Question: Question Completion Status: 3 pumms Saved Ben Holt has obtained several forward contract quotations for the Thai baht to determine whether covered interest arbitrage may

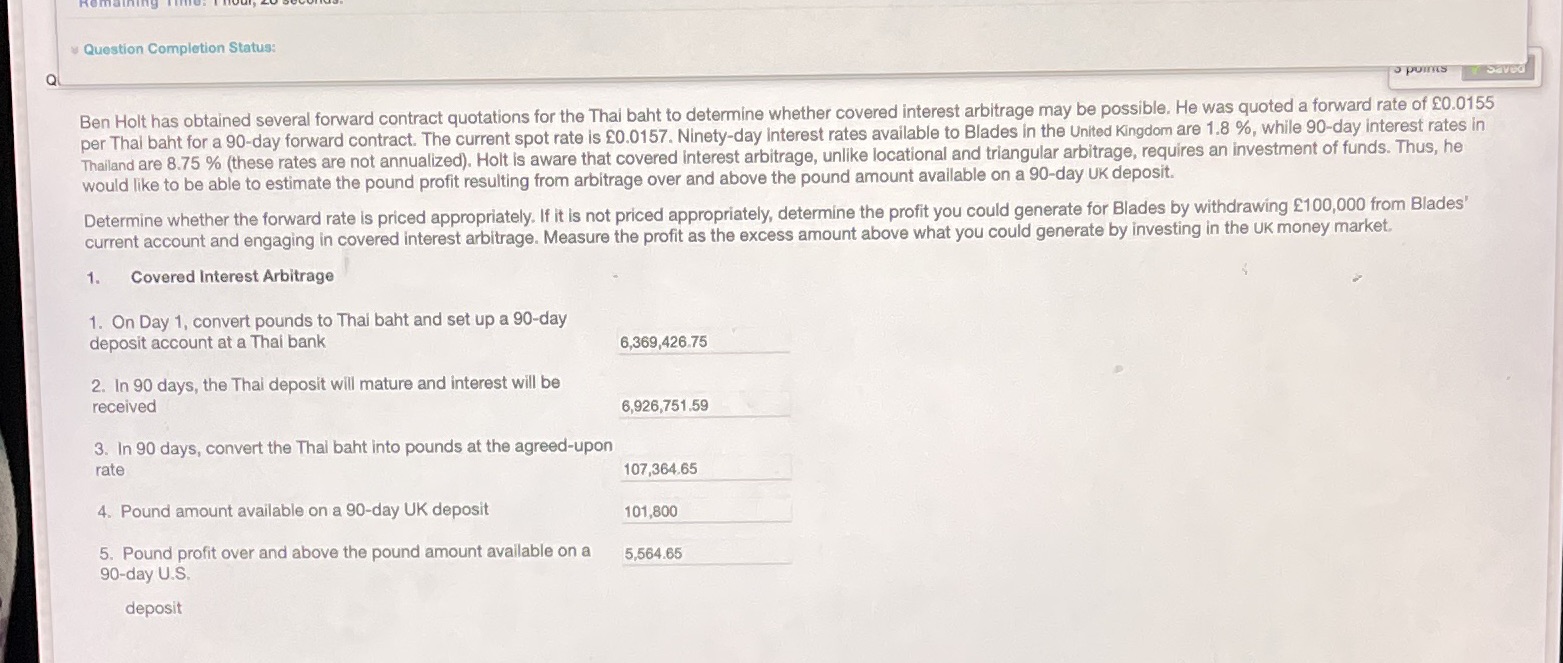

Question Completion Status: 3 pumms Saved Ben Holt has obtained several forward contract quotations for the Thai baht to determine whether covered interest arbitrage may be possible. He was quoted a forward rate of 20.0155 per Thai baht for a 90-day forward contract. The current spot rate is 20.0157. Ninety-day interest rates available to Blades in the United Kingdom are 1.8 %, while 90-day interest rates in Thailand are 8.75 % (these rates are not annualized). Holt is aware that covered interest arbitrage, unlike locational and triangular arbitrage, requires an investment of funds. Thus, he would like to be able to estimate the pound profit resulting from arbitrage over and above the pound amount available on a 90-day UK deposit. Determine whether the forward rate is priced appropriately. If it is not priced appropriately, determine the profit you could generate for Blades by withdrawing 2100,000 from Blades' current account and engaging in covered interest arbitrage. Measure the profit as the excess amount above what you could generate by investing in the UK money market. 1. Covered Interest Arbitrage 1. On Day 1, convert pounds to Thai baht and set up a 90-day deposit account at a Thai bank 6,369,426.75 2. In 90 days, the Thai deposit will mature and interest will be received 6,926,751.59 3. In 90 days, convert the Thai baht into pounds at the agreed-upon rate 107,364.65 4. Pound amount available on a 90-day UK deposit 101,800 5. Pound profit over and above the pound amount available on a 5,564.65 90-day U.S. deposit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts