Question: * Question Completion Status: 80 9 110 310 12 326 136 330 210 140 340 350 160 170 180 360 370 380 190 200 390

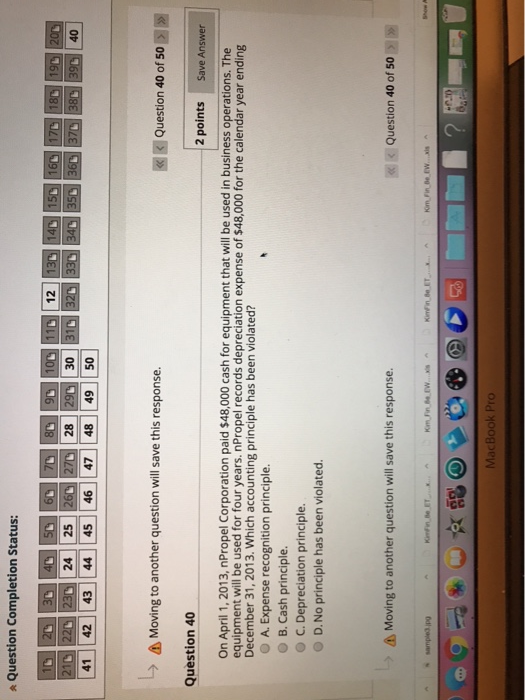

* Question Completion Status: 80 9 110 310 12 326 136 330 210 140 340 350 160 170 180 360 370 380 190 200 390 40 -> Moving to another question will save this response. >> Question 40 2 points Save Answer On April 1, 2013, nPropel Corporation paid $48,000 cash for equipment that will be used in business operations. The equipment will be used for four years. nPropel records depreciation expense of $48,000 for the calendar year ending December 31, 2013. Which accounting principle has been violated? A. Expense recognition principle. B. Cash principle. C. Depreciation principle. D. No principle has been violated. > A Moving to another question will save this response. >> Kiinte E k im Fin .. Kimin ... KomFin de w... MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts