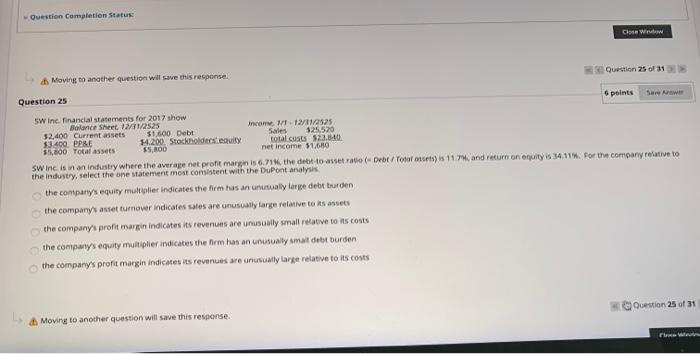

Question: Question Completion Status Close Wit Moving to another question will save this response Question 25 of 1 Question 25 6 points Sare swine financial statements

Question Completion Status Close Wit Moving to another question will save this response Question 25 of 1 Question 25 6 points Sare swine financial statements for 2017 show Be Sheet 12/31/2525 Incom, W. 12/11/2525 $2,400 Current assets $1,600 Debt Sales 125.520 53.400 PPBE 14,200 Stockholdersuit total costs $23.840 3.600 Total assets $5,000 net income 314.30 swine is in an industry where the average net profit margin is 6.71, the debt to asset ratio (Debt/Totoros) is 117 and return on equity is 34.11. For the company relative to the industry, select the one statement most consistent with the DuPont analysis the company's equity multiplier indicates the firm has an unusually large debt turden the company's asset turnover indicates sales are unusually large relative to its assets the company profit margin indicates its revenues are unusually small relative to its costs the company's equity multiplier indicates the film has an unusually smal debt burden the company's profit margin indicates its revenues are unusually large relative to its costs Question 25 of 31 Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts