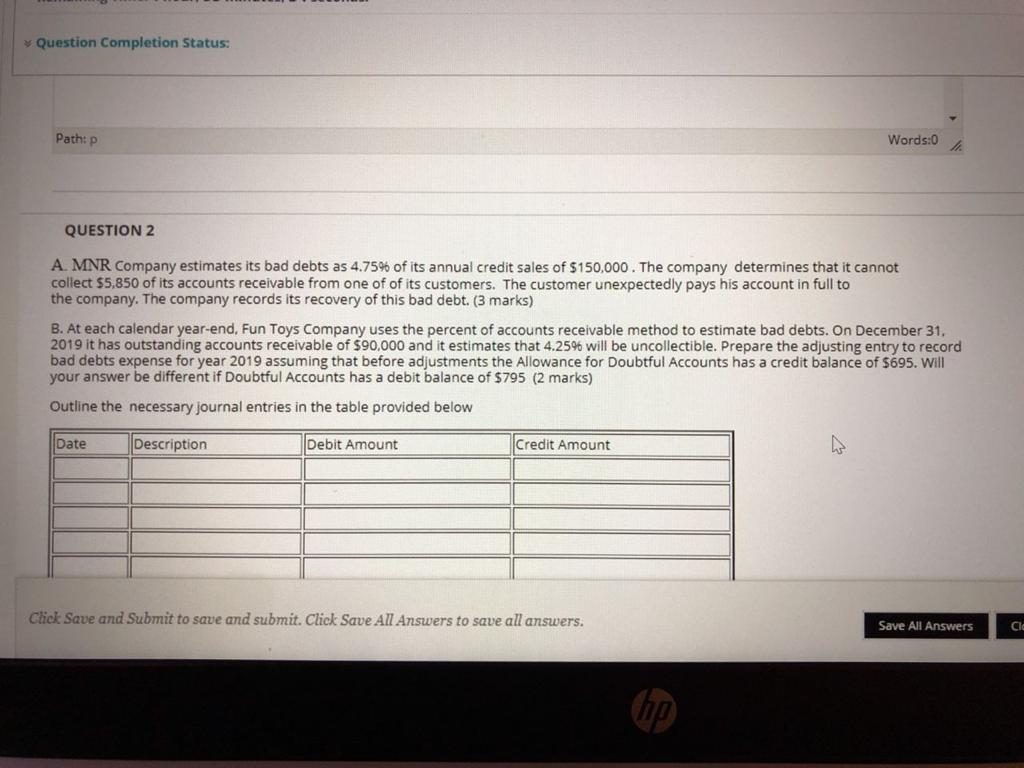

Question: Question Completion Status: Path: P Words:0 QUESTION 2 A. MNR Company estimates its bad debts as 4.75% of its annual credit sales of $150,000. The

Question Completion Status: Path: P Words:0 QUESTION 2 A. MNR Company estimates its bad debts as 4.75% of its annual credit sales of $150,000. The company determines that it cannot collect $5,850 of its accounts receivable from one of of its customers. The customer unexpectedly pays his account in full to the company. The company records its recovery of this bad debt. (3 marks) B. At each calendar year-end, Fun Toys Company uses the percent of accounts receivable method to estimate bad debts. On December 31, 2019 it has outstanding accounts receivable of $90,000 and it estimates that 4.25% will be uncollectible. Prepare the adjusting entry to record bad debts expense for year 2019 assuming that before adjustments the Allowance for Doubtful Accounts has a credit balance of $695. Will your answer be different if Doubtful Accounts has a debit balance of $795 (2 marks) Outline the necessary journal entries in the table provided below Date Description Debit Amount Credit Amount Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Cle hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts