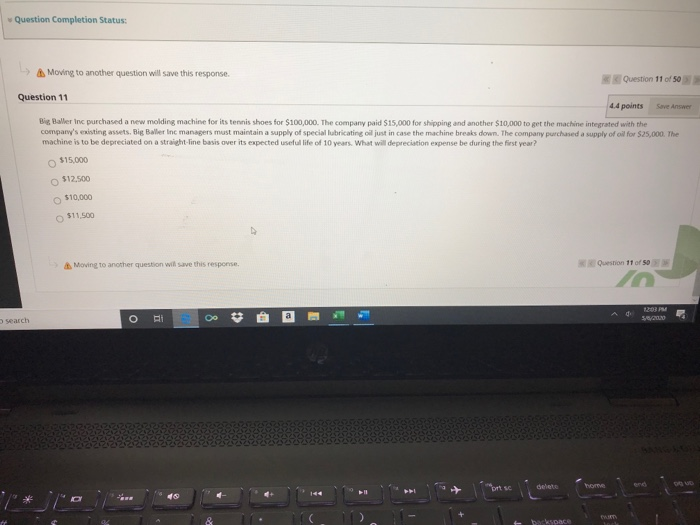

Question: Question Completion Status: > Moving to another question will save this response. Question 11 of 50 Question 11 44 points B allerine purchased a new

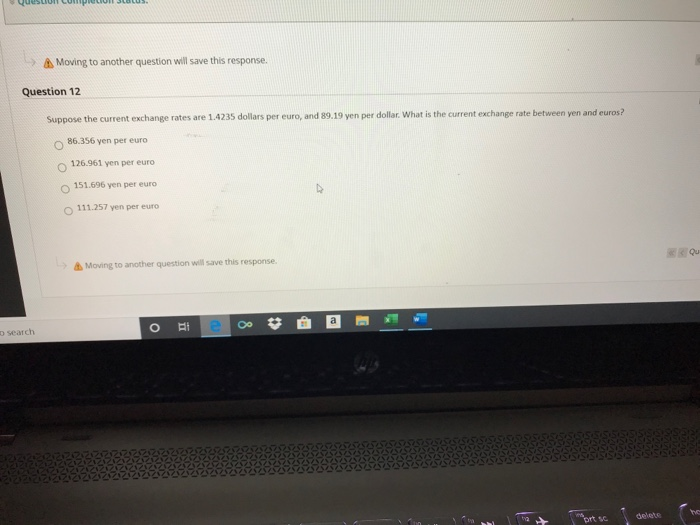

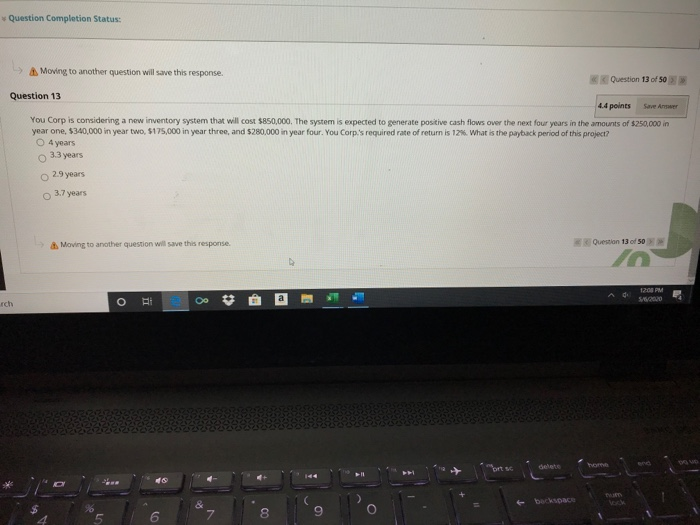

Question Completion Status: > Moving to another question will save this response. Question 11 of 50 Question 11 44 points B allerine purchased a new molding machine for its tennis shoes for $100,000. The company paid $15.000 for shipping and another $10,000 t e the machine integrated with the company's existing assets. Big Ballerine managers must maintain a supply of special lubricating oil just in case the machine breaks down. The company purchased a supply of 525.000 The machine is to be depreciated on a straight line basis over its expected useful life of 10 years. What will depreciation expense be during the first year? $15.000 $12.500 510.000 511.500 Moving to another question will save this response Question 11 of so Search onts Moving to another question will save this response. Question 12 Suppose the current exchange rates are 1.4235 dollars per euro, and 89.19 yen per dollar. What is the current exchange rate between yen and euros? 86.356 yen per euro 126.961 yen per euro 151.696 yen per euro 111.257 yen per euro Moving to another question will save this response search o e co a Question Completion Status: -> Moving to another question will save this response. Question 13 of 50 Question 13 4.4 points Save Answer You Corp is considering a new inventory system that will cost $850,000. The system is expected to generate positive cash flows over the next four years in the amounts of $250,000 in year one, $340,000 in year two, $175,000 in year three, and $280,000 in year four. You Corp.'s required rate of return is 12%. What is the payback period of this project? O 4 years 3.3 years 2.9 years 3.7 years Moving to another question will save this response Question 13 of 50 ortsc e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts