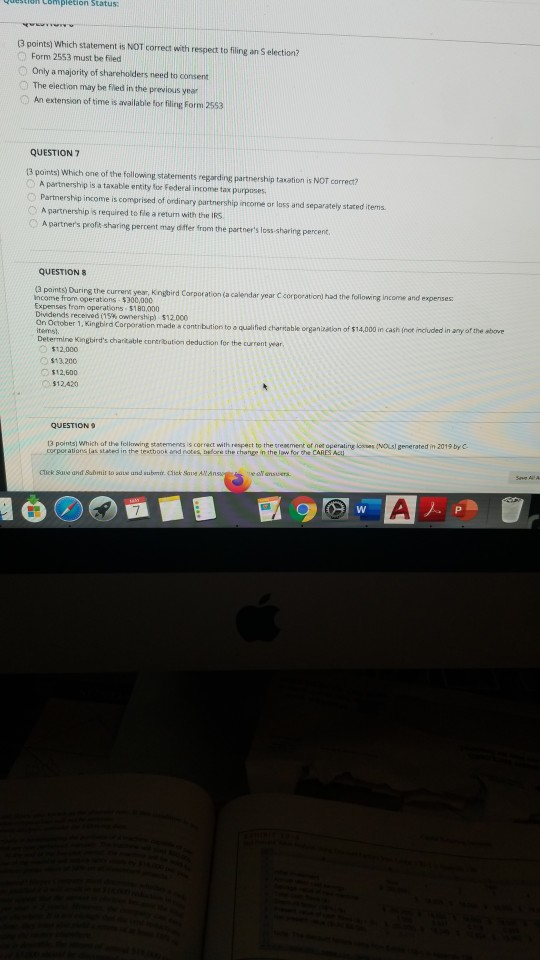

Question: Question completion Status points) Which statement is NOT correct with respect to filing an Selection? Form 2553 must be filed Only a majority of shareholders

Question completion Status points) Which statement is NOT correct with respect to filing an Selection? Form 2553 must be filed Only a majority of shareholders need to consent The election may be filed in the previous year An extension of time is available for filing Form 2553 QUESTION 7 3 points) Which one of the following statements regarding partnership taxation is NOT correct? A partnership is a taxable entity for Federal income tax purposes. Partnership income is comprised of ordinary partnership income or less and separately stated items Apartnership is required to file a retum with the IRS Apartner's profit sharing percent may differ from the partner's loss sharing percent. QUESTIONS (points) During the current year, Kngbird Corporation (a calendar year corporation had the following income and expenses Income from operations $300,000 Expenses from operations. $180,000 Dividends received (15% ownership 512.000 On October 1, Kingbird Corporation made a contribution to qualified charitable organization of $14,000 in cash not included in any of the above items! Determine Kingbird's charitable contribution deduction for the current war $12,000 $13.200 $12,600 312.420 QUESTION 13 points Which of the following statements is correct with respect to the treatment of not operating loss L corporations as stated in the textbook and rotas, before the change in the low for the CARES ACHI e rated in 2019 byc Click Save and submit to and subm. Click S AMAS oner. Hou 90 w Ale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts