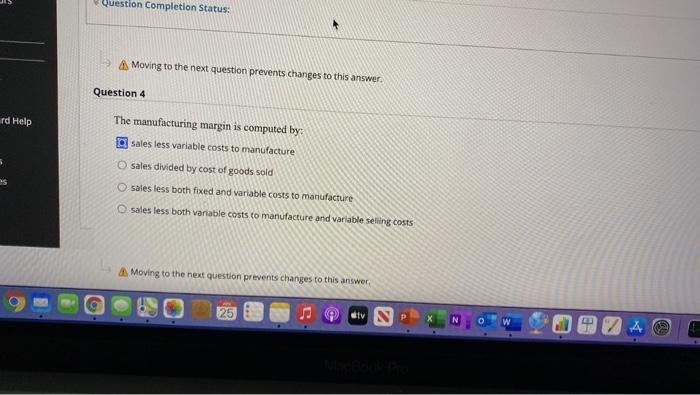

Question: Question Completion Status: Moving to the next question prevents changes to this answer. Question 4 rd Help The manufacturing margin is computed by: 1a sales

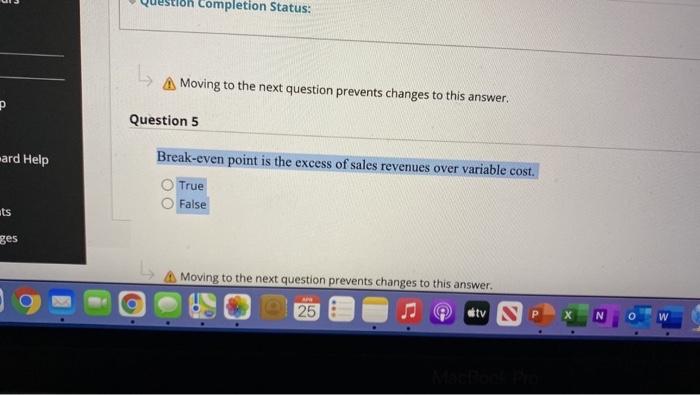

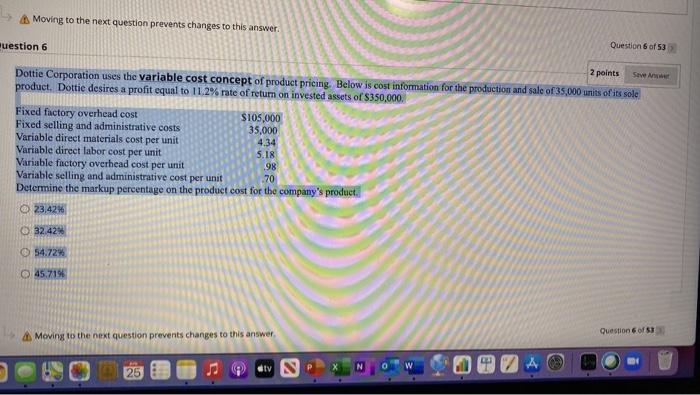

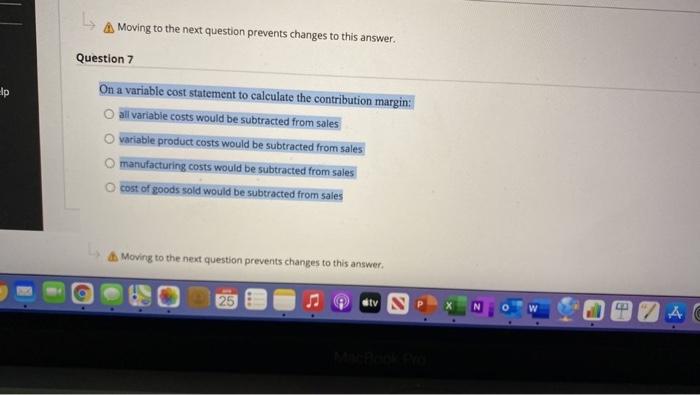

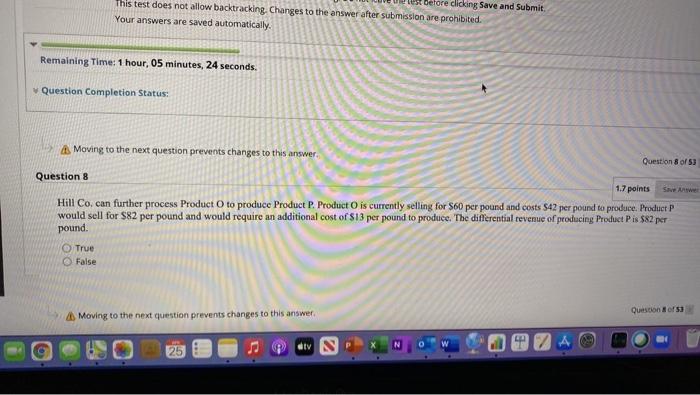

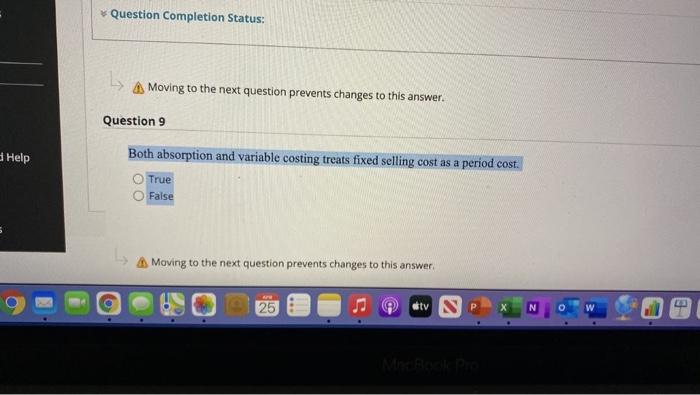

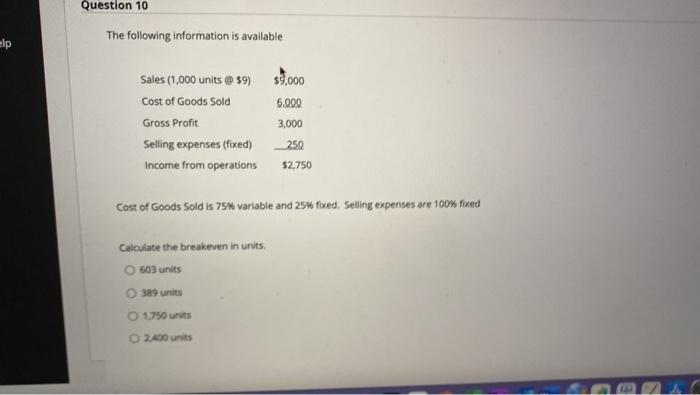

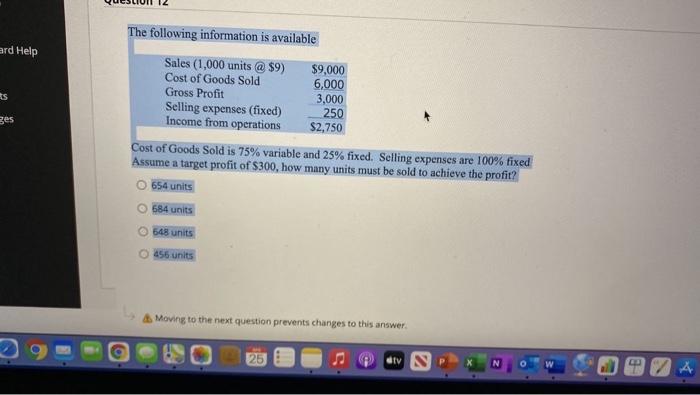

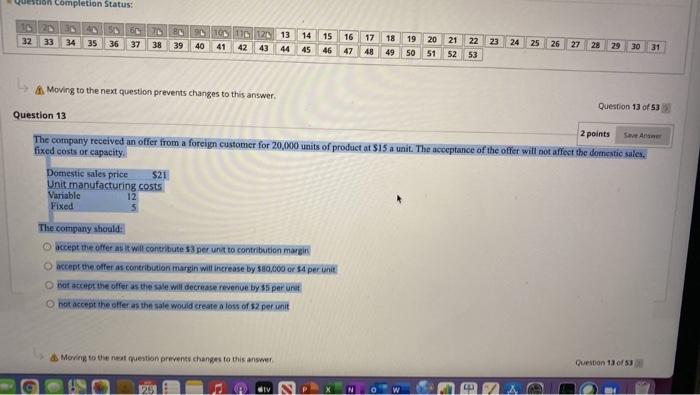

Question Completion Status: Moving to the next question prevents changes to this answer. Question 4 rd Help The manufacturing margin is computed by: 1a sales less variable costs to manufacture sales divided by cost of goods sold sales less both fixed and variable costs to manufacture sales less both variable costs to manufacture and variable selling costs Moving to the next question prevents changes to this answer 25 div A Completion Status: Moving to the next question prevents changes to this answer. Question 5 nard Help Break-even point is the excess of sales revenues over variable cost. True ts False ges Moving to the next question prevents changes to this answer. 25 atv NP N w Moving to the next question prevents changes to this answer. uestion 6 Question 6 of 53 Sive 2 points Dottie Corporation uses the variable cost concept of product pricing Below is cost information for the production and sale of 35,000 units of its sole product. Dottie desires a profit equal to 11.2% rate of return on invested assets of $350,000. Fixed factory overhead cost $105,000 Fixed selling and administrative costs 35,000 Variable direct materials cost per unit 4.34 Variable direct labor cost per unit 5.18 Variable factory overhead cost per unit 98 Variable selling and administrative cost per unit .70 Determine the markup percentage on the product cost for the company's product 23,4246 32.42% 54.72% 45.7196 Question of Moving to the next question prevents changes to this answer 25 etv S2 VA A Moving to the next question prevents changes to this answer. Question 7 lp On a variable cost statement to calculate the contribution margin: all variabie costs would be subtracted from sales variable product costs would be subtracted from sales O manufacturing costs would be subtracted from sales O cost of goods sold would be subtracted from sales Moving to the next question prevents changes to this answer. 25 est before clicking Save and Submit This test does not allow backtracking. Changes to the answer after submission are prohibited. Your answers are saved automatically. Remaining Time: 1 hour, 05 minutes, 24 seconds. Question Completion Status: Moving to the next question prevents changes to this answer Question 8 of 53 Question 8 1.7 points Hill Co. can further process Product Oto produce Product P. Product is currently selling for S60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential revenue of producing Product is $82 per pound. True False Question of 53 Moving to the next question prevents changes to this answer 25 dtv s Question Completion Status: A Moving to the next question prevents changes to this answer. Question 9 Help Both absorption and variable costing treats fixed selling cost as a period cost. True False Moving to the next question prevents changes to this answer 25 tv N Question 10 elp The following information is available $9,000 5.000 Sales (1,000 units @ $9) Cost of Goods Sold Gross Profit Selling expenses (fixed) Income from operations 3.000 250 $2,750 Cost of Goods Sold is 75% variable and 25% fixed. Selling expenses are 100% nived Calculate the breakeven in units. 603 units 389 units 0 1.750 units 2.400 units The following information is available ard Help s 3es Sales (1,000 units @ $9) $9,000 Cost of Goods Sold 6,000 Gross Profit 3,000 Selling expenses (fixed) 250 Income from operations $2,750 Cost of Goods Sold is 75% variable and 25% fixed. Selling expenses are 100% fixed Assume a target profit of $300, how many units must be sold to achieve the profit? 654 units 684 units 548 units 456 units Moving to the next question prevents changes to this answer dtv N Question completion Status: Pr ASS 34 35 36 37 14 16 32 9 10 11 12 13 40 41 42 43 44 33 38 15 46 23 39 17 48 18 49 19 20 50 51 24 25 26 27 45 21 52 28 22 53 29 31 30 47 A Moving to the next question prevents changes to this answer. Question 13 of 53 Question 13 2 points The company received an offer from a foreign customer for 20,000 units of product at $15 a unit. The acceptance of the offer will not affect the domestic sales, fixed costs or capacity Domestic sales price $21 Unit manufacturing costs Variable 12 Fixed 5 The company should o accept the offer as it will contribute 33 per unit to contribution margir accept the offer a contribution margin will increase by $80,000 or 54 per unit Hot accept the offer as the sale wil decrease revenue by 5 per un o not accept the offer as the sale would create a loss of per unit Moving to the rest question prevent changes to this answer Queston 13 0153 25 av Question Completion Status: Moving to the next question prevents changes to this answer. Question 4 rd Help The manufacturing margin is computed by: 1a sales less variable costs to manufacture sales divided by cost of goods sold sales less both fixed and variable costs to manufacture sales less both variable costs to manufacture and variable selling costs Moving to the next question prevents changes to this answer 25 div A Completion Status: Moving to the next question prevents changes to this answer. Question 5 nard Help Break-even point is the excess of sales revenues over variable cost. True ts False ges Moving to the next question prevents changes to this answer. 25 atv NP N w Moving to the next question prevents changes to this answer. uestion 6 Question 6 of 53 Sive 2 points Dottie Corporation uses the variable cost concept of product pricing Below is cost information for the production and sale of 35,000 units of its sole product. Dottie desires a profit equal to 11.2% rate of return on invested assets of $350,000. Fixed factory overhead cost $105,000 Fixed selling and administrative costs 35,000 Variable direct materials cost per unit 4.34 Variable direct labor cost per unit 5.18 Variable factory overhead cost per unit 98 Variable selling and administrative cost per unit .70 Determine the markup percentage on the product cost for the company's product 23,4246 32.42% 54.72% 45.7196 Question of Moving to the next question prevents changes to this answer 25 etv S2 VA A Moving to the next question prevents changes to this answer. Question 7 lp On a variable cost statement to calculate the contribution margin: all variabie costs would be subtracted from sales variable product costs would be subtracted from sales O manufacturing costs would be subtracted from sales O cost of goods sold would be subtracted from sales Moving to the next question prevents changes to this answer. 25 est before clicking Save and Submit This test does not allow backtracking. Changes to the answer after submission are prohibited. Your answers are saved automatically. Remaining Time: 1 hour, 05 minutes, 24 seconds. Question Completion Status: Moving to the next question prevents changes to this answer Question 8 of 53 Question 8 1.7 points Hill Co. can further process Product Oto produce Product P. Product is currently selling for S60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential revenue of producing Product is $82 per pound. True False Question of 53 Moving to the next question prevents changes to this answer 25 dtv s Question Completion Status: A Moving to the next question prevents changes to this answer. Question 9 Help Both absorption and variable costing treats fixed selling cost as a period cost. True False Moving to the next question prevents changes to this answer 25 tv N Question 10 elp The following information is available $9,000 5.000 Sales (1,000 units @ $9) Cost of Goods Sold Gross Profit Selling expenses (fixed) Income from operations 3.000 250 $2,750 Cost of Goods Sold is 75% variable and 25% fixed. Selling expenses are 100% nived Calculate the breakeven in units. 603 units 389 units 0 1.750 units 2.400 units The following information is available ard Help s 3es Sales (1,000 units @ $9) $9,000 Cost of Goods Sold 6,000 Gross Profit 3,000 Selling expenses (fixed) 250 Income from operations $2,750 Cost of Goods Sold is 75% variable and 25% fixed. Selling expenses are 100% fixed Assume a target profit of $300, how many units must be sold to achieve the profit? 654 units 684 units 548 units 456 units Moving to the next question prevents changes to this answer dtv N Question completion Status: Pr ASS 34 35 36 37 14 16 32 9 10 11 12 13 40 41 42 43 44 33 38 15 46 23 39 17 48 18 49 19 20 50 51 24 25 26 27 45 21 52 28 22 53 29 31 30 47 A Moving to the next question prevents changes to this answer. Question 13 of 53 Question 13 2 points The company received an offer from a foreign customer for 20,000 units of product at $15 a unit. The acceptance of the offer will not affect the domestic sales, fixed costs or capacity Domestic sales price $21 Unit manufacturing costs Variable 12 Fixed 5 The company should o accept the offer as it will contribute 33 per unit to contribution margir accept the offer a contribution margin will increase by $80,000 or 54 per unit Hot accept the offer as the sale wil decrease revenue by 5 per un o not accept the offer as the sale would create a loss of per unit Moving to the rest question prevent changes to this answer Queston 13 0153 25 av

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts