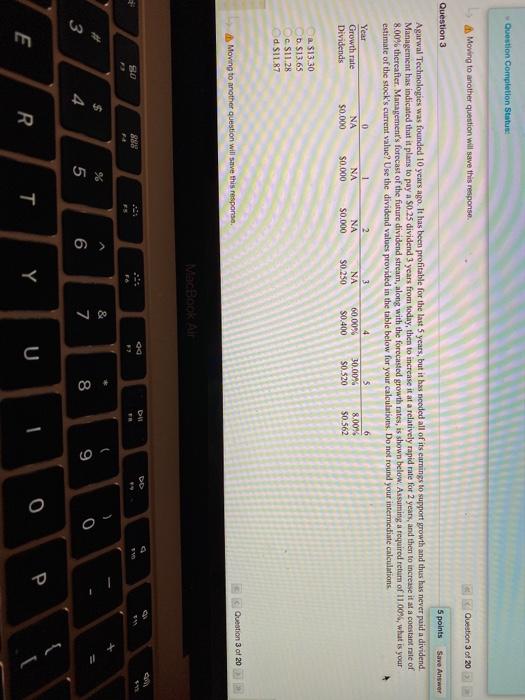

Question: Question Completion Status Moving to another question will save this response. Question 3 of 20 Question 3 Spoints Save Answer Agarwal Technologies was founded 10

Question Completion Status Moving to another question will save this response. Question 3 of 20 Question 3 Spoints Save Answer Agarwal Technologies was founded 10 years ago. It has been profitable for the last 5 years, but it has needed all of its earnings to support growth and thus has never paid a dividend Management has indicated that it plans to pay a 0.25 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant role of 8.00% thereafter. Management's forecast of the future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required return of 11.00%, what is your estimate of the stock's current value? Use the dividend values provided in the table below for your calculations. Do not round your intermediate calculations Year Growth rate Dividends 0 NA $0,000 1 NA 50.000 2 NA S0.000 NA S0.250 60.00% $0.400 30.00% $0.520 6 8.00% 50.562 a $13.30 b. $13.65 c $11.28 d. SIL.87 Question 3 of 20 Moving another question will save this response MacBook Air og DM 30 31 $ & 7 9 6 4 3 0 8 5 0 P E R T Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts