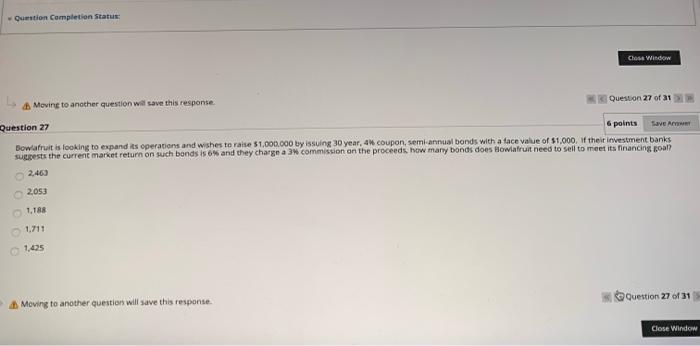

Question: Question Completion Status Close Window Moving to another question will save this response Question 27 of 21 Question 27 6 points Save A Bowlafruit is

Question Completion Status Close Window Moving to another question will save this response Question 27 of 21 Question 27 6 points Save A Bowlafruit is looking to expand its operations and wishes to raise $1.000.000 by issuing 30 year, 4 coupon, semiannual bonds with a face value of $1,000, their investment banks suggests the current market return on such bonds is 6% and they charge a 3 commission on the proceeds, how many bonds does Bowiatruit need to sell to meet its financing soal 2053 TRE 1711 105 Question 27 of 31 Moving to another question will save this response Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts