Question: Question Completion Status: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and

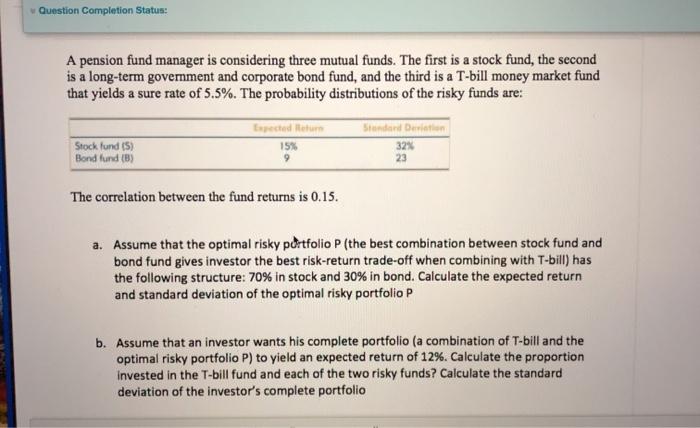

Question Completion Status: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Standard Derman Deprecated alum 15% 9 Stock fund (5) Bond lund (B) 32% 23 The correlation between the fund returns is 0.15. a. Assume that the optimal risky portfolio P (the best combination between stock fund and bond fund gives investor the best risk-return trade-off when combining with T-bill) has the following structure: 70% in stock and 30% in bond. Calculate the expected return and standard deviation of the optimal risky portfolio P b. Assume that an investor wants his complete portfolio (a combination of T-bill and the optimal risky portfolio P) to yield an expected return of 12%. Calculate the proportion invested in the T-bill fund and each of the two risky funds? Calculate the standard deviation of the investor's complete portfolio

Step by Step Solution

There are 3 Steps involved in it

To solve the problem well go through each part stepbystep Part a Optimal Risky Portfolio P 1 Expecte... View full answer

Get step-by-step solutions from verified subject matter experts