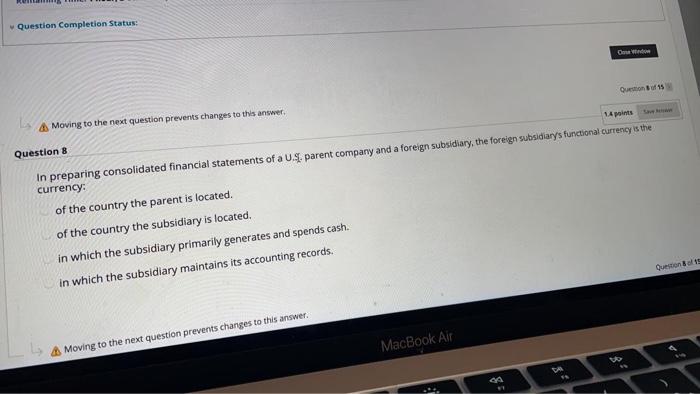

Question: Question Completion Status: Om 1 points Moving to the next question prevents changes to this answer Question 8 In preparing consolidated financial statements of a

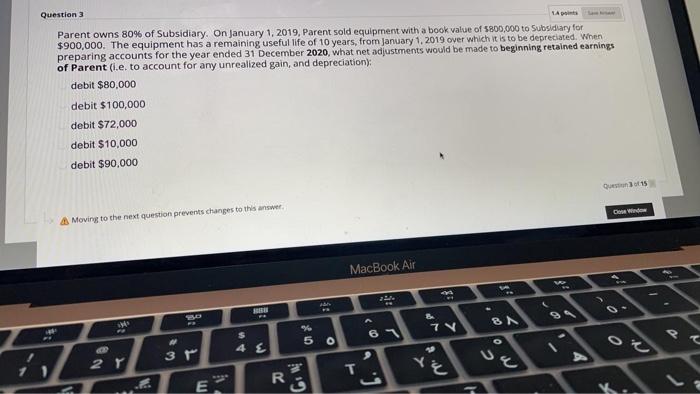

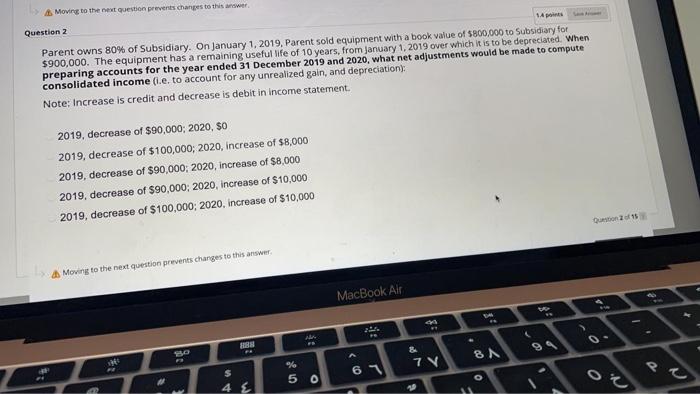

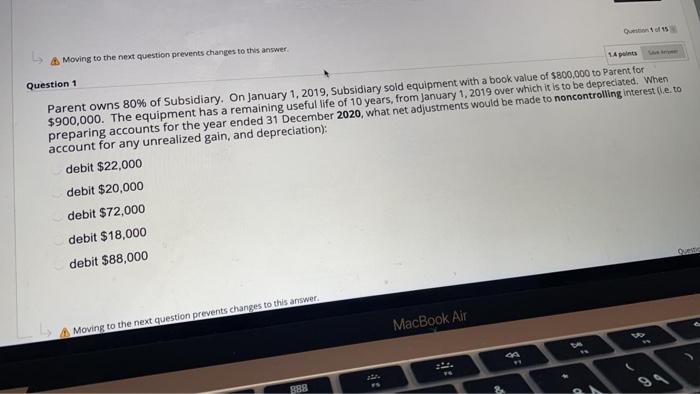

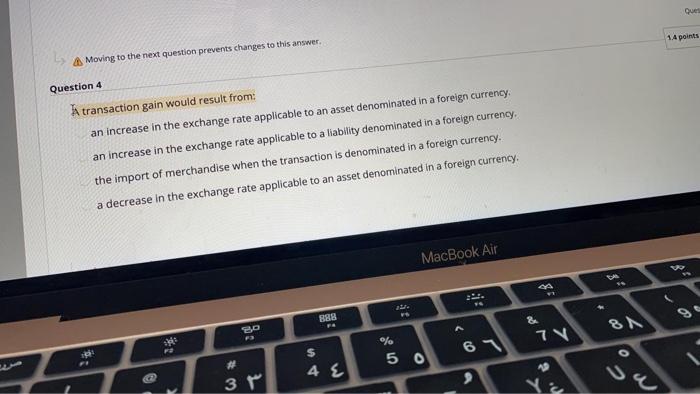

Question Completion Status: Om 1 points Moving to the next question prevents changes to this answer Question 8 In preparing consolidated financial statements of a U.S parent company and a foreign subsidiary, the foreign subsidiarys functional currency is the currency: of the country the parent is located. of the country the subsidiary is located. in which the subsidiary primarily generates and spends cash. in which the subsidiary maintains its accounting records. Questions Moving to the next question prevents changes to this answer. MacBook Air Question 3 Parent owns 80% of Subsidiary. On January 1, 2019, Parent sold equipment with a book value of 5800,000 to Subsidiary for $900,000. The equipment has a remaining useful life of 10 years, from January 1, 2019 over which it is to be depreciated. When preparing accounts for the year ended 31 December 2020, what net adjustments would be made to beginning retained earnings of Parent (i.e. to account for any unrealized gain, and depreciation: debit $80,000 debit $100,000 debit $72,000 debit $10,000 debit $90,000 US30115 Wide Moving to the next question prevents changes to this answer MacBook Air 2 18 8 BN 6 77 5 O o 43 ,, 2 R E Moving to the question prevents changes to this awer Question 2 1A Parent owns 80% of Subsidiary. On January 1, 2019. Parent sold equipment with a book value of 5800,000 to Subsidiary for $900,000. The equipment has a remaining useful life of 10 years, from January 1, 2019 over which it is to be depreciated. When preparing accounts for the year ended 31 December 2019 and 2020, what net adjustments would be made to compute consolidated income (i.e. to account for any unrealized gain, and depreciation): Note: Increase is credit and decrease is debit in income statement. 2019, decrease of $90,000: 2020, $0 2019, decrease of $100,000; 2020, increase of $8,000 2019, decrease of $90,000; 2020, increase of $8,000 2019, decrease of $90,000; 2020, increase of $10,000 2019, decrease of $100,000; 2020, increase of $10,000 os A Moving to the next question prevents changes to this answer MacBook Air A se NE & 99 8N 7 V % 50 67 P 0 Apunts Moving to the next question prevents changes to this answer Question 1 Parent owns 80% of Subsidiary. On January 1, 2019, Subsidiary sold equipment with a book value of $800,000 to Parent for $900,000. The equipment has a remaining useful life of 10 years, from January 1, 2019 over which it is to be depreciated. When preparing accounts for the year ended 31 December 2020, what net adjustments would be made to noncontrolling interest (e.to account for any unrealized gain, and depreciation), debit $22,000 debit $20,000 debit $72,000 debit $18,000 debit $88,000 DS MacBook Air Moving to the next question prevents changes to this answer ;* 18 888 14 Moving to the next question prevents changes to this answer Question 9 Monetary assets and liabilities that are entered on the balance sheet at their current value are translated using the: future exchange rate. historical exchange rate. current rate. translation rate, Moving to the next question prevents changes to this answer. MacBook Air 1: b Moving to the next question prevents changes to this answer. Question 7 Common stocks are translated using the historical exchange rate under: the current rate method only. the temporal method only. both the current rate and temporal methods. neither the current rate nor temporal methods. Moving to the next question prevents changes to this answer. MacBook Air 14 Moving to the next question prevents changes to this answer Question 6 A direct exchange rate quotation is one in which the exchange rate is quoted: in terms of how many units of the domestic currency can be converted into one unit of foreign currency. for the immediate delivery of currencies exchanged. in terms of how many units of the foreign currency can be converted into one unit of domestic currency for the future delivery of currencies exchanged. A Moving to the next question prevents changes to this answer. MacBook Air DA . Moving to the next question prevents changes to this answer Questions Companies may hedge their exposure to fluctuations in foreign exchange rates by using commodities futures fixed rates forward contracts future rates Moving to the next question prevents changes to this answer MacBook Air Que 14 points Moving to the next question prevents changes to this answer. Question 4 A transaction gain would result from: an increase in the exchange rate applicable to an asset denominated in a foreign currency an increase in the exchange rate applicable to a liability denominated in a foreign currency. the import of merchandise when the transaction is denominated in a foreign currency. a decrease in the exchange rate applicable to an asset denominated in a foreign currency MacBook Air U : 8 is 8 BAR & SD A 79 6 2 $ 50 # a 4 E 33 w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts