Question: Question Completion Status: For the calculations in this problem, increase decimal places for any intermediate calculations to sav. 6 or higher. The more the better

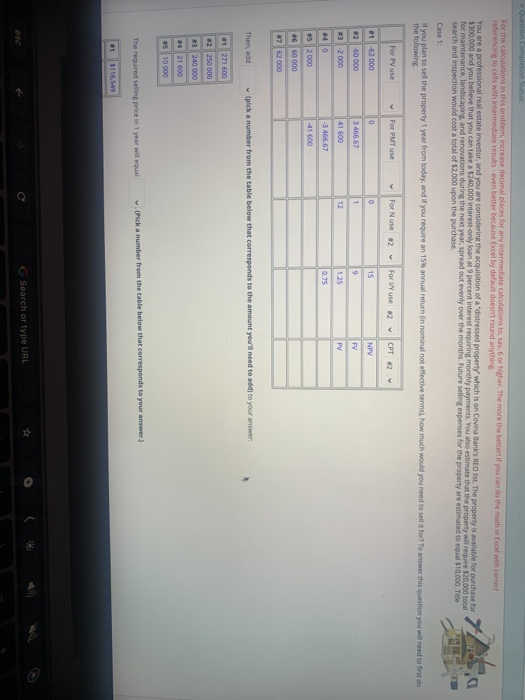

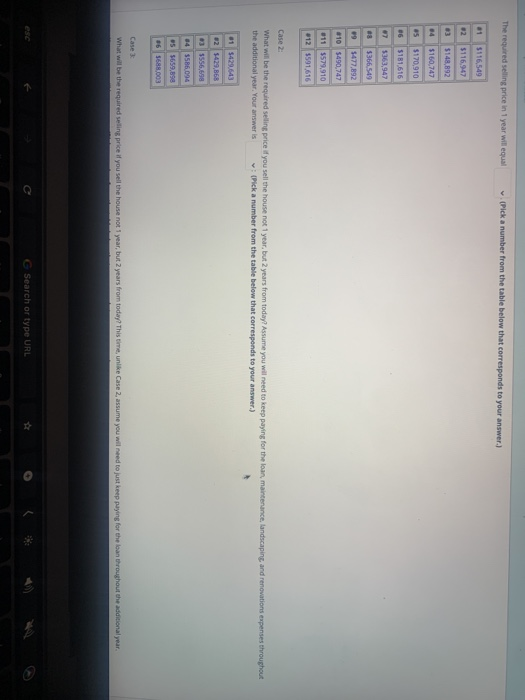

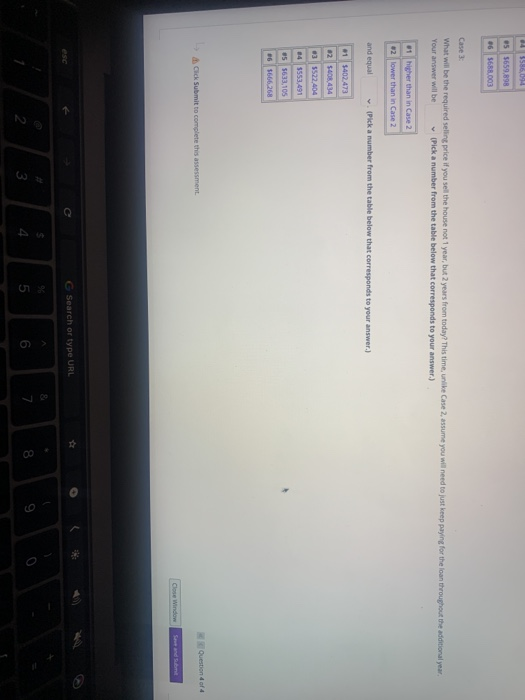

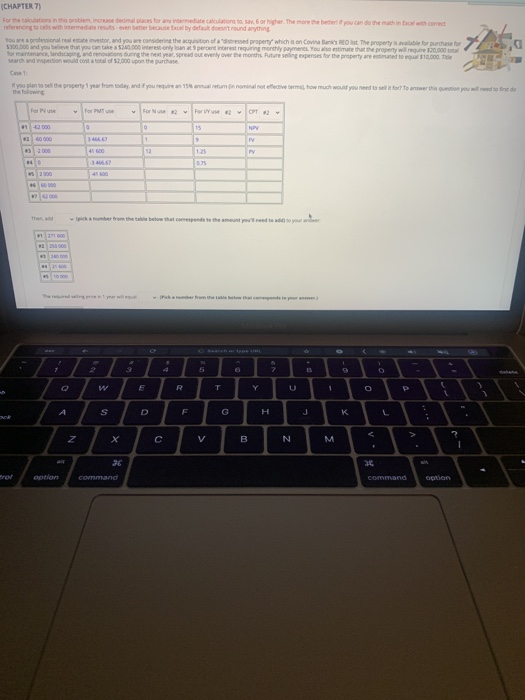

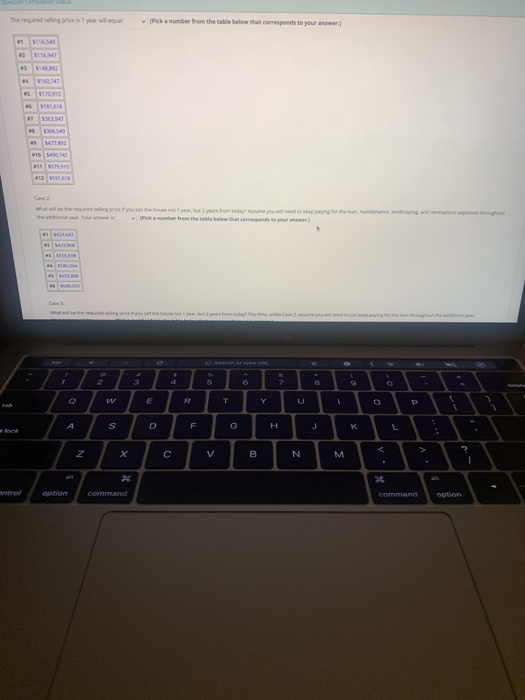

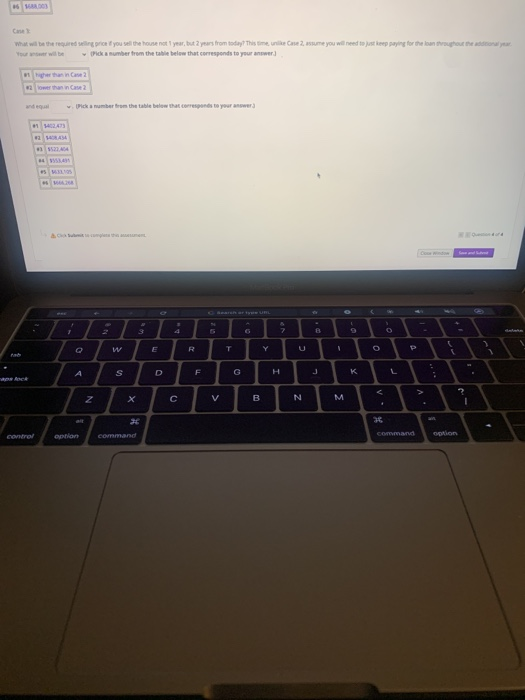

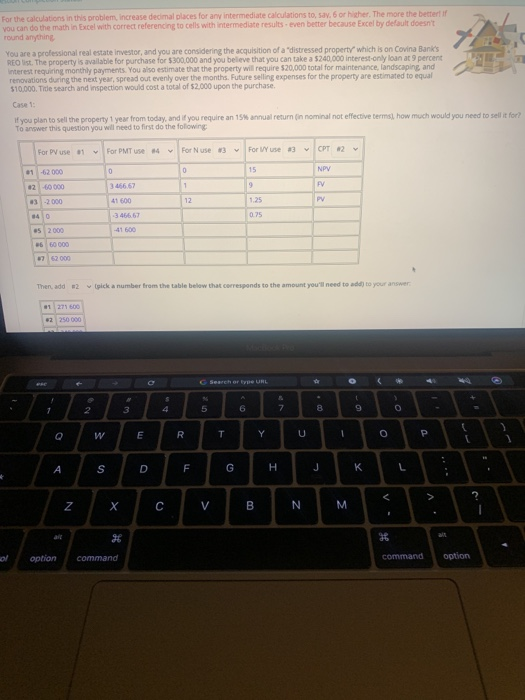

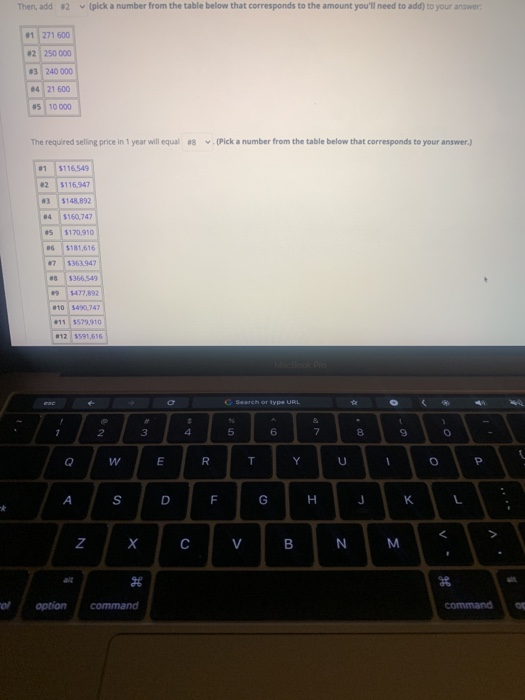

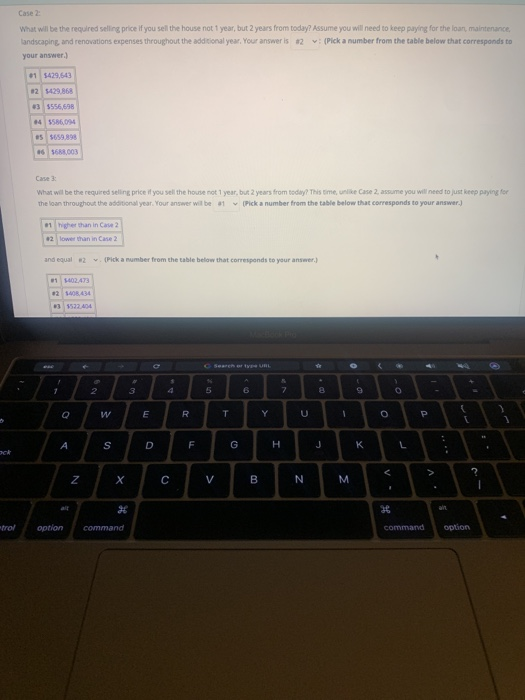

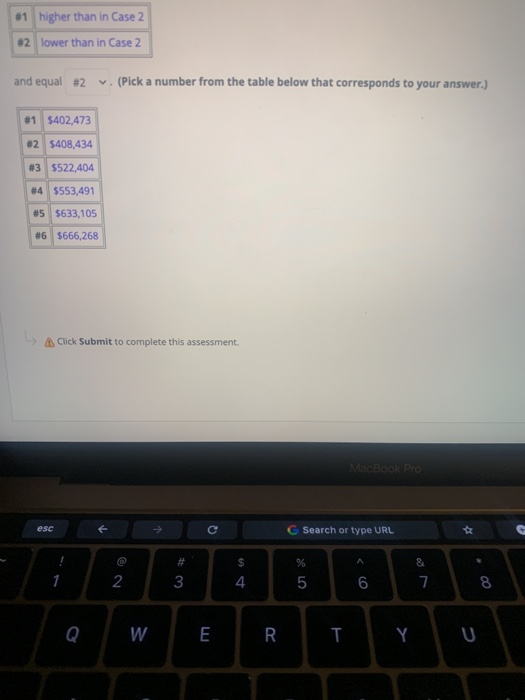

Question Completion Status: For the calculations in this problem, increase decimal places for any intermediate calculations to sav. 6 or higher. The more the better if you can do the math in Excel with correct referencing to cells with intermediate results even better because Excel by default doesn't round anything You are a professional real estate Investor, and you are considering the acquisition of a distressed property which is on Covina Bank's REO Ist. The property is available for purchase for $300,000 and you believe that you can take a $240,000 interest-only loan at 9 percent interest requiring monthly payments. You also estimate that the property will require $20,000 total for maintenance, landscaping and renovations during the next year, spread out evenly over the months. Future selling expenses for the property are estimated to equal $10,000. Title search and inspection would cost a total of $2,000 upon the purchase Case 1: if you plan to sell the property 1 year from today, and if you require an 15 annual return in nominal not effective terms, how much would you need to sell it for? To answer this question you will need to first do the following For PV use For PMT use For Nuse 2 For Vy use 2 CPT 2 01 -62000 0 0 15 NPV 02 -60 000 3 466.67 1 9 FV 13 -2000 41 600 12 1.25 PV 04 0 3466 67 0.75 05 2 000 41 600 06 60 000 2 62 000 Then, add (pick a number from the table below that corresponds to the amount you'll need to add to your answer 61 271 600 250 000 3 240 000 84 21 600 45 10 000 The required selling price in 1 year wil equal Pick a number from the table below that corresponds to your answer.) 5116,549 G Search or type URL The required selling price in 1 year will equal Pick a number from the table below that corresponds to your answer.) 01 5116,549 2 $116,947 03 5148,892 24 $160,747 $170,910 05 26 $181.616 7 5363,947 $366.542 09 $477,892 610 $490,747 611 5579,910 212 5591,616 Case 2 What will be the required selling price if you sell the house not 1 year, but 2 years from today? Assume you will need to keep paying for the loan, maintenance, landscaping and renovations expenses throughout the additional year. Your answer is (Pick a number from the table below that corresponds to your answer.) 81 5429643 2 1429,868 03 1556.98 34 3586094 95 5659,899 46 5688.003 Case 3 What will be the required selling price if you sell the house not 1 year, but 2 years from today! This time, unike Case 2, assume you will need to just keep paying for the loan throughout the additional year. G Search or type URL 436044 es $659,898 6 5688.003 Case 3 What will be the required selling price if you sell the house not 1 year, but 2 years from today? This time, unlike Case 2, assume you will need to just keep paying for the loan throughout the additional year, Your answer will be Pick a number from the table below that corresponds to your answer.) 01 higher than in Case 2 #2 lower than in Case 2 and equal .(Pick a number from the table below that corresponds to your answer.) 01 5402.473 2 5408,434 3 5522 404 14 5553,491 5 5633,105 6 1666.268 Question of 4 Click Submit to complete this assessment Close Window c C Search or type URL 8 3 6 4 CHAPTER 7 For the interse decimal places for any reduction to a 6 or higher. The more the beri you can do this with correct references with hermes even better because Excel by entround anything You professional, and you are considering the acquisition of property which is on Covina Ost. The property for purchase $30,000 and you that you can take a 2.000 interest only and percent requiring monthly payments. You wote property will require 30.000 for manera, and ons during the next year. Spread out evenly over the months. Ruture sing expenses for the property are estimated to equa 10.000 you plan to the property year from today and you require a 15 minit lecteer how much would you need to follower the question you want the following (for Put Forse For . 2000 2 000 NPY BE PV 1 12 460 125 PY 3466 410 5 2000 Then 2 3 . 5 6 7 W R . Y U S D F G H J K L V > B. C V ? N M 1 3 Orion Command Command Open es The required sling price in year will equal Pick a number from the table below that corresponds to your answer 5170,910 SA S 2 3 7 B Q W T Y 0 A S D F G . J K ? N C V B N M 1 ontrol option command Command option What will be the required sing price you sell the house not year, but 2 years from today? This time, unlike Case 2. sume you will need to just keep paying for the loan throughout the additional or Pick a number from the table below that corresponds to your answer.) han Case Pick a number from the table below that corresponds to your answer T 3 8 Q w E R Y 1 F G H S K 2 V B N M contrer options Command CON Command For the calculations in this problem, increase decimal places for any intermediate calculations to say, 6 or higher. The more the better if you can do the math in Excel with correct referencing to cells with intermediate results - even better because Excel by default doesn't round anything You are a professional real estate investor, and you are considering the acquisition of a 'distressed property which is on Covina Bank's REO it. The property is available for purchase for $300,000 and you believe that you can take a $240.000 interest-only loan at 9 percent Interest requiring monthly payments. You also estimate that the property will require $20,000 total for maintenance, landscaping and renovations during the next year, spread out evenly over the months. Future selling expenses for the property are estimated to equal $10.000. Tide search and inspection would cost a total of $2.000 upon the purchase. Case 1: If you plan to sell the property 1 year from today, and if you require an 15% annual return in nominal not effective terms, how much would you need to sell it for To answer this question you will need to first do the following For PV use 1 For PMT Use #4 For Nuse 3 For WY use #3 CPT #2 01 -62000 0 0 15 NPV 3.466.67 1 FV 260 000 3-2000 9 1.25 41600 12 PV 340 -3.466.67 0.75 25 2000 -41 600 6 60 000 67 62000 Then add #2 pick a number from the table below that corresponds to the amount you'll need to add to your answer 1 271600 62 250 000 C Search or type URL - S 4 L 9 7 3 2 5 8 6 7 0 ) w E R T Y U . S D F H J K L B. C V ? N M 1 3 Orion Command Command Open es The required sling price in year will equal Pick a number from the table below that corresponds to your answer 5170,910 SA S 2 3 7 B Q W T Y 0 A S D F G . J K ? N C V B N M 1 ontrol option command Command option What will be the required sing price you sell the house not year, but 2 years from today? This time, unlike Case 2. sume you will need to just keep paying for the loan throughout the additional or Pick a number from the table below that corresponds to your answer.) han Case Pick a number from the table below that corresponds to your answer T 3 8 Q w E R Y 1 F G H S K 2 V B N M contrer options Command CON Command For the calculations in this problem, increase decimal places for any intermediate calculations to say, 6 or higher. The more the better if you can do the math in Excel with correct referencing to cells with intermediate results - even better because Excel by default doesn't round anything You are a professional real estate investor, and you are considering the acquisition of a 'distressed property which is on Covina Bank's REO it. The property is available for purchase for $300,000 and you believe that you can take a $240.000 interest-only loan at 9 percent Interest requiring monthly payments. You also estimate that the property will require $20,000 total for maintenance, landscaping and renovations during the next year, spread out evenly over the months. Future selling expenses for the property are estimated to equal $10.000. Tide search and inspection would cost a total of $2.000 upon the purchase. Case 1: If you plan to sell the property 1 year from today, and if you require an 15% annual return in nominal not effective terms, how much would you need to sell it for To answer this question you will need to first do the following For PV use 1 For PMT Use #4 For Nuse 3 For WY use #3 CPT #2 01 -62000 0 0 15 NPV 3.466.67 1 FV 260 000 3-2000 9 1.25 41600 12 PV 340 -3.466.67 0.75 25 2000 -41 600 6 60 000 67 62000 Then add #2 pick a number from the table below that corresponds to the amount you'll need to add to your answer 1 271600 62 250 000 C Search or type URL - S 4 L 9 7 3 2 5 8 6 7 0 ) w E R T Y U . S D F H J K L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts