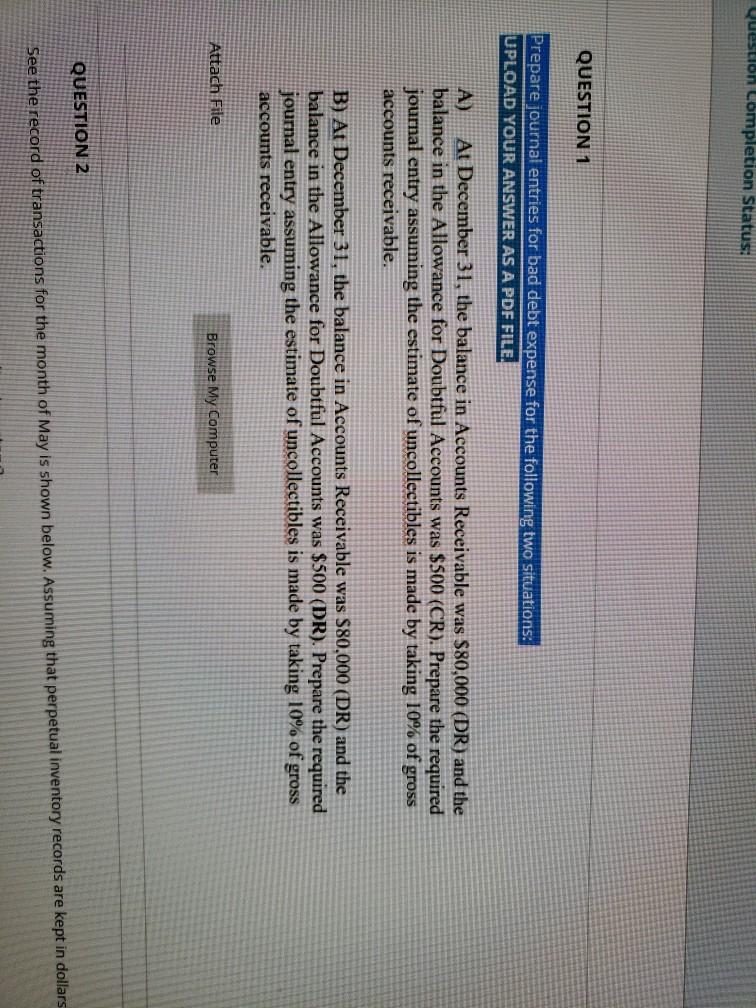

Question: Question completion Status: QUESTION 1 Prepare journal entries for bad debt expense for the following two situations: UPLOAD YOUR ANSWER AS A PDF FILE. A)

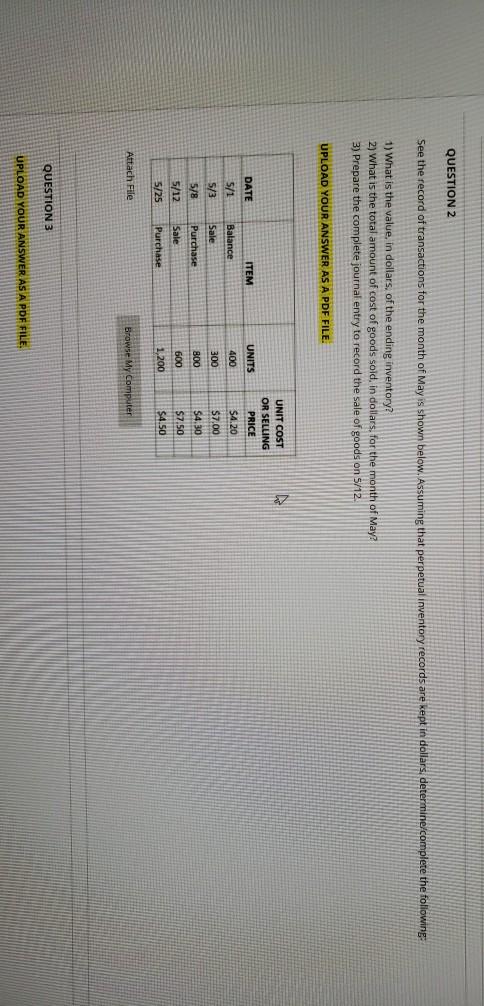

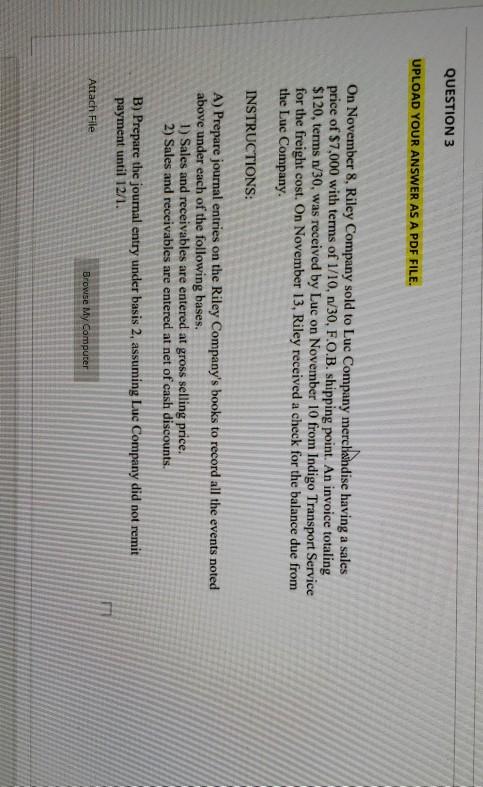

Question completion Status: QUESTION 1 Prepare journal entries for bad debt expense for the following two situations: UPLOAD YOUR ANSWER AS A PDF FILE. A) At December 31, the balance in Accounts Receivable was $80,000 (DR) and the balance in the Allowance for Doubtful Accounts was $500 (CR). Prepare the required journal entry assuming the estimate of uncollectibles is made by taking 10% of gross accounts receivable. B) At December 31, the balance in Accounts Receivable was $80,000 (DR) and the balance in the Allowance for Doubtful Accounts was $500 (DR). Prepare the required journal entry assuming the estimate of uncollectibles is made by taking 10% of gross accounts receivable. Attach File Browse My Computer QUESTION 2 See the record of transactions for the month of May is shown below. Assuming that perpetual inventory records are kept in dollars QUESTION 2 See the record of transactions for the month of May is shown below. Assuming that perpetual inventory records are kept in dollars, determine/complete the following: 1) What is the value, in dollars, of the ending inventory? 2) What is the total amount of cost of goods sold, in dollars, for the month of May 3) Prepare the complete journal entry to record the sale of goods on 5/12 UPLOAD YOUR ANSWER AS A PDF FILE. N DATE UNITS 5/1 400 300 UNIT COST OR SELLING PRICE $4,20 $7.00 $4.30 $7.50 $4.50 ITEM Balance Sale Purchase Sale Purchase 5/3 5/8 800 600 5/12 5/25 1,200 Attach File Browse My Computer QUESTION 3 UPLOAD YOUR ANSWER AS A PDF FILE QUESTION 3 UPLOAD YOUR ANSWER AS A PDF FILE. On November 8, Riley Company sold to Luc Company merchandise having a sales price of $7,000 with terms of 1/10, 1/30, F.O.B. shipping point. An invoice totaling $120, terms 1/30, was received by Luc on November 10 from Indigo Transport Service for the freight cost. On November 13, Riley received a check for the balance due from the Luc Company. INSTRUCTIONS: A) Prepare journal entries on the Riley Company's books to record all the events noted above under each of the following bases. 1) Sales and receivables are entered at gross selling price. 2) Sales and receivables are entered at net of cash discounts. B) Prepare the journal entry under basis 2, assuming Luc Company did not remit payment until 12/1. Attach File Browse My Computer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts