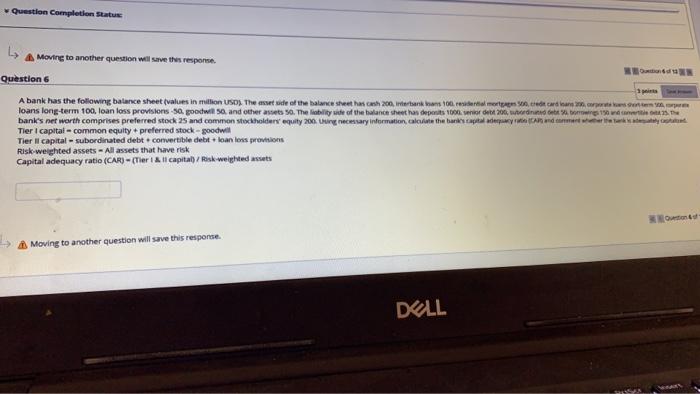

Question: Question Completion Status A Moving to another question will save the response. Questions A bank has the following balance sheet values in million USD). The

Question Completion Status A Moving to another question will save the response. Questions A bank has the following balance sheet values in million USD). The stude of the balance sheet has cash 200 merakam 100 creditcardan loans long-term 100. loan loss provisions-50. goodwil 50 and other assets 50. The libility ide of the balance sheet has deposit 100 ordet 200, wordt. 15 de bank's net worth comprises preferred stock 25 and common stockholders equity 200 g necessary information, call the band's capital de and come weer ter Tier I capital - common equity preferred stock - goodwill Tier Il capital - subordinated debt convertible debt loan los provisions Risk-weighted assets - All assets that have risk Capital adequacy ratio (CAR) - (Ter 1&11 capital/Risk weighted assets Moving to another question will save this response. DELL Question Completion Status A Moving to another question will save the response. Questions A bank has the following balance sheet values in million USD). The stude of the balance sheet has cash 200 merakam 100 creditcardan loans long-term 100. loan loss provisions-50. goodwil 50 and other assets 50. The libility ide of the balance sheet has deposit 100 ordet 200, wordt. 15 de bank's net worth comprises preferred stock 25 and common stockholders equity 200 g necessary information, call the band's capital de and come weer ter Tier I capital - common equity preferred stock - goodwill Tier Il capital - subordinated debt convertible debt loan los provisions Risk-weighted assets - All assets that have risk Capital adequacy ratio (CAR) - (Ter 1&11 capital/Risk weighted assets Moving to another question will save this response. DELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts