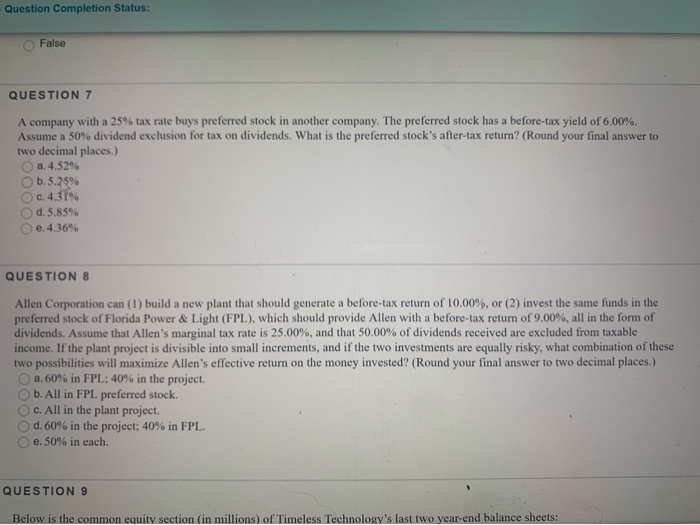

Question: Question Completion Status: False QUESTION 7 A company with a 25% tax rate buys preferred stock in another company. The preferred stock has a before-tax

Question Completion Status: False QUESTION 7 A company with a 25% tax rate buys preferred stock in another company. The preferred stock has a before-tax yield of 6.00%. Assume a 50% dividend exclusion for tax on dividends. What is the preferred stocks after-tax return? (Round your final answer to two decimal places.) a. 4.52% b.5.2596 c.4.39 d. 5.85% e. 4.36% QUESTION 8 Allen Corporation can (1) build a new plant that should generate a before-tax return of 10.00%, or (2) invest the same funds in the preferred stock of Florida Power & Light (FPL), which should provide Allen with a before-tax return of 9.00%, all in the form of dividends. Assume that Allen's marginal tax rate is 25.00%, and that 50.00% of dividends received are excluded from taxable income. If the plant project is divisible into small increments, and if the two investments are equally risky, what combination of these two possibilities will maximize Allen's effective return on the money invested? (Round your final answer to two decimal places.) a. 60% in FPL: 40% in the project. b. All in FPL preferred stock. c. All in the plant project. d. 60% in the project; 40% in FPL. e. 50% in each QUESTION 9 Below is the common equity section (in millions) of Timeless Technology's last two year-end balance sheets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts