Question: Question Completion Status: A Moving to another question will save this response. Question 5 of 10 > Question 5 1 points Save Answer Suppose that

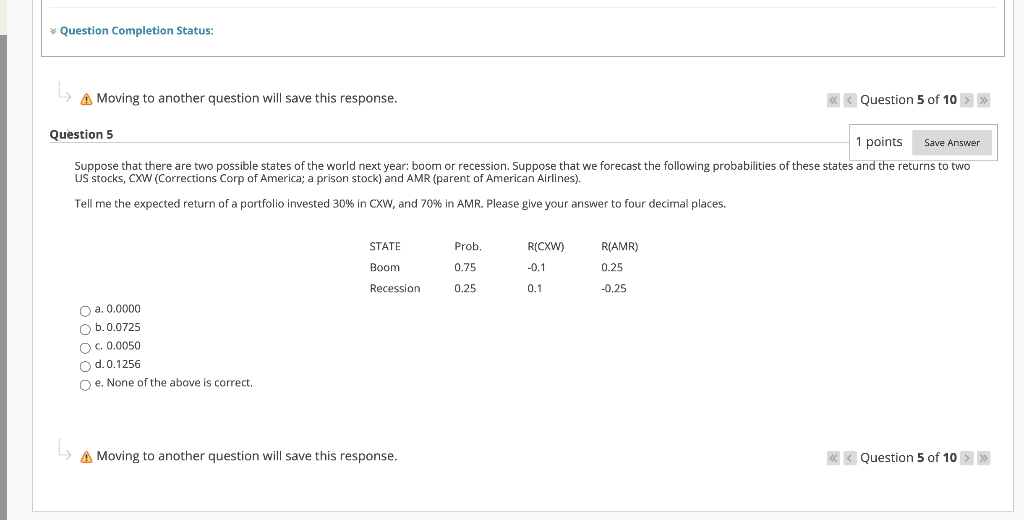

Question Completion Status: A Moving to another question will save this response. Question 5 of 10 > Question 5 1 points Save Answer Suppose that there are two possible states of the world next year: boom or recession. Suppose that we forecast the following probabilities of these states and the returns to two US stocks, cxw (Corrections Corp of America; a prison stock) and AMR (parent of American Airlines). Tell me the expected return of a portfolio invested 30% in CXW, and 70% in AMR. Please give your answer to four decimal places. STATE R(CXW) Prob. 0.75 R(AMR) 0.25 Boom -0.1 Recession 0.25 0.1 -0.25 a. 0.0000 b. 0.0725 OC. 0.0050 d. 0.1256 e. None of the above is correct. A Moving to another question will save this response. >>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts