Question: Question Completion Status: -> Moving to another question will save this response. s Question 13 of 16 Question 13 6 points Save Ans Marsha had

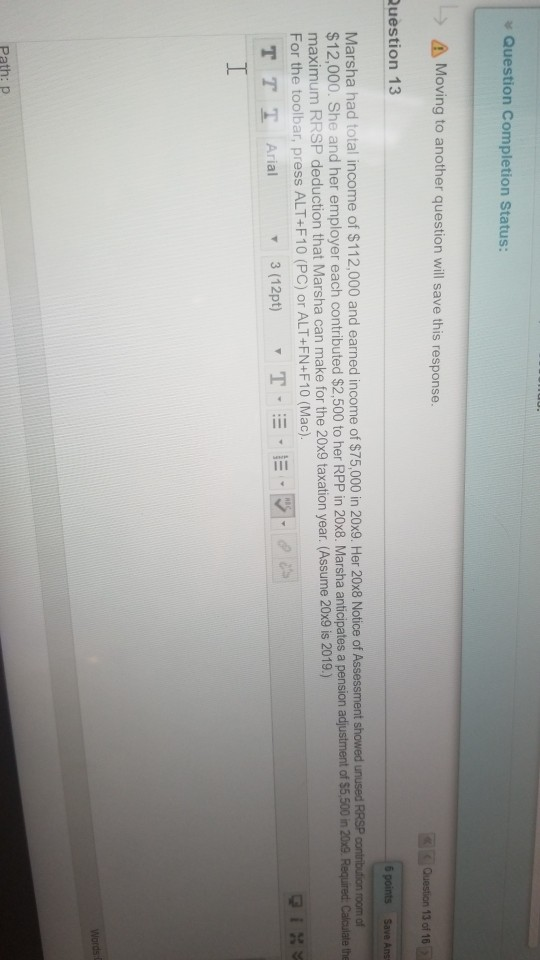

Question Completion Status: -> Moving to another question will save this response. s Question 13 of 16 Question 13 6 points Save Ans Marsha had total income of $112,000 and earned income of $75,000 in 20x9. Her 20x8 Notice of Assessment showed unused RRSP contribution room of $12.000. She and her employer each contributed $2,500 to her RPP in 20x8. Marsha anticipates a pension adjustment of $5.500 in 2009. Required. Calculate the maximum RRSP deduction that Marsha can make for the 20x9 taxation year. (Assume 20x9 is 2019.) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). TT T Arial 3 (12pt) TEES Words Path:p Question Completion Status: -> Moving to another question will save this response. s Question 13 of 16 Question 13 6 points Save Ans Marsha had total income of $112,000 and earned income of $75,000 in 20x9. Her 20x8 Notice of Assessment showed unused RRSP contribution room of $12.000. She and her employer each contributed $2,500 to her RPP in 20x8. Marsha anticipates a pension adjustment of $5.500 in 2009. Required. Calculate the maximum RRSP deduction that Marsha can make for the 20x9 taxation year. (Assume 20x9 is 2019.) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). TT T Arial 3 (12pt) TEES Words Path:p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts