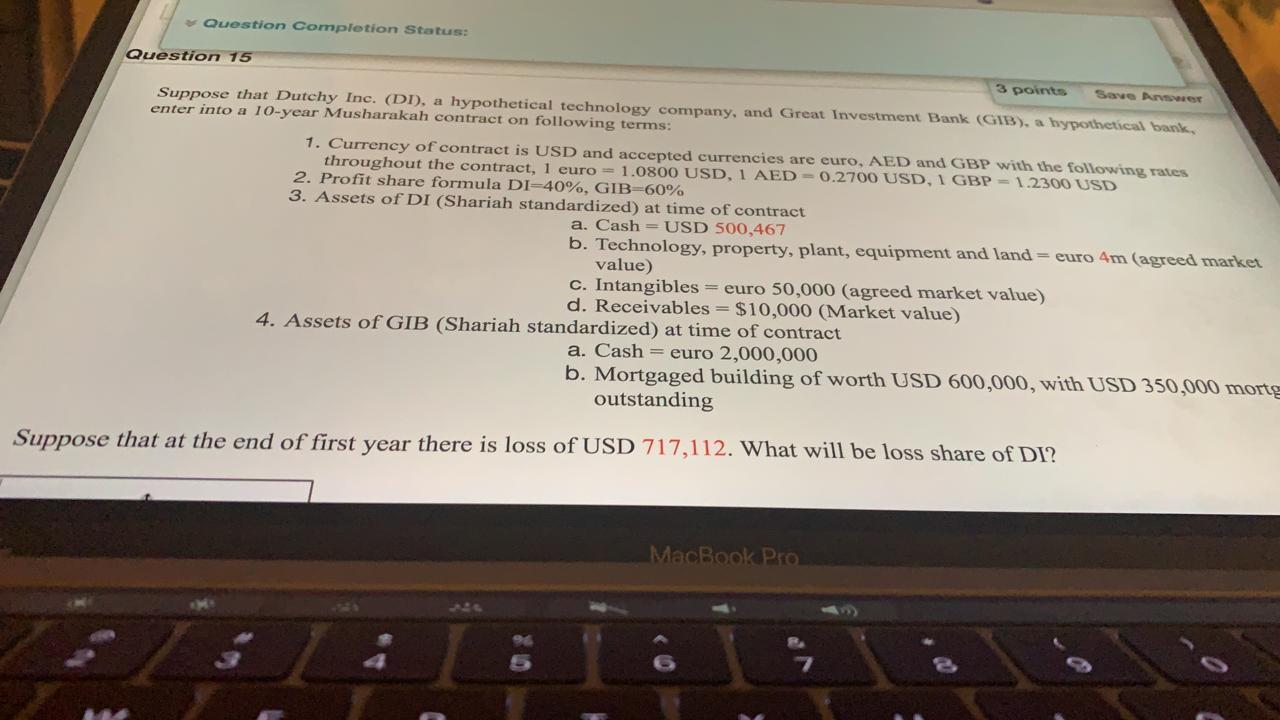

Question Completion Status: 3 points Question 15 Save Answer Suppose that Dutchy Inc. (DI), a hypothetical technology company, and Great Investment Bank (GIB), a hypothetical bank, enter into a 10-year Musharakah contract on following terms: 1. Currency of contract is USD and accepted currencies are euro, AED and GBP with the following rates throughout the contract, 1 euro = 1.0800 USD, 1 AED -0.2700 USD, 1 GBP = 1.2300 USD 2. Profit share formula DI-40%, GIB-60% 3. Assets of DI (Shariah standardized) at time of contract a. Cash = USD 500,467 b. Technology, property, plant, equipment and land = euro 4m (agreed market value) c. Intangibles = euro 50,000 (agreed market value) d. Receivables = $10,000 (Market value) 4. Assets of GIB (Shariah standardized) at time of contract a. Cash = euro 2,000,000 b. Mortgaged building of worth USD 600,000, with USD 350,000 morte outstanding Suppose that at the end of first year there is loss of USD 717,112. What will be loss share of DI? MacBook Pro Question Completion Status: 3 points Question 15 Save Answer Suppose that Dutchy Inc. (DI), a hypothetical technology company, and Great Investment Bank (GIB), a hypothetical bank, enter into a 10-year Musharakah contract on following terms: 1. Currency of contract is USD and accepted currencies are euro, AED and GBP with the following rates throughout the contract, 1 euro = 1.0800 USD, 1 AED -0.2700 USD, 1 GBP = 1.2300 USD 2. Profit share formula DI-40%, GIB-60% 3. Assets of DI (Shariah standardized) at time of contract a. Cash = USD 500,467 b. Technology, property, plant, equipment and land = euro 4m (agreed market value) c. Intangibles = euro 50,000 (agreed market value) d. Receivables = $10,000 (Market value) 4. Assets of GIB (Shariah standardized) at time of contract a. Cash = euro 2,000,000 b. Mortgaged building of worth USD 600,000, with USD 350,000 morte outstanding Suppose that at the end of first year there is loss of USD 717,112. What will be loss share of DI? MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts