Question: Question Completion Status: 9 10 11 12 13 14 15 16 19 Sweaver 20 3 50 17 18 Question 9 5 points Metals Corp. has

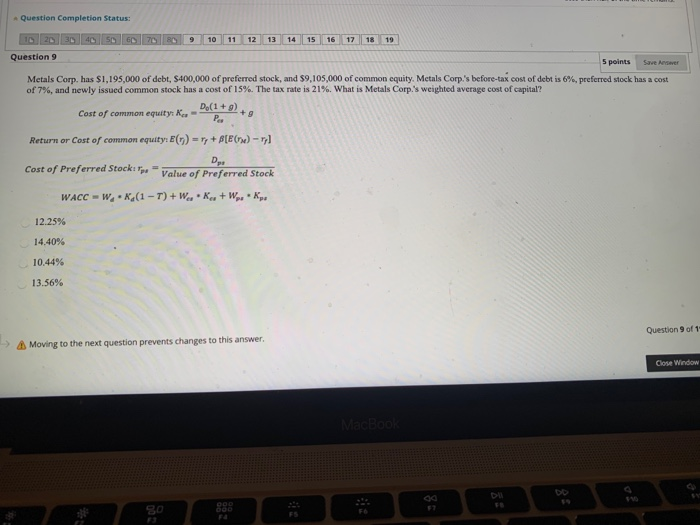

Question Completion Status: 9 10 11 12 13 14 15 16 19 Sweaver 20 3 50 17 18 Question 9 5 points Metals Corp. has $1,195,000 of debt, $400,000 of preferred stock, and $9,105,000 of common cquity, Metals Corp.'s before-tax cost of debt is 6%, preferred stock has a cost of 7%, and newly issued common stock has a cost of 15%. The tax rate is 21%. What is Metals Corp.'s weighted average cost of capital? Du(179) +9 Cost of common equity: K Po Return or Cost of common equity: E() = ry + [E6w) - Dp Cost of Preferred Stockit Value of Preferred Stock WACC =W.K.(1-7)+ W... K+W.K. 12.25% 14,40% 10.44% 13.56% Question of 1 Moving to the next question prevents changes to this answer. Close Window MacBook 80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts