Question: Question Completion Status: A Moving to another question will save this response. Question 2 Which of the following statements is correct? a. Callable bonds tend

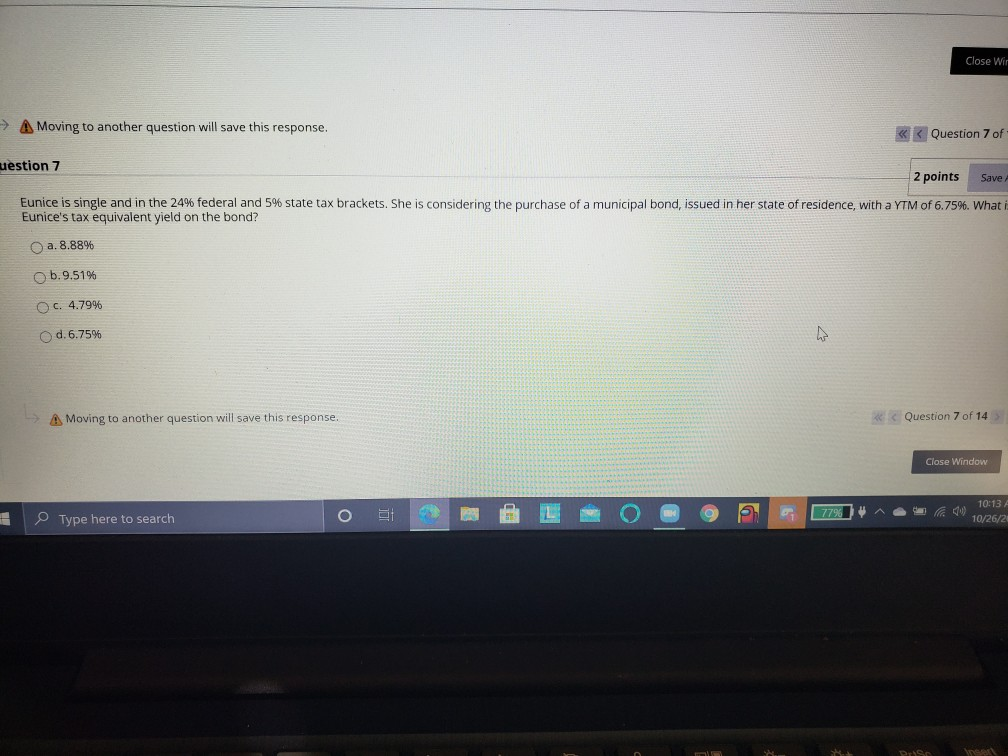

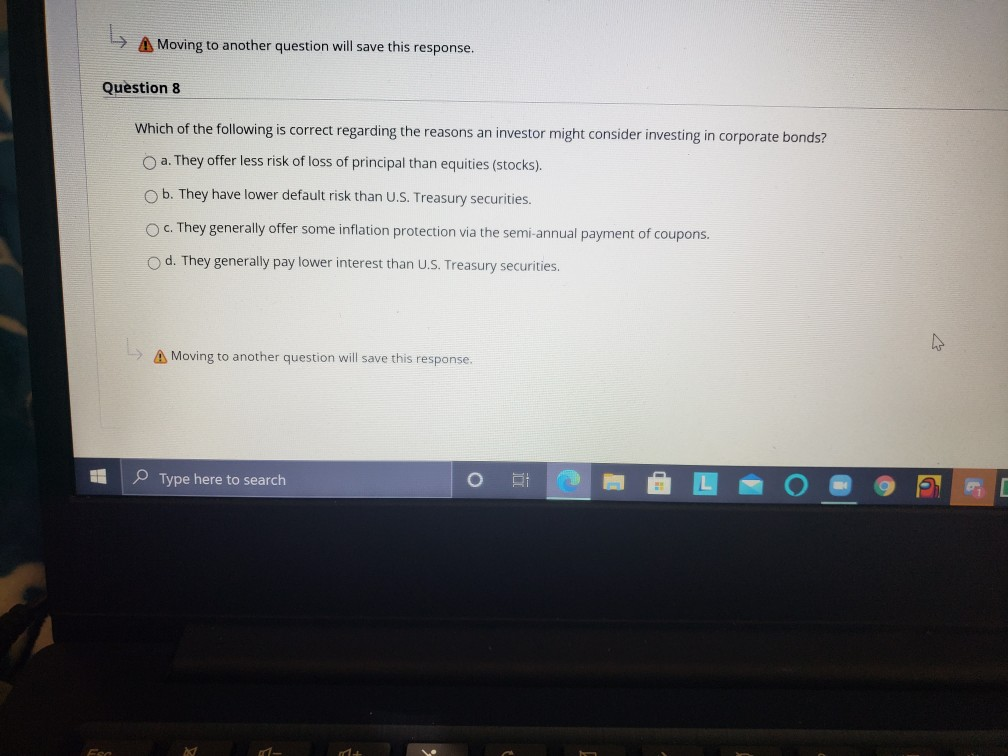

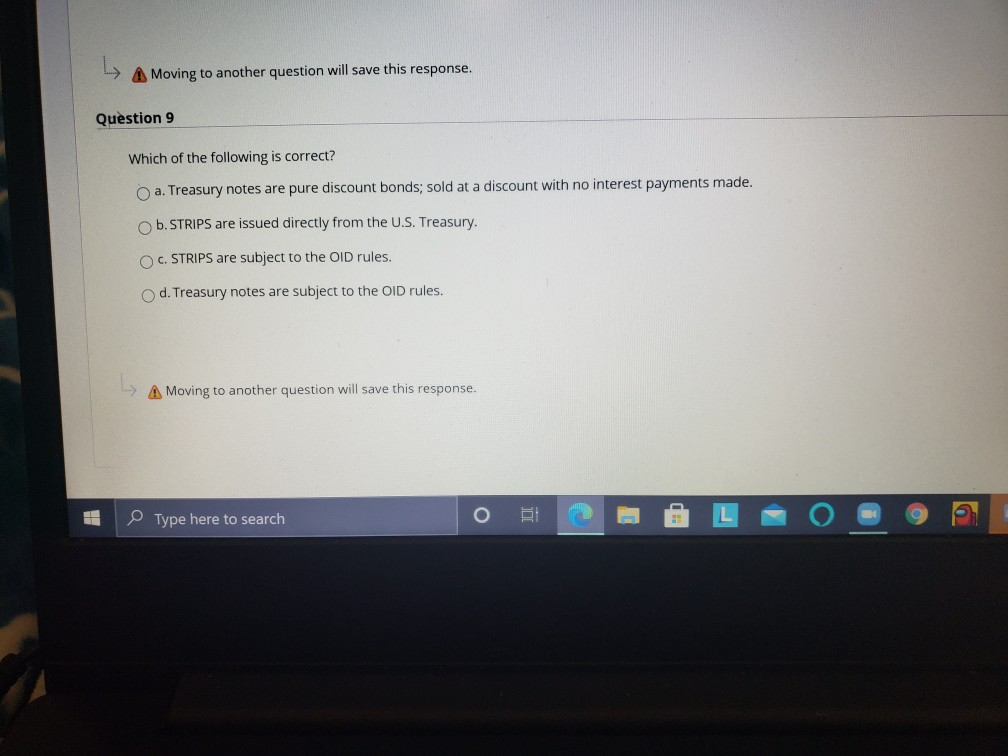

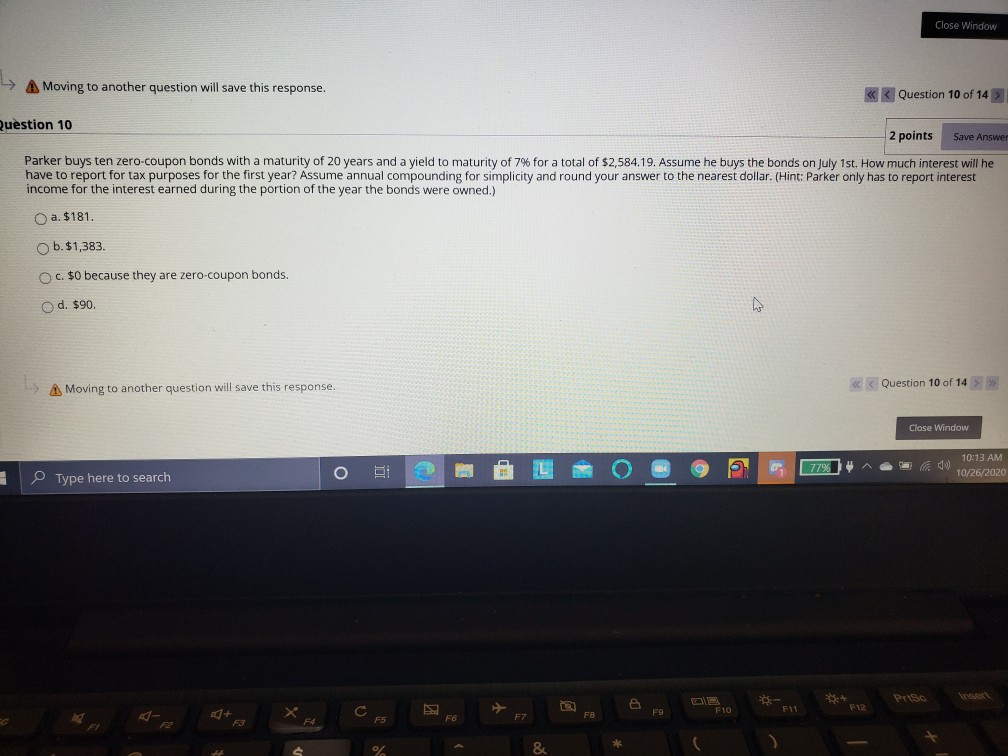

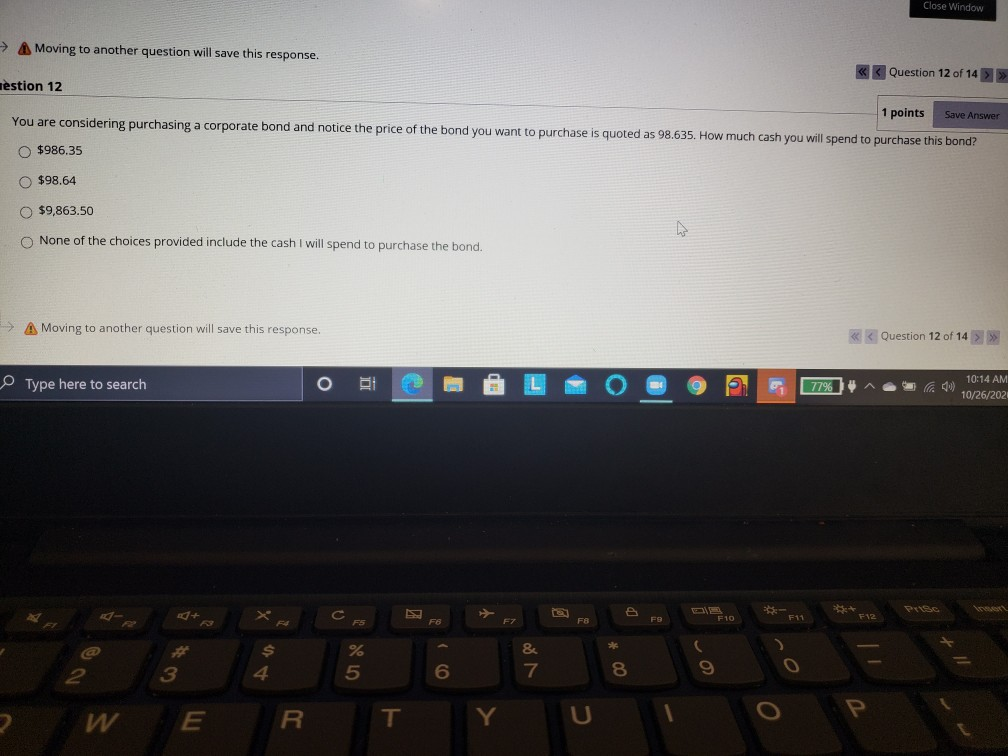

Question Completion Status: A Moving to another question will save this response. Question 2 Which of the following statements is correct? a. Callable bonds tend to have a lower YTM than non-callable bonds with the same default risk and maturity. b. The YTM for investment grade bonds is higher than the YTM for non-investment grade bonds. c. The coupon rate is the rate of interest paid on the market value of a bond. Od. None of the above are correct. -> A Moving to another question will save this response. Type here to search C ESC 5 12 F6 F7 F8 @ % & # 3 2 4 6 A Moving to another question will save this response. Question 3 A bond for which the bondholder (investor) has the right to cash in the bond before maturity at a specific price after a specific date is a: O a. Convertible bond. b. Callable bond. c. Puttable bond. Od. Coupon bond. A Moving to another question will save this response. O 76% Type here to search A Moving to another question will save this response. Question 4 Which of the following statements about Treasury bills and commercial paper is correct? a. T-bills and commercial paper are default-risk free b. Yields on T-bills are slightly higher than commercial paper since they are issued by the United States government c. Both of the statements provided are correct. d. Neither of the statements provided is correct. A Moving to another question will save this response. Type here to search Moving to another question will save this response. Question 6 Jordan is considering purchasing a CMO. Which of the following is NOT correct? a. CMOs are divided into tranches, which will permit Jordan to better match the timing of the cash flows to her needs. b. CMOs are not subject to default risk. OC. CMOs are subject to interest rate risk, reinvestment rate risk, and pre-payment risk. O d. All of the choices provided are correct. A Moving to another question will save this response. O Type here to search Close Wir A Moving to another question will save this response. Question 10 2 points Save Answer Parker buys ten zero-coupon bonds with a maturity of 20 years and a yield to maturity of 7% for a total of $2,584.19. Assume he buys the bonds on July 1st. How much interest will he have to report for tax purposes for the first year? Assume annual compounding for simplicity and round your answer to the nearest dollar. (Hint: Parker only has to report interest income for the interest earned during the portion of the year the bonds were owned.) a. $181. b. $1,383. c. $0 because they are zero-coupon bonds. Od. $90. A Moving to another question will save this response. > Close Window (0) 77% P 10:13 AM 10/26/2020 Type here to search Piso We A F10 F11 F12 F9 F8 F7 3 F# F5 F6 % & Close Window A Moving to another question will save this response. Question 12 of 14 >>> Festion 12 1 points Save Answer You are considering purchasing a corporate bond and notice the price of the bond you want to purchase is quoted as 98.635. How much cash you will spend to purchase this bond? $986.35 $98.64 $9,863.50 None of the choices provided include the cash I will spend to purchase the bond. A Moving to another question will save this response. >> Type here to search o 77% 10:14 AM 10/26/202 A 25 F7 F8 FE F9 F5 F11 F10 F12 $ 4. % 5 8 7 2 0 9 3 6 8 W E R T Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts