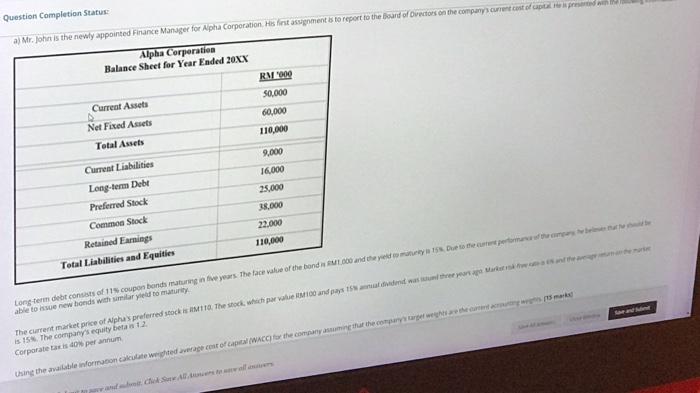

Question: Question Completion Status: a) Mr. John is the newly appointed Finance Manager for Alpha Corporation. His first assignments to report to the bound lectors on

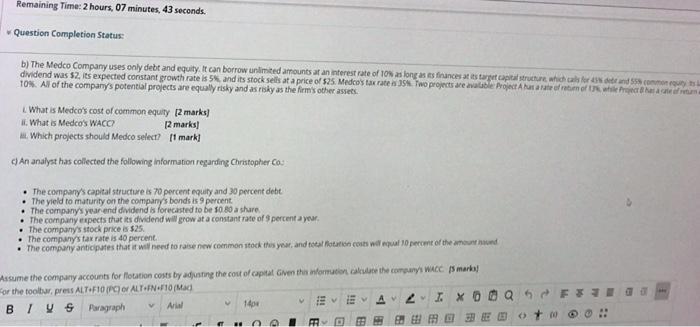

Question Completion Status: a) Mr. John is the newly appointed Finance Manager for Alpha Corporation. His first assignments to report to the bound lectors on the company current costo Alpha Corporation Balance Sheet for Year Ended 20XX RM90 50.000 60,000 Current Assets Net Fixed Assets Total Assets 110,000 9,000 16.000 25,000 18.000 Current Liabilities Long-term Debt Preferred Stock Common Stock Retained Earnings Total Liabilities and Equities 22.000 110,000 Long term debt contests of 11 coupon bonds matung in fe years. The face value of the body and the Dutertom able to se new bonds with similar yer to maturity The current market price of Alphus preferred stocks 110. The stock, which per value 100 and pays 15 anni dond was and their partage Markers were is 15. The company's equity beta 12 Corporates do per annum thing the wall information calculate wederage cost of capital (WACO or the company that the comparar y make Remaining Time: 2 hours, 07 minutes, 43 seconds. Question Completion Status: b) The Medco Company uses only debt and equity. It can borrow unlimited amounts at an interest rate of 10 as long as its finances at its target capital structure which was for and dividend was 52. its expected constant growth rate is 5% and its stock sells at a price of $25. Medco's tax rate 35. Two projects are able Project Alutate of time while that 10%. All of the company's potential projects are equally risky and as risky as the firm's other assets. What is Medco's cost of common equity [2 marks] . What is Medco's WACO 12 marks] Mt. Which projects should Medco selecr? [1 mark] An analyst has collected the following information regarding Christopher Co The company's capital structure is 70 percent equity and 30 percent debt The yield to maturity on the company's bonds is 9 percent The company's year end dividend is forecasted to be 50 80 a share The company expects that its dividend will grow at a constant rate of percent year The company's stock price is $25 The company's tax rate is 40 percent. The company anticipates that it will need to raise new common stock this year, and to tation cost percer of the mud Assume the company accounts for Hotation costs by adjusting the cout of capital Given the information at the company's WACC Smarla for the toolturpress ALT=F10/PC) or ALT.INF10/Mad BIUS Paragraph AW 1404 I XOOQ 110 E G E Question Completion Status: a) Mr. John is the newly appointed Finance Manager for Alpha Corporation. His first assignments to report to the bound lectors on the company current costo Alpha Corporation Balance Sheet for Year Ended 20XX RM90 50.000 60,000 Current Assets Net Fixed Assets Total Assets 110,000 9,000 16.000 25,000 18.000 Current Liabilities Long-term Debt Preferred Stock Common Stock Retained Earnings Total Liabilities and Equities 22.000 110,000 Long term debt contests of 11 coupon bonds matung in fe years. The face value of the body and the Dutertom able to se new bonds with similar yer to maturity The current market price of Alphus preferred stocks 110. The stock, which per value 100 and pays 15 anni dond was and their partage Markers were is 15. The company's equity beta 12 Corporates do per annum thing the wall information calculate wederage cost of capital (WACO or the company that the comparar y make Remaining Time: 2 hours, 07 minutes, 43 seconds. Question Completion Status: b) The Medco Company uses only debt and equity. It can borrow unlimited amounts at an interest rate of 10 as long as its finances at its target capital structure which was for and dividend was 52. its expected constant growth rate is 5% and its stock sells at a price of $25. Medco's tax rate 35. Two projects are able Project Alutate of time while that 10%. All of the company's potential projects are equally risky and as risky as the firm's other assets. What is Medco's cost of common equity [2 marks] . What is Medco's WACO 12 marks] Mt. Which projects should Medco selecr? [1 mark] An analyst has collected the following information regarding Christopher Co The company's capital structure is 70 percent equity and 30 percent debt The yield to maturity on the company's bonds is 9 percent The company's year end dividend is forecasted to be 50 80 a share The company expects that its dividend will grow at a constant rate of percent year The company's stock price is $25 The company's tax rate is 40 percent. The company anticipates that it will need to raise new common stock this year, and to tation cost percer of the mud Assume the company accounts for Hotation costs by adjusting the cout of capital Given the information at the company's WACC Smarla for the toolturpress ALT=F10/PC) or ALT.INF10/Mad BIUS Paragraph AW 1404 I XOOQ 110 E G E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts