Question: Question Completion Status: QUESTION 1 When discounting future dividends to arrive at an equity valuation, the appropriate discount factor to use is the risk -

Question Completion Status:

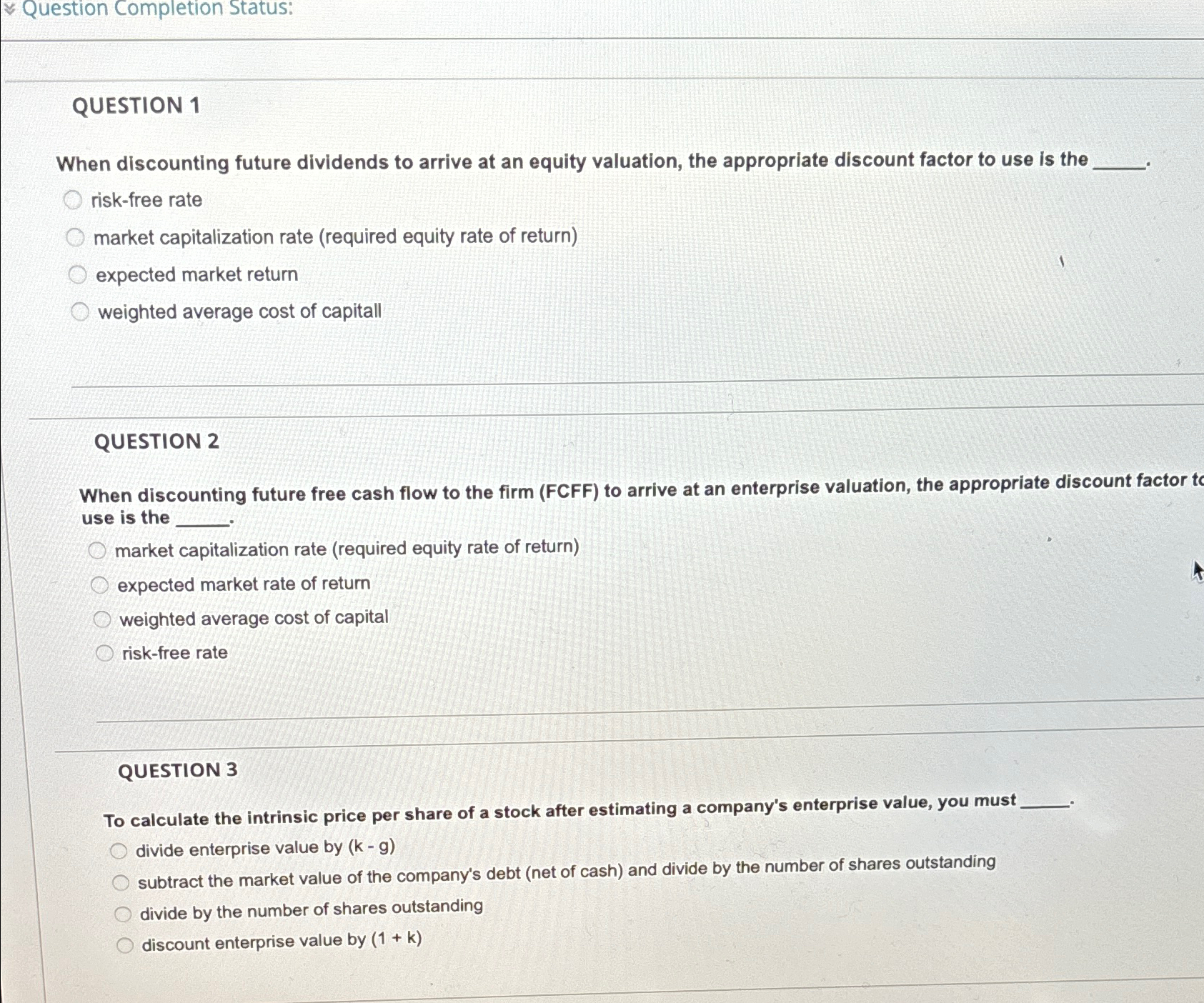

QUESTION

When discounting future dividends to arrive at an equity valuation, the appropriate discount factor to use is the riskfree rate market capitalization rate required equity rate of return expected market return weighted average cost of capitall

QUESTION

When discounting future free cash flow to the firm FCFF to arrive at an enterprise valuation, the appropriate discount factor tc use is the

market capitalization rate required equity rate of return

expected market rate of return

weighted average cost of capital

riskfree rate

QUESTION

To calculate the intrinsic price per share of a stock after estimating a company's enterprise value, you must divide enterprise value by

subtract the market value of the company's debt net of cash and divide by the number of shares outstanding

divide by the number of shares outstanding

discount enterprise value by

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock