Question: Question Completion Status: A Moving to the next question prevents changes to this answer. Questi Question 1 10 points Textron Corp. has 8% convertible bonds

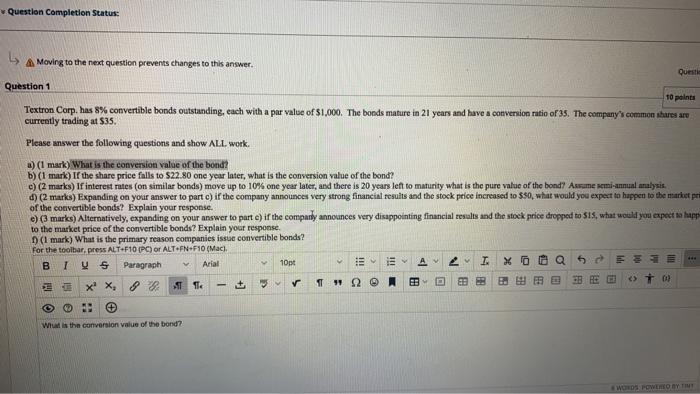

Question Completion Status: A Moving to the next question prevents changes to this answer. Questi Question 1 10 points Textron Corp. has 8% convertible bonds outstanding, each with a par value of $1,000. The bonds mature in 21 years and have a conversion ratio of 35. The company's common shares are currently trading at $35. Please answer the following questions and show ALL work. a) (1 mark) What is the conversion value of the bond? b) (1 mark) If the share price falls to $22.80 one year later, what is the conversion value of the bond? c) (2 marks) If interest rates (on similar bonds) move up to 10% one year later, and there is 20 years left to maturity what is the pure value of the bond? Assume semi-annual analysis. d) (2 marks) Expanding on your answer to part c) if the company announces very strong financial results and the stock price increased to $50, what would you expect to happen to the market per of the convertible bonds? Explain your response. e) marks) Alternatively, expanding on your answer to parte) if the company announces very disappointing financial results and the stock price dropped to $15, what would you expect so happ to the market price of the convertible bonds? Explain your response. (1 mark) What is the primary reason companies issue convertible bonds? for the toolbar, press ALT F10 PC) or ALT FN+F10 (Mac). B I VS Paragraph Arial 10pt A X @ @ 6 XX, 82. + ED 59 F. FB 33 REC 01.) I. Wat is the conversion value of the bond? WDS POWERED BY TIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts