Question: Question completion Status: General Electric (G.E.), a U.S. based company currently exports electrical equipment to a Japanese customer. The current exchange rate is JPY100/USD but

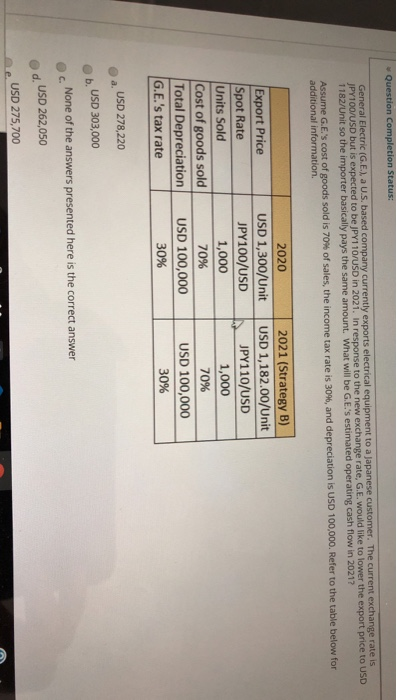

Question completion Status: General Electric (G.E.), a U.S. based company currently exports electrical equipment to a Japanese customer. The current exchange rate is JPY100/USD but is expected to be JPY110/USD in 2021. In response to the new exchange rate, G.E. would like to lower the export price to USD 1182/Unit so the importer basically pays the same amount What will be G.E.'s estimated operating cash flow in 2021? Assume G.E.'s cost of goods sold is 70% of sales, the income tax rate is 30%, and depreciation is USD 100,000. Refer to the table below for additional information. Export Price Spot Rate Units Sold Cost of goods sold Total Depreciation G.E.'s tax rate 2020 USD 1,300/Unit JPY100/USD 1,000 70% USD 100,000 30% 2021 (Strategy B) USD 1,182.00/Unit JPY110/USD 1,000 70% | USD 100,000 30% a. USD 278,220 b. USD 303,000 None of the answers presented here is the correct answer d. USD 262,050 e USD 275,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts