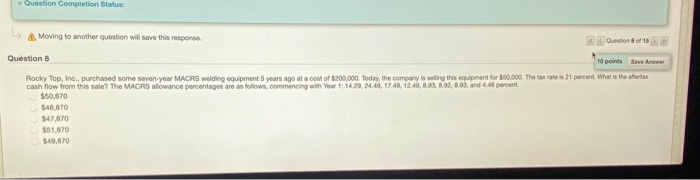

Question: Question Completion Status Moving to another question will save this response Question of 15 Questions 10 points Saver Rocky Top, Inc., purchased some seven-year MACRS

Question Completion Status Moving to another question will save this response Question of 15 Questions 10 points Saver Rocky Top, Inc., purchased some seven-year MACRS welding equipment 5 years ago at a cost of $200,000. Today, the company is sting this ment for $50,000. The tax rate is 1 percent What is t here cash flow from this sale? The MACRS allowance percentages are as follows commencing with Year: 1420.24.49, 17.49, 12:49, 03, 02.0), and 4.4 percent $50,870 $48.870 $47870 $51.870 STO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts