Question: Question Completion Status: A Moving to the next question prevents changes to this answer. Question 1 of 4 Question 1 12 points Save Answer Scott

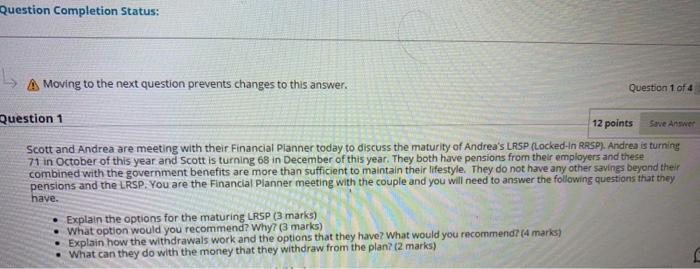

Question Completion Status: A Moving to the next question prevents changes to this answer. Question 1 of 4 Question 1 12 points Save Answer Scott and Andrea are meeting with their Financial Planner today to discuss the maturity of Andrea's LRSP (Locked-In RRSP). Andrea is turning 71 in October of this year and Scott is turning 68 in December of this year. They both have pensions from their employers and these combined with the government benefits are more than sufficient to maintain their lifestyle. They do not have any other savings beyond their pensions and the LRSP. You are the Financial Planner meeting with the couple and you will need to answer the following questions that they have. Explain the options for the maturing LRSP (3 marks) What option would you recommend? Why? (3 marks) Explain how the withdrawals work and the options that they have? What would you recommend? (4 marks) What can they do with the money that they withdraw from the plan? (2 marks) Question Completion Status: A Moving to the next question prevents changes to this answer. Question 1 of 4 Question 1 12 points Save Answer Scott and Andrea are meeting with their Financial Planner today to discuss the maturity of Andrea's LRSP (Locked-In RRSP). Andrea is turning 71 in October of this year and Scott is turning 68 in December of this year. They both have pensions from their employers and these combined with the government benefits are more than sufficient to maintain their lifestyle. They do not have any other savings beyond their pensions and the LRSP. You are the Financial Planner meeting with the couple and you will need to answer the following questions that they have. Explain the options for the maturing LRSP (3 marks) What option would you recommend? Why? (3 marks) Explain how the withdrawals work and the options that they have? What would you recommend? (4 marks) What can they do with the money that they withdraw from the plan? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts