Question: Question Completion Status: A Moving to another question will save this response. Question 10 If the beta of a stock is equal to zero then

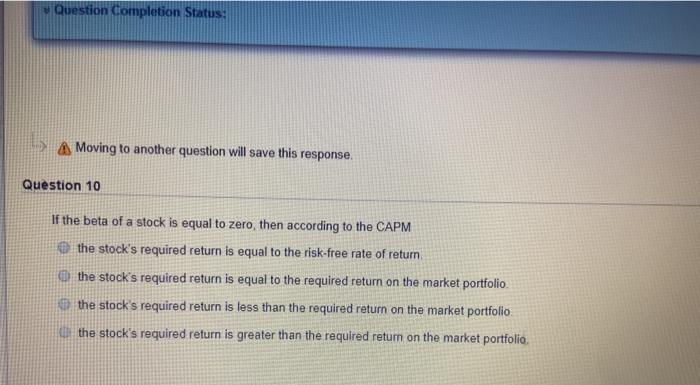

Question Completion Status: A Moving to another question will save this response. Question 10 If the beta of a stock is equal to zero then according to the CAPM the stock's required return is equal to the risk-free rate of return the stock's required return is equal to the required return on the market portfolio the stock's required return is less than the required return on the market portfolio the stock's required return is greater than the required return on the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts